What is a health insurance broker?

Health insurance brokers assist their clients with the process of enrolling in health insurance and utilizing their coverage. Health insurance brokers must hold an insurance producer license in each state where they do business. Brokers are generally contracted with multiple insurance companies, so they can offer various options to the clients they represent.1

During the open enrollment period for 2024 health coverage, more than three-quarters of all active enrollments in the federally run Marketplace (HealthCare.gov) were facilitated by a broker.2

Before the internet was widely available, health insurance brokers generally met face to face with their clients. But with the rise of the internet, many brokers have moved their businesses online, providing their clients with user-friendly, side-by-side plan comparison tools and online applications for health insurance.3 Brokers continue to serve an important role in helping their clients enroll in ACA-compliant health insurance.

Unlike Navigators and certified application counselors (CACs), brokers can make specific plan recommendations, and can help people enroll in plans both on and off a Marketplace/exchange. Brokers are paid commissions by insurance companies after their clients enroll. (Brokers must be contracted and appointed with an insurance company in order to receive commissions.)4. The premium that a consumer pays for their coverage is the same regardless of whether they use a broker or not.

In order to be certified with the exchange (either the federally facilitated HealthCare.gov or a state-run exchange), a broker must complete the exchange certification process in addition to the state licensing requirements. Brokers continue to provide ongoing support to their clients after the enrollment process is complete.

What’s the difference between an agent and a broker?

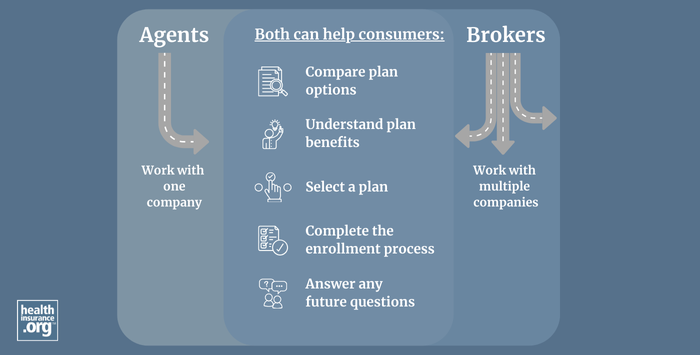

The terms “agent” and “broker” are sometimes used interchangeably,5 and both are required to be licensed as insurance producers by their state insurance department.1 But “agent” generally refers to a producer who represents a single insurer (a captive agent) or multiple insurers (an independent agent), while “broker” generally refers to a producer who represents the consumer and who is contracted with multiple insurers.1

What’s the difference between a broker and a web-broker?

The term “web-broker” is used by the Centers for Medicare & Medicaid Services (CMS) to describe agents or brokers that provide a third-party website “that interfaces with an Exchange to assist consumers with direct enrollment in QHPs offered through the Exchange.” CMS clarifies that they also use the term “web-broker” to include Direct Enrollment technology providers, which are not licensed by the states as insurance producers.6

But online web-based health insurance brokerages, sometimes referred to as “e-brokers,” already existed well before the ACA.3 Regardless of whether a broker provides assistance in-person, over the phone, or online, they must have a current insurance producer license in each state where they’re assisting clients.

Footnotes

- “Insurance Agents vs. Insurance Brokers vs. Insurance Producers” Agent Sync. Feb. 28, 2025 ⤶ ⤶ ⤶

- “The Impact of Brokers on ACA Marketplace Growth” Wiley Online Library. June 15, 2024 ⤶

- “Web brokers wait to sell Obamacare” Politico. Oct. 16, 2013 ⤶ ⤶

- “Contract & Get Appointed to Sell with Health Insurance Companies” Ritter Insurance Marketing. Aug. 20, 2024 ⤶

- “Insurance Brokers and the ACA: Early Barriers and Options for Expanding Their Role” Urban Institute, Robert Wood Johnson Foundation. Feb. 2015 ⤶

- “Web-broker Operational Readiness Reviews for the Classic Direct Enrollment and Enhanced Direct Enrollment Pathways and Related Oversight Requirements” Centers for Medicare & Medicaid Services. Jan. 10, 2024 ⤶