What is an indemnity health plan?

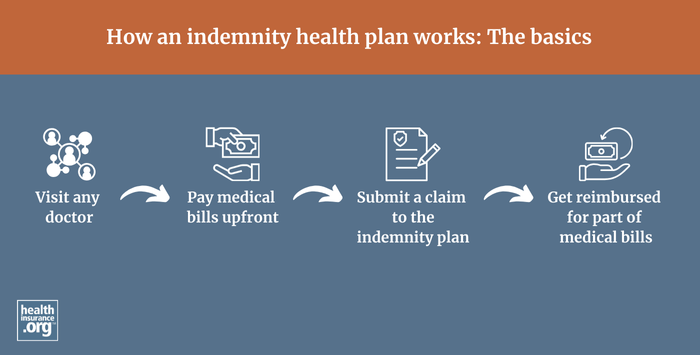

An indemnity health plan pays a set amount for a given service — a fee-for-service approach — regardless of what medical provider the member uses or how much the provider bills. The insurance company pays a pre-determined percentage of the reasonable and customary charges for a given service, and the policyholder pays the rest.

Indemnity plans do not have provider networks, so patients can choose their own doctors and hospitals. The amount the plan will pay varies by service, but is defined by the plan and pre-determined (typically a certain percentage of the reasonable and customary charges for that procedure), regardless of how much the medical provider bills for the service. This leaves the insured on the hook for potentially large and possibly unexpected medical bills, depending on how much the provider charges for the service.

Providers can balance bill the patient for any billed amounts above what the insurance company pays, since the providers don't have contracts with the insurer requiring them to accept the insurer's "reasonable and customary" amounts as payment in full.

How common are indemnity health plans?

Indemnity plans primarily existed before the rise of HMOs, PPOs, and other managed care plans, and are quite rare today. In the employer-sponsored health insurance market, they account for just 1% of all enrollment in 2024.1 And all plans available in the health insurance Marketplace are managed care plans (HMO, PPO, EPO, or POS).

However, people can purchase fixed indemnity plans, which are a subset of indemnity plans, and use them to supplement a major medical plan obtained from an employer or in the individual market. Fixed indemnity plans are not regulated by the ACA, so they don't have to cover the essential health benefits or pre-existing conditions. They are not suitable to serve as a person's only coverage, and should only be thought of as a supplement to major medical coverage.

Footnotes

- "2024 Employer Health Benefits Survey" KFF.org. Oct. 9, 2024 ⤶