What is a qualified health plan?

A qualified health plan (QHP) is a health insurance plan that meets requirements established by Obamacare, which is also known as the Affordable Care Act (ACA), and also meets the certification requirements of the state's health insurance exchange/Marketplace.

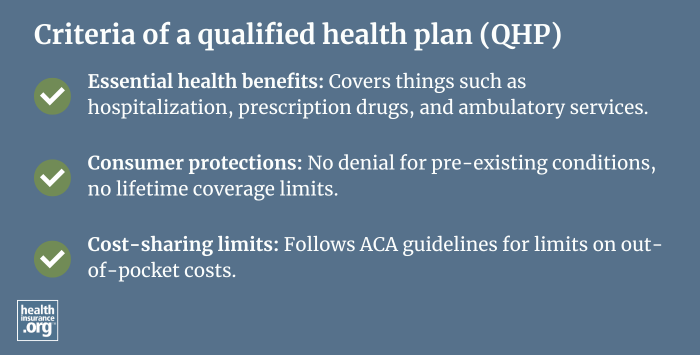

Some of the QHP rules include being licensed in the state where coverage is provided, covering pre-existing conditions, following cost-sharing limits, and covering the ACA’s ten essential health benefits with no dollar limits on annual or lifetime benefits.

Qualified health plans are certified by the federal or state-run health insurance marketplace/exchange. The certification process happens each year ahead of the marketplaces’ annual enrollment period.

Do I have to go through the health insurance marketplace to get a qualified health plan?

No, many QHP plans are also available off-exchange, directly from the health insurance company. However, you can only qualify for the ACA’s premium tax credits and/or cost-sharing reductions if you buy a QHP policy through the federal or a state health insurance Marketplace. (Note that enrollment via an enhanced direct enrollment entity is considered on-exchange and does allow a person to receive subsidies.)

The marketplace’s premium tax credits and cost-sharing reductions are available for most enrollees, depending on their income. But again, these are not available if you enroll outside the exchange.

Are all 'metal' plans qualified health plans?

All plans sold in the exchange/Marketplace, at any metal level, are qualified health plans. All individual/family plans sold outside the exchange must also fall into one of the four metal levels (or be a catastrophic plan). But while these off-exchange plans must all be compliant with the ACA, they do not necessarily have to meet all of the requirements for being qualified health plans.

The categorization of individual (and small group) plans by metal level makes it easier for consumers to compare plans. Plans are assigned to a metal level based on actuarial value. While all QHPs (and off-exchange non-QHPs with effective dates of 2014 or later) must cover essential health benefits, a lower metal-level policy (for example, a Bronze plan) pays less of average covered health care costs than a higher metal level policy (for example, a Gold plan).

Should I look for a qualified health plan if I have Medicare?

No, you should not buy a qualified health plan if you qualify for Medicare. It's illegal for anyone to sell you a QHP if you have Medicare, and there's no coordination of benefits between QHPs and Medicare, so the QHP would not provide you with benefits. Qualified health plans are specific to Obamacare/the ACA and apply to people who don’t have employer-provided coverage and who don’t meet eligibility requirements for Medicare or Medicaid.

Is a non-qualified health plan lower quality?

While plans that are not “qualified health plans” haven’t gone through a Marketplace certification process, it doesn’t necessarily mean they don’t provide good health insurance coverage.

All individual/family and small group major medical health plans with effective dates of 2014 or later are required to be fully compliant with the ACA. This means they cover the essential health benefits and pre-existing conditions, do not have annual or lifetime benefit caps, etc. But if they're not sold through the exchange, they don't necessarily have to be QHPs (some insurers sell their certified QHPs both on-exchange and off-exchange).

However, plans that aren't compliant with the ACA, including short-term health plans, limited benefits plans, fixed indemnity plans, and health care sharing ministry plans, do not have to provide any of the ACA's consumer protections. Here's how you can determine whether a plan you're considering is ACA-compliant.

And Grandfathered and grandmothered health insurance plans – which pre-date the ACA — meet some, but not all ACA requirements. But while these plans can continue to cover people who already had them when the ACA was enacted and implemented, they are no longer available for purchase.