What is a high-deductible health plan (HDHP)?

In lay terms, a high-deductible health plan could simply be considered a policy with a high deductible. But the term “high-deductible health plan,” or HDHP, is specific to plans that not only have high deductibles, but also conform to other established federal guidelines set by the IRS.

Can I combine a high-deductible health plan with an HSA?

Yes. HDHPs are the only plans that allow an enrollee to contribute to a health savings account (HSA). High-deductible insurance is considered a type of consumer-driven health plan, so you may hear the term CDHP used in conjunction with these plans. The idea is to give patients control over how to spend and invest their money.

Are HDHPs available for purchase in the health insurance Marketplace?

Yes, nearly all areas of the country have at least one HDHP available through the Marketplace. But HHS notes that the number of available Marketplace HDHPs has declined in recent years, as has enrollment in those plans.

In 2019, HDHPs accounted for 7% of all plans available through HealthCare.gov, and that had dropped to 3% by 2023 (mostly at the Bronze level). And while 8% of all HealthCare.gov enrollees selected HDHPs in 2019, that had dropped to 5% by 2022. 1

Are HDHPs offered by employers?

Yes, HDHPs are offered by many employers. The availability of employer-sponsored HDHPs has grown over the last decade. Among employees who have access to employer-sponsored health coverage, slightly more than half were offered an HDHP option in 2023.2

What do HDHPs cover?

HDHPs pay for certain preventive care before the deductible – the ACA requires this of all plans – but under an HDHP, no other services can be paid for by the health plan until the insured has met the deductible (or at least the minimum deductible that applies to HDHPs, explained below). So HDHPs cannot have copays for office visits or prescriptions before the deductible is met. This is in contrast to a plan that’s got a high deductible but also offers copays for office visits from the get-go; people might generally consider the latter to be a high-deductible plan, but it’s not an HDHP.

(As described below, there is some flexibility related to pre-deductible coverage of certain chronic conditions. And telehealth benefits can be provided pre-deductible through 2024, if the plan chooses to offer this.3 In 2024, the IRS expanded the list of preventive services that can be paid for by an HDHP pre-deductible.4)

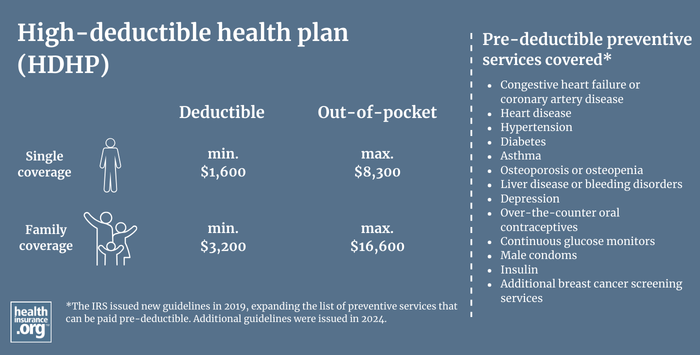

What are HDHP deductible and out-of-pocket rules?

HDHPs have specific guidelines in terms of allowable deductibles and out-of-pocket costs. These are adjusted annually by the IRS, although there have been some years when there were no changes.

For 2024 coverage, an HDHP must have a minimum deductible of $1,600 for a single individual and $3,200 for family coverage. The maximum allowable out-of-pocket limit is $8,050 for single coverage and $16,100 for family coverage.5

For 2025 coverage, the minimum HDHP deductibles are $1,650 for individual coverage and $3,300 for family coverage. The maximum allowable out-of-pocket limit is $8,300 for single coverage and $16,600 for family coverage.6

(Note that the IRS also clarifies that if a plan has both an individual deductible and a family deductible (wherein a person who meets the individual deductible does not have to meet the family deductible in order to receive post-deductible coverage), "if either the deductible for the family as a whole or the deductible for an individual family member is less than the minimum annual deductible for family coverage, the plan doesn’t qualify as an HDHP."7 In other words, a plan with family coverage in 2025 will need to have individual deductibles of at least $3,300 to be an HDHP.)

The HDHP out-of-pocket caps for 2024 were an increase from 2023 but still quite a bit lower than the total out-of-pocket allowed on non-HDHPs under the ACA; the gap between the maximum allowable out-of-pocket limit for HDHPs versus other health plans has been widening since the ACA was implemented (for 2025, however, the maximum out-of-pocket caps for non-HDHPs will decrease, while the maximum out-of-pocket caps for HDHPs will increase, so the gap won't be as significant). People are often surprised to learn that Bronze and Silver-level HDHPs often have lower out-of-pocket limits than Bronze and Silver-level plans that aren't HDHPs.

But not all plans that fall within these dollar limit guidelines are HDHPs, since HDHPs also cannot pay for non-preventive services before the enrollee has met the deductible. So a plan with a $5,000 deductible would fail to be an HDHP if it also offers $25 copays for office visits before the deductible is met (as opposed to having the enrollee pay the full cost of the office visit and count it toward the deductible).

What are the contribution limits for an HSA?

To help pay these out-of-pocket costs, you can pair your high-deductible plan with a health savings account (HSA).

For 2024, the HSA contribution limit is $4,150 if your HDHP covers just yourself, and $8,300 if your HDHP also covers at least one other family member.8 People with HDHP coverage in 2024 have until the tax filing deadline in April 2025 to make 2024 contributions to their HSA.

For 2025 coverage, the HSA contribution limit is $4,300 if your HDHP covers just yourself, and $8,550 if your HDHP also covers at least one other family member.6

If you’re 55 or older, you can contribute an extra $1,000 a year. This amount is not indexed for inflation. If two spouses are each 55 or older they can each make the additional $1,000 contribution but only if they each have their own HSA. If they make the family-level contribution to a single HSA (owned by either one of them), they can only make the additional $1,000 contribution for one of them.9

The money you contribute to an HSA will reduce your ACA-specific modified adjusted gross income – or MAGI – (which determines your eligibility for premium subsidies in the exchange). In some cases, selecting an HDHP and contributing to an HSA could result in larger premium subsidies than you'd otherwise receive.

Although the American Rescue Plan and Inflation Reduction Act have temporarily eliminated the ACA's subsidy cliff (through 2025), subsidies are still not available if the cost of the benchmark plan (second-lowest-cost silver plan) is less than 8.5% of your MAGI. So reducing your MAGI with HSA contributions could also result in subsidies when you might not otherwise be eligible for them.

How did the IRS expand HDHPs' allowable preventive care coverage?

The IRS issued new guidelines in mid-2019, expanding the list of preventive services that can be paid pre-deductible by an HDHP, with enrollees retaining their HSA eligibility. The IRS issued additional new guidelines in late 2024, again expanding the list of preventive services that an HDHP can pay for before the deductible is met.4

The 2019 rules allow — but do not require — certain treatments for certain chronic conditions to be classified as preventive care for HDHP purposes, and thus paid by the plan pre-deductible without the plan losing its HDHP status. The medical conditions and treatments include:

- Congestive heart failure or coronary artery disease: ACE inhibitors and/or beta blockers

- Heart disease: Statins and LDL cholesterol testing

- Hypertension: Blood pressure monitor

- Diabetes: ACE inhibitors, insulin or other glucose-lowering agents, retinopathy screening, glucometer, hemoglobin A1c testing, and statins (Note that as of 2023, Section 11408 of the Inflation Reduction Act allows HDHPs to pay for insulin pre-deductible regardless of whether the person has been diagnosed with diabetes.)

- Asthma: Inhalers and peak flow meters

- Osteoporosis or osteopenia: Anti-resorptive therapy

- Liver disease or bleeding disorders: International Normalized Ratio (INR) testing

- Depression: Selective Serotonin Reuptake Inhibitors (SSRIs)

The 2024 rules are designed to keep pace with evolving preventive care coverage rules, allowing HDHPs to pay for several services before the deductible is met (the Biden administration has proposed a rule change that would require health plans to cover some of these services without cost-sharing10). They include:

- Over-the-counter oral contraceptives (Opill, approved by the FDA in 2023)

- Male condoms, regardless of whether the HDHP enrollee is male or female

- Continuous glucose monitors

- Insulin "without regard to whether the insulin product is prescribed to treat an individual diagnosed with diabetes or prescribed for the purpose of preventing the exacerbation of diabetes or the development of a secondary condition.

- Additional breast cancer screening services (screening mammograms were already covered, but the new rule allows for pre-deductible coverage of breast MRI and ultrasound).4

Although male condoms can now be paid for pre-deductible by an HDHP, the IRS does not consider male sterilization to be preventive care, and this is still true as of 2024.4

Some states have begun mandating pre-deductible male contraceptive coverage, including vasectomy coverage, on all plans. So through the end of 2019, the IRS still considered a plan to be HSA-qualified if it covered male contraception before the deductible. That gave states time to modify their requirements to allow an exemption for HSA-qualified plans, to ensure that the male contraceptive mandates wouldn't cause people to lose the ability to contribute to an HSA.

How can HSA funds be used?

This money in your HSA is yours to withdraw, tax-free, at any time, to pay for medical expenses that aren’t paid by your high-deductible policy. You can reimburse yourself after the fact if you prefer – so if you incur a medical expense after your HSA is opened but pay for it without withdrawing money from your HSA, you can opt to reimburse yourself for that spending several years down the road, as long as you keep your receipts and the medical expense isn't reimbursed by any other entity.

If you take money out of your HSA for anything other than a qualified medical expense, you’ll pay taxes on the withdrawal, plus a penalty. But once you turn 65, the HSA functions in much the same way as a traditional IRA: you can pull money out for any purpose, paying only income taxes, but no penalty.

You also have the option to leave the money in the HSA and use it to fund long-term care later in life. The money is never taxed if you’re withdrawing it to pay for qualified medical expenses, even if you’re no longer covered by an HDHP at the time that you make the withdrawals. But contributions to the HSA can only be made while you have in-force coverage under an HDHP.

You can also withdraw tax-free money from your HSA to pay Medicare premiums (for Part A, if you don't get it for free, and for Parts B and D, but not for Medigap plans).

You can also withdraw tax-free money from your HSA to pay long-term care premiums. There are limits, based on age, on how much you can pull out of your HSA to pay long-term care insurance premiums with pre-tax money (the following limits are for 2024;11 they're indexed for inflation each year by the IRS, and 2024 is the first time we've seen a reduction in these limits, which are a little lower than they were in 202312). If your age is:

- 40 or younger, you can withdraw $470 tax-free to pay long-term care insurance premiums

- 41 to 50, you can withdraw $880

- 51 to 60, you can withdraw $1,760

- 61 to 70, you can withdraw $4,710

- 71 or older, you can withdraw $5,880

How do HDHP premiums compare to other plans?

In terms of premiums, HDHPs are usually among the lower-cost plans available in a given area, but they're typically not the least expensive plans. That's because the rules that govern maximum out-of-pocket costs for HDHPs differ from the rules that govern maximum out-of-pocket costs for all ACA-compliant plans.

In 2014, the two were equal: the maximum allowable out-of-pocket for HDHPs was $6,350 for an individual and $12,700 for a family, and those were the same limits that applied to all ACA-compliant plans. So in that year, HDHPs were among the least expensive plans available.

But as time went on, the limits that apply to all ACA-compliant plans climbed faster than the limits that apply to HDHPs. For 2024, HDHPs can have a maximum out-of-pocket of $8,050 for an individual and $16,100 for a family.8 But the 2024 upper limit for out-of-pocket costs on non-HDHPs is $9,450 for an individual, and $18,900 for a family.13

For 2025, however, the out-of-pocket limit for HDHPs increased again (to $8,300 for single coverage and $16,600 for family coverage)6, while the out-of-pocket limit for non-HDHPs decreased slightly (to $9,200 for single coverage and $18,400 for family coverage).14 So the discrepancy has narrowed somewhat.

But there are still non-HDHP plans available that have higher out-of-pocket exposure (and sometimes lower premiums as a result) than HDHPs.

If being able to contribute to an HSA is a priority for you, you'll want to focus on the HDHPs available in your area. But if the premium is your primary concern and you don't plan to contribute to an HSA, you may find less-expensive plans that aren't HDHPs, and that have higher out-of-pocket exposure than the available HDHPs.

Footnotes

- ”Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2024” U.S. Department of Health and Human Services. April 27, 2023. ⤶

- "High deductible health plans and health savings accounts" Bureau of Labor Statistics. Accessed Nov. 19, 2024 ⤶

- Federal Telehealth Flexibilities in Private Health Insurance During the COVID-19 Public Health Emergency: In Brief. Congressional Research Service. February 2023. ⤶

- "Notice 2024-75: Preventive Care for Purposes of Qualifying as a High Deductible Health Plan under Section 223" Internal Revenue Service. Accessed Nov. 19, 2024 ⤶ ⤶ ⤶ ⤶

- "Revenue Procedure 2023-23". Internal Revenue Service. Accessed January 2024. ⤶

- "Revenue Procedure 2024-25" Internal Revenue Service. Accessed Sep. 20, 2024. ⤶ ⤶ ⤶

- "Publication 969 (2023), Health Savings Accounts and Other Tax-Favored Health Plans; Family plans that don’t meet the high deductible rules" Internal Revenue Service. Accessed March 15, 2024 ⤶

- Revenue Procedure 2023-23. Internal Revenue Service. Accessed January 2024. ⤶ ⤶

- "Rules for married people" Internal Revenue Service. Accessed March 24, 2024. ⤶

- "Enhancing Coverage of Preventive Services Under the Affordable Care Act" U.S. Departments of the Treasury, Labor, and Health & Human Services. Oct. 23, 2024 ⤶

- Revenue Procedure 2023-34. Internal Revenue Service. Accessed January 2024. ⤶

- Revenue Procedure 2022-38. Internal Revenue Service. Accessed January 2024. ⤶

- Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2024 Benefit Year. Centers for Medicare and Medicaid Services. December 2022. ⤶

- ”Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2025 Benefit Year” Centers for Medicare & Medicaid Services. November 15, 2023. ⤶