Medicare in Massachusetts

Medigap plans are different in Massachusetts — there are only three plan designs (and only two for newly-eligible enrollees), instead of ten.

Key Takeaways

- More than 1.4 million residents are enrolled in Medicare in Massachusetts.1

- About 36% of Massachusetts Medicare beneficiaries are enrolled in Medicare Advantage plans.1

- The Medicare Advantage market is active in most of Massachusetts, but some counties like Berkshire have lower penetration rates, with only 17% of residents enrolled in a Medicare Advantage plan.2

- Eight insurers offer Medigap plans in Massachusetts. The state conducts its own Medigap standardization, so there are only three plan designs available (as opposed to as many as ten in most states).3

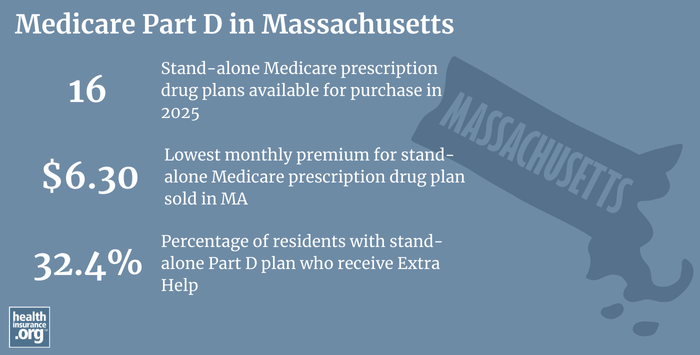

- There are 16 stand-alone Medicare Part D prescription drug plans available in Massachusetts for 2025, with premiums starting at $6.30 per month.4

Medicare enrollment in Massachusetts

1,457,091 people had Medicare in Massachusetts as of September 2024,1 amounting to about 20% of the state’s population.5

In most cases, transitioning to Medicare goes along with retirement and turning 65. But Medicare enrollment is also available to younger individuals after they have been receiving disability benefits for 24 months, or if they have amyotrophic lateral sclerosis (ALS) or end-stage renal disease (ESRD).

About 11% of Medicare beneficiaries in Massachusetts are under the age of 65,1 which is just slightly higher than the nationwide percentage.6

Medicare options

Medicare beneficiaries can choose to get their healthcare coverage via Original Medicare, where coverage is paid for directly by the federal government, or they can select a Medicare Advantage plan, in which a private health insurance company contracts with the federal government to provide Medicare benefits to beneficiaries. Original Medicare beneficiaries also have options around Medigap policies and Medicare Part D prescription drug coverage (Medigap plans cannot be used in conjunction with Medicare Advantage plans, and most Medicare Advantage plans include Medicare prescription drug coverage).

Original Medicare includes Part A (also called hospital insurance, which helps pay for inpatient stays at a hospital, skilled nursing facility, or hospice center) and Part B (also called medical insurance, which helps pay for outpatient and physician care). Medicare Advantage plans provide all of the covered benefits of Medicare Parts A and B, although the out-of-pocket expenses can be quite different, as Medicare Advantage plans set their own copay, coinsurance, and deductible levels, within general parameters established by the Centers for Medicare & Medicaid Services (CMS). When you’re deciding between Medicare Advantage and Original Medicare, there are pros and cons to either option; the right solution is different for each person.

Learn about Medicare plan options in Massachusetts by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Massachusetts

We’ve created this guide to help you understand the Massachusetts health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Learn about health insurance coverage options in Massachusetts.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Massachusetts.

Learn about Massachusetts’ Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Massachusetts.

Learn about short-term insurance regulations in Massachusetts.

Frequently asked questions about Medicare in Massachusetts

What is Medicare Advantage?

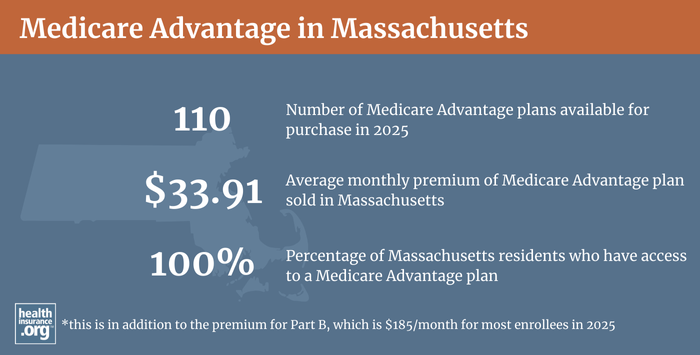

Medicare Advantage plans are offered by private insurers, whose service areas vary from county to county. All of Massachusetts has an active Medicare Advantage market, with numerous plans available for 2025 — 110 in total.4 But some counties like Berkshire have lower penetration rates where only 17% of residents are enrolled in a Medicare Advantage plan compared to Worcester county with a 44% penetration rate.7

About 24% of Massachusetts Medicare beneficiaries were enrolled in Medicare Advantage plans as of May 2018.8 By Septmber 2024, about 36% of Massachusetts Medicare beneficiaries had Medicare Advantage coverage,1 mirroring the nationwide increase in Medicare Advantage enrollment (nationwide, more than 50% of Medicare beneficiaries were enrolled in private plans as of September 2024,6 nearly all of which were Medicare Advantage plans). But Original Medicare continues to be more popular in Massachusetts than it is nationwide, with almost two-thirds of Massachusetts Medicare beneficiaries enrolled in Original Medicare.7

Medicare’s annual election period (October 15 to December 7 each year) allows Medicare beneficiaries the chance to switch between Medicare Advantage plans and Original Medicare (and add, drop, or switch to a different Medicare Part D prescription drug plan). And people who are already enrolled in a Medicare Advantage plan also have the option to switch to a different Medicare Advantage plan or to change to Original Medicare during the Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31.

- Learn about Medicare’s annual open enrollment period.

- Learn about how Massachusetts Medicaid can help Medicare beneficiaries with limited financial means (income and assets).

- Questions to ask yourself when you’re deciding between Original Medicare and Medicare Advantage.

What are Medigap plans?

Original Medicare does not limit out-of-pocket costs, so most enrollees maintain some form of supplemental medical coverage. Nationwide, about 46% of Original Medicare beneficiaries get their supplemental coverage through an employer-sponsored plan or Medicaid.9 But for those who don’t, optional private Medigap plans (also known as Medicare Supplement Insurance plans, or MedSupp) will pay some or all of the out-of-pocket costs they would otherwise have to pay if they had only Original Medicare. About 42% of Original Medicare beneficiaries nationwide have Medigap coverage.10

According to an AHIP (formerly called America’s Health Insurance Plans) analysis, there were 342,982 Massachusetts Medicare beneficiaries enrolled in Medigap coverage as of 2022.11 That was a decrease of 3,240 from the year before,12 which makes sense given the growing share of Massachusetts Medicare beneficiaries enrolled in Medicare Advantage, and the fact that Medigap plans can only be used with Original Medicare.

Eight insurers offer Medigap plans in Massachusetts for 2025.3

In all but three states, Medigap plans are standardized under federal rules. But Massachusetts is one of the three states where a waiver allows the state to design different Medigap plans. In other states, there are ten different Medigap plan designs. But in Massachusetts, there’s just the Medicare Core Plan and the Medicare Supplements 1 and 1A.13

Massachusetts added Medicare Supplement 1A as of 2020; it’s the same as Supplement 1 except that it does not cover the Medicare Part B deductible, which is $257 in 2025. The addition of Supplement 1A was necessary because federal law (MACRA) does not allow people who become eligible for Medicare in 2020 or later to enroll in a Medicare supplement that covers the Part B deductible. So people who were eligible for Medicare in Massachusetts in 2019 or earlier can choose from among all three supplement options, whereas people who become eligible for Medicare in 2020 or later cannot enroll in Supplement 1 (they can choose the Core Plan or Supplement 1A instead).

(Prior to 2006, Massachusetts also had Medicare Supplement 2, which included coverage for prescription drugs; nationwide, all Medigap plans that included prescription drugs ceased to be available for purchase after the end of 2005 — people began enrolling in Medicare Part D instead — but people who had Supplement 2 in Massachusetts were allowed to keep it if they wanted to).

In addition to having different standardization rules for Medigap coverage, Massachusetts has among the country’s strongest consumer protections for Medigap plans. It’s one of eight states where insurers are required to use community rating, which means that premiums cannot vary based on age. Community rating even extends to disabled Medicare beneficiaries under age 65 in Massachusetts. The state also prohibits pre-existing condition waiting periods on Medigap plans (in most states, Medigap insurers can impose pre-existing condition waiting periods of up to six months if the enrollee didn’t have continuous coverage before enrolling).

Massachusetts also has an annual Medigap open enrollment period (see 211 CMR 17.10 (5)). The open enrollment window runs from February 1 to March 31 each year, and gives people a guaranteed-issue opportunity to enroll in Medigap for the first time, if they missed their initial six-month enrollment window, or to switch from one plan to another. This is an unusual provision; people in most states who miss their initial six-month enrollment period or wish to pick a different plan later on do not have another guaranteed-issue opportunity to enroll, unless they qualify for one of the federal government’s limited guaranteed-issue rights for Medigap.

Under federal Medicare rules, people who aren’t yet 65 can enroll in Medicare if they’re disabled and have been receiving disability benefits for at least two years, or if they have ALS or end-stage renal disease. But federal rules do not guarantee access to Medigap plans for people who are under 65. Massachusetts is among the majority of the states that have implemented rules to ensure that disabled Medicare beneficiaries have at least some access to Medigap plans. Massachusetts requires Medigap insurers to offer coverage to disabled Medicare beneficiaries under age 65, and does not allow insurers to charge those enrollees higher premiums; the state’s Medigap community rating rules extend to disabled beneficiaries as well (this is unusual; while the majority of the states do require Medigap insurers to offer at least some plans to disabled beneficiaries, most states allow them to charge these enrollees higher premiums).

But while most of those states simply require Medigap insurers to offer at least some plans to any Medicare beneficiary under the age of 65, Massachusetts law notes that Medigap insurers are not required to offer coverage to people who are eligible for Medicare due to having end-stage renal disease.

Medicare beneficiaries who are disabled and under the age of 65 have the option to enroll in a Medicare Advantage plan instead of Original Medicare,14 and this includes people with kidney failure (people with kidney failure used to be barred from enrolling in most Medicare Advantage plans, but federal rules changed that as of 2021). Medicare Advantage monthly premiums are not higher for those under 65. But as noted above, Medicare Advantage plans have more limited provider networks than Original Medicare, and total out-of-pocket costs can be as high as $9,350 for in-network care in 2025, plus the out-of-pocket cost of prescription drugs.15

What is Medicare Part D?

Original Medicare does not provide coverage for outpatient prescription drugs. About 46% of Original Medicare beneficiaries nationwide have supplemental coverage via an employer-sponsored plan (from a current or former employer or spouse’s employer) or Medicaid, and these plans often include prescription drug coverage.9 (Note that if the supplemental coverage is provided by Medicaid, the drug coverage is provided by Medicare Part D.)

Medicare beneficiaries who do not have prescription drug coverage through Medicaid or an employer-sponsored plan can get prescription drug coverage under Medicare Part D.

This coverage can be obtained as part of a Medicare Advantage plan or as a stand-alone Part D plan.

There are 16 stand-alone Medicare Part D prescription drug plans for sale in Massachusetts for 2025, with premiums starting at $6.30.4

715,136 Medicare beneficiaries in Massachusetts had stand-alone Medicare Part D prescription drug coverage as of September 2024. Another 492,125 had Medicare Part D prescription drug coverage as part of their Medicare Advantage plans.1 Enrollment in Part D coverage is optional, but people who forego it without having creditable drug coverage from another source will end up paying a late enrollment penalty if they decide to sign up for Part D later in life.

Medicare Part D enrollment is available on an annual basis, during the Medicare Annual Election Period (October 15 to December 7). Medicare beneficiaries also have an opportunity to enroll in a Medicare Part D prescription drug coverage when they’re first eligible for Medicare, or after another creditable prescription drug plan ends.

How does Medicaid provide financial assistance to Medicare beneficiaries in Massachusetts?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums, prescription drug expenses, and services Medicare doesn’t cover – such as long-term care.

Our guide to financial assistance for Medicare enrollees in Massachusetts includes overviews of these benefits, including long-term care coverage, Medicare Savings Programs, and eligibility guidelines for assistance.

What additional resources are available for Medicare beneficiaries and their caregivers in Massachusetts?

If you have questions about Medicare eligibility in Massachusetts or Medicare enrollment in Massachusetts, the SHINE Program (Serving the Health Insurance Needs of Everyone) can help.

Massachusetts also maintains a web page devoted to Massachusetts Medicare laws.

The Medicare Rights Center is a nationwide service that can provide a variety of information and assistance with questions related to Medicare eligibility, enrollment, and benefits.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Medicare Monthly Enrollment – Massachusetts.” Centers for Medicare & Medicaid Services Data, September 2024. Accessed Jan. 21, 2025 ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- “Medicare Advantage in 2024: Enrollment Update and Key Trends.” KFF.org. August 8, 2024 ⤶

- ”Medicare Supplement Plans Offered in Massachusetts, 2024/2025” Mass.gov. Accessed Jan. 21, 2025 ⤶ ⤶

- Fact Sheet – Centers for Medicare & Medicaid Services. Page 65. CMS, September 27, 2024. ⤶ ⤶ ⤶

- “U.S. Census Bureau Quick Facts: U.S. & Massachusetts.” U.S. Census Bureau, July 1, 2024. Accessed Jan. 21, 2025 ⤶

- “Medicare Monthly Enrollment – U.S.” Centers for Medicare & Medicaid Services Data, September 2024. Accessed Jan. 21, 2025 ⤶ ⤶

- Fuglesten Biniek, Jeannie, Tricia Neuman, Meredith Freed, and Nancy Ochieng. “Medicare Advantage in 2024: Enrollment Update and Key Trends.” Kaiser Family Foundation, August 8, 2024. ⤶ ⤶

- “Medicare Monthly Enrollment – MA (2018).” Centers for Medicare & Medicaid Services Data, May 2018. ⤶

- Ochieng, Nancy, Gabrielle Clerveau, and Tricia Neuman. “A Snapshot of Sources of Coverage among Medicare Beneficiaries.” KFF.org. Sep. 23, 2024 ⤶ ⤶

- Ochieng, Nancy, Gabrielle Clerveau, and Tricia Neuman. “A Snapshot of Sources of Coverage among Medicare Beneficiaries.” KFF. Sep. 23, 2024 ⤶

- “The State of Medicare Supplement Coverage.” Page 12. AHIP, May 2024 ⤶

- “The State of Medicare Supplement Coverage.” Page 11. AHIP, February 2023. ⤶

- ”Medigap in Massachusetts” Medicare.gov. Accessed Jan. 21, 2025 ⤶

- “Medicare Coverage of Dialysis and Kidney Transplant Services.” Medicare.gov. Accessed September 8, 2023. ⤶

- ”Final Contract Year (CY) 2025 Standards for Part C Benefits, Bid Review and Evaluation” Centers for Medicare & Medicaid Services. May 6, 2024 ⤶