With each State of the Union Address, Americans can expect both the sitting president and the opposition party to introduce emotionally appealing guests – the Americans who embody the challenges that each party has overcome or is promising to address in the years ahead.

And, with the battle over the Affordable Care act still being fought in the trenches, it wasn't surprising at all that this year's SOTU guests included Americans affected by health reform. President Barack Obama introduced his guest: a "winner" – Amanda Shelley, whose pre-existing condition kept her from getting health coverage until the ACA took effect on January 1. The GOP, meanwhile, brought Emilie Lamb, a guest they considered an obvious Obamacare "loser."

But in selecting Lamb as a "victim" who is being robbed of "stellar" health coverage, the Republicans unwittingly thrust into the spotlight another "winner" for Obamacare – a perfect example of one of the millions of Americans who are, in actuality, being rescued from the kind of coverage that has financially destroyed thousands of American families each year.

The 'victim'

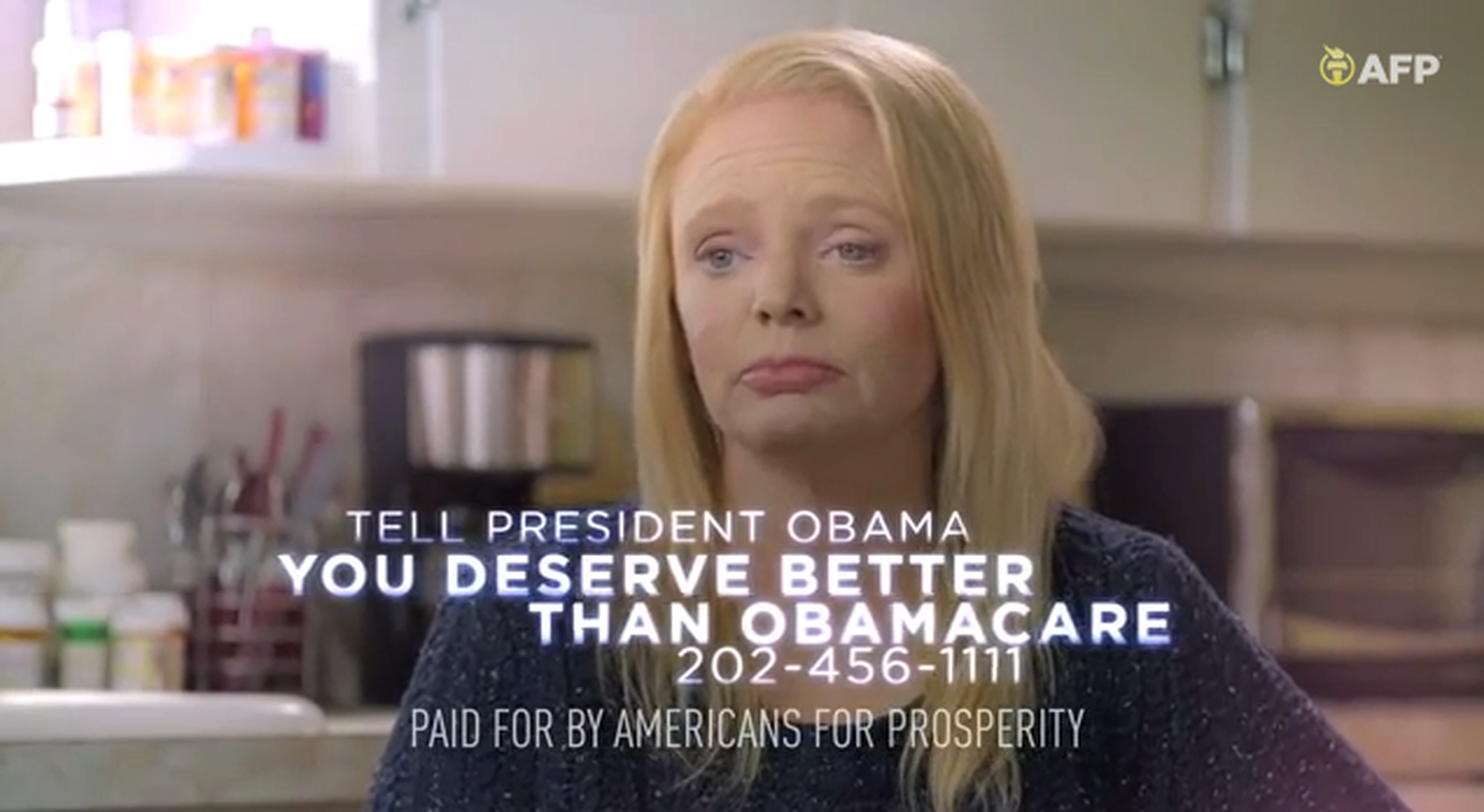

Emilie Lamb, a constituent from Rep. Marsha Blackburn's Tennessee district, has received a wealth of attention since taking a coveted seat at the State of Union. She has been featured not only in news reports and op-eds written by her and by Rep. Blackburn, but also in a slick video produced and distributed by Americans for Prosperity.

Emilie Lamb, a constituent from Rep. Marsha Blackburn's Tennessee district, has received a wealth of attention since taking a coveted seat at the State of Union. She has been featured not only in news reports and op-eds written by her and by Rep. Blackburn, but also in a slick video produced and distributed by Americans for Prosperity.

In the video (which has been removed from YouTube), the 40-year-old Lamb explains that since age 27, she's been afflicted with lupus, a devastating and unpredictable autoimmune disease. She tells us that she had voted for President Obama, and even says in the video that she "thought that Obamacare was going to be a good thing." Now she says, "instead of helping me, Obamacare has made my life almost impossible."

Lamb explains that Obamacare resulted in cancellation of health coverage she's had since 2006. To replace that coverage, which she called "stellar and affordable," she had to buy a plan on the Tennessee exchange. The premium for her new ACA-compliant plan? $373 a month – even with an ACA income-based subsidy.

At first glance, it may seem obvious to viewers that Lamb is facing a huge financial burden because of the premium increase. She certainly supports that case when she says that she'll need to take a second job to afford the premium. But will her new policy truly make her life "impossible?" or might the new coverage actually rescue her from a plan that could have destroyed her life financially and left her without any realistic access to care?

'Stellar' coverage? Not quite.

Emilie Lamb's "stellar" coverage was actually a limited-benefit policy through CoverTN that was cancelled in December because it didn't meet ACA standards.

CoverTN was a collaboration between employers and the state of Tennessee that sought to provide affordable limited-benefit policies for people who had little else in the way of coverage options.

Lamb definitely falls into that category: If she had tried to buy a comprehensive plan on the individual market before 2014, she would have been declined because of her lupus. There were only five states where individual policies were guaranteed issue, and Tennessee wasn't one of them.

Cases like Emilie's are one of the reasons the ACA was created in the first place. I asked her why she was initially excited about the ACA, she told me that she knows what it's like to be uninsurable based on a pre-existing condition. She said that she liked the idea that everyone would have access to health insurance regardless of their medical history.

But her support waned when it came down to the reality of having to pay higher premiums – even if it meant she'd get a much better policy.

Lamb's policy did provide good coverage for low medical costs. (Despite having a chronic medical condition, her expenses have never been catastrophic.) And it's easy to understand why she considered her premiums stellar. They were just $52 a month, thanks to the fact that her employer and the state of Tennessee each chipped in one-third of her premiums. (Technically, her new ACA premium is a little more than double her old premium of $156/month, but since she was only responsible for a third of that cost, the new premium seems like more of an increase than it really is.)

But while CoverTN may have seemed "stellar" for both employers and employees, its benefits were limited to relatively low-cost care. There were two coverage options, both run by Blue Cross Blue Shield of Tennessee: Plan A and Plan B. Both policies had no limit on out-of-pocket expenses, and the maximum amount they would pay annually was $25,000.

Both plans covered only generic medications, and even that was limited to generics on the CoverTN formulary. Plan A paid up to $250 per quarter in medication costs, and plan B paid up to $75 per quarter. Despite the limitations, Emilie told me that her average monthly out-of-pocket cost for medications was usually around $95 with her old plan. Her brand-name drugs were not covered by her policy, but the network-negotiated discount that she received kept her total drug costs to a level that she considered manageable.

Network discounts only go so far though, and Emilie is lucky that her lupus didn't require drugs like Benlysta or Rituximab, which would have cost tens of thousands of dollars – not covered by her insurance.

Lucky to avoid financial catastrophe

But what about those emergency room visits and surgeries? Both CoverTN plans limited emergency room coverage to two visits per year. There was also a limit of two outpatient surgeries per year. For inpatient care, Plan A would cover up to $10,000 in hospital fees and up to $10,000 in physician/surgeon fees. Plan B has similar restrictions, but the limit is slightly higher at $15,000 each (although the total amount the plan will pay is still capped at $25,000 for the year).

When I asked Emilie about the caps on hospitalization, she explained that she was comfortable with her old plan, despite its limitations. A surgery in 2007 resulted in a hospital bill of $125,000, but the network-negotiated rates reduced the total to within the limits of her plan. Again, Emilie was lucky.

Her bill was reduced by at least 80% in order to bring the paid charges under the limits of her plan. Although this is not unheard of, it's certainly stretching the limits of how much network negotiations can lower a hospital bill. Medicare reduces bills by an average of 73 percent, and it's unusual for a private insurer to receive a discount larger than that.

Essentially, if Emilie's total bill had been any higher than it was, she would have been on the hook for significant charges. Emilie's surgery was related to a horseback-riding accident – it had nothing to do with lupus and was unanticipated. And a more serious accident would have resulted in higher medical bills. Obtaining coverage that caps payment at $25,000 annually is playing with fire. Sometimes you don't get burned. But that doesn't mean it's safe. Other times you burn down the whole house.

The Alliance for Lupus Research puts the average cost of care for a lupus patient in the range of $14,000 to $28,000 per year. If there's kidney involvement, the average cost can climb to nearly $63,000 (and that doesn't count medical issues that are not lupus-related, like Emilie's equestrian accident). Emilie's CoverTN plan was paying the bulk of her medical costs only because she was lucky enough to not run afoul of the plan's limitations.

But when it comes to whether or not your health insurance covers the care you need, you shouldn't have to rely on luck. Eventually, luck runs out. And health insurance used to run out as well. (One of the basic consumer protections in the ACA is a ban on annual and lifetime benefit maximums.)

When I talked to Emilie last week, her position was that "something is better than nothing." Indeed, CoverTN was better than nothing. But it was not a solid safety net. It was the sort of policy that could easily leave an insured with insurmountable bills in the event of an even moderately expensive medical situation.

When people are uninsured or have limited-benefit plans and are unable to pay their medical bills, the result is also higher healthcare costs for everyone else (and bankruptcy for the individual). One of the goals of the ACA was to minimize the number of unpaid medical bills, and eliminating limited-benefit plans was an essential part of accomplishing that.

Expensive plans not the only option

Although it makes sense for a person with a chronic condition to seek out a Platinum or Gold exchange policy, the video might lead viewers to believe that the most expensive plans are the only available option. The video presents Emilie's premium increasing from $52 to $373 – without any clarification.

Emilie actually had 37 policy options on HealthCare.gov, with pre-subsidy premiums ranging from $164/month to $420/month. (She qualified for a $15 per month subsidy that could be applied to any metal-level plan.) She confirmed that the reason she selected the platinum plan was to minimize her total expenses for premiums plus out-of-pocket costs. She would have been able to keep her doctors with almost all of the BCBS plans – Bronze, Gold and Silver included – in the exchange, as the same network used for the Platinum plans is also available with most of their other plans.

It's worth noting that people like Emilie who have chronic medical conditions will almost always come out ahead with health insurance. For a person who has little or no medical bills during the year, premiums are purchasing peace of mind. But for someone with extensive medical needs, the amount received in benefits can be significantly more than the amount paid in premiums. Emilie is well aware of this fact – she explained that going without health insurance is not feasible for her at all, so she was among the first wave of enrollees getting coverage in the exchange with a January 1 effective date.

She chose a Blue Cross Blue Shield Platinum policy with a $1,500 out-of-pocket maximum. It's the second most expensive plan available, but it's the one that makes the most sense for someone with a chronic medical condition, since the higher premiums are more than offset by the lower out-of-pocket costs.

But again, it makes no sense to compare Emilie's old plan to her new policy. A Geo Metro costs a lot less than a new Mercedes, but we wouldn't expect their sticker prices to be compared side by side as if they were equal products or the only vehicle options.

For truly catastrophic medical bills – which Emilie has thankfully avoided thus far – the old plan offered very poor coverage. The new plan provides outstanding coverage – far better than most new policies in the exchanges, and dramatically better than most individual policies that were available last year. With just one hospital visit, Emilie's old plan realistically could have put her in the category of people bankrupt by medical bills.

Irresponsible messages

Each person's situation is different. Certainly, not everyone needs to buy a Platinum exchange plan, and in most cases, if you're eligible for a subsidy, you can pay far less for a Bronze or Gold plan – or a Silver plan. (With a Silver plan, you may actually be eligible for a plan with reduced cost-sharing requirements.) If you haven't shopped for health insurance yet, don't be dissuaded by negative anecdotes – like Emilie's. Compare your own options and find the plan that works best for you.

It's understandable that there are people who liked their old limited-benefit plans – especially if they have never experienced extremely expensive medical conditions. Because she desperately tried to control her health coverage costs, one could even consider Emilie responsible.

What's not responsible at all, are the efforts of people who should know better – elected leaders like Rep. Blackburn and national organizations such as Americans for Prosperity – to mislead people into thinking that just because they paid less for a "junk policies," they had a reliable safety net.

We know critics will continue to portray people like Emilie as "victims" of health reform when in truth, it's far more accurate say that – because of the comprehensive, affordable ACA-certified plans afforded by health reform – Emilie and others can avoid becoming victims of medical or financial disasters.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act, including a guide to open enrollment and a guide to special enrollment. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.