In this edition

- President Biden's American Recovery Plan calls for additional premium subsidies and COBRA subsidies

- Open enrollment for 2021 coverage ends Saturday in Massachusetts and Rhode Island

- Partial 2022 health insurance rules finalized by outgoing Trump administration

- Lawsuit filed to block Georgia's plan to eliminate its health insurance exchange

- Bills introduced in Virginia to eliminate current ban on abortion coverage on marketplace plans, and study infertility coverage mandate

- Legislation introduced in Maryland and Rhode Island to create universal health care commissions

- Legislation introduced in Missouri calls for a Medicaid work requirement as of 2022

- Uncompensated care funding in Florida and Texas extended through 2030

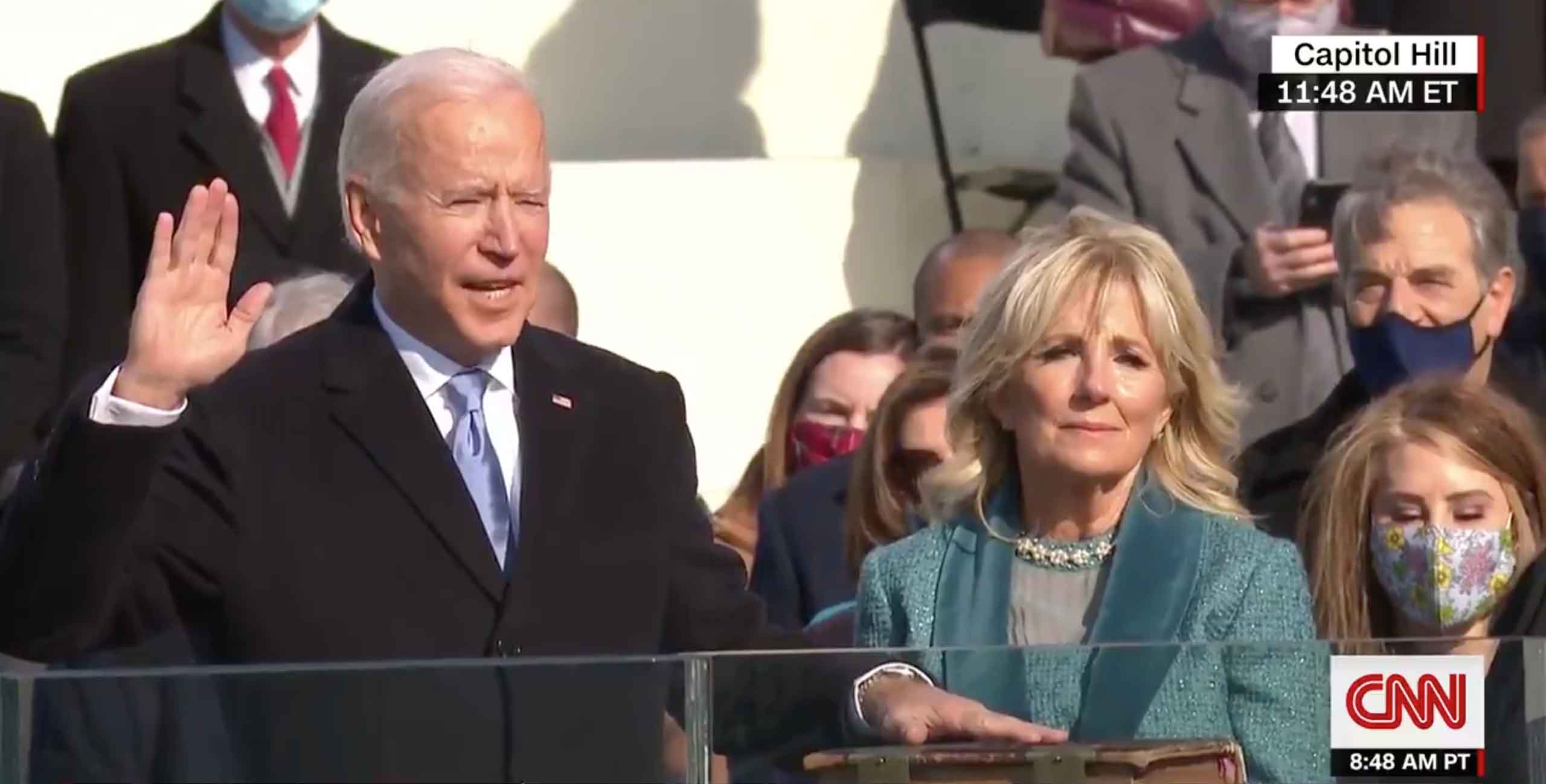

President Biden's American Recovery Plan calls for additional premium subsidies and COBRA subsidies

Newly inaugurated President Joe Biden outlined his American Recovery Plan last week, and it includes some important provisions aimed at improving access to health coverage. The wide-ranging $1.9 trillion proposal, which would have to be approved by Congress, calls for premium tax credits to be increased "to lower or eliminate health insurance premiums" and to cap any enrollee's after-subsidy premium at no more than 8.5 percent of their income. This second provision would primarily help people with income near or a little above 400 percent of the poverty level, and could make a substantial difference in the affordability of coverage for some households that currently have to pay full-price for their coverage — sometimes amounting to well over a quarter of their income.

The plan also calls for government subsidies of COBRA premiums through the end of September 2021. In 2009, the American Recovery and Reinvestment Act provided COBRA subsidies, which could serve as a model for how a new round of COBRA subsidies might work.

Biden's American Recovery Plan encompasses far more than just health coverage. But if you're curious about how health care reform might proceed under the new administration and the new Congress, check out this two-part series from Andrew Sprung, this piece from Charles Gaba, and this piece from Katie Keith.

Open enrollment ends Saturday in Massachusetts and Rhode Island

Open enrollment for 2021 health coverage is still ongoing in five states and Washington, DC (plus a COVID-related special enrollment period for uninsured residents in Maryland). But the enrollment window ends this Saturday, January 23, in Massachusetts and Rhode Island. After Saturday, residents in those states will need a qualifying event in order to enroll or make changes to their 2021 coverage.

As of this week, confirmed marketplace enrollment totals for 2021 coverage have surpassed 11.6 million nationwide.

Partial 2022 health insurance rules finalized by outgoing Trump administration

Last fall, the Trump administration published the proposed Notice of Benefit and Payment Parameters for 2022. This annual rulemaking document is wide-ranging and typically addresses a variety of issues related to the health insurance exchanges, special enrollment periods, risk adjustment, etc. At the time, we summarized several of the proposed rule changes that were most likely to directly affect people with individual market health plans.

Last week, the Trump administration announced that it was finalizing some aspects of the proposal — including the most controversial ones — but that the rest of the proposed rule changes would be finalized in an additional rule that will be issued "at a later date." That will be under the Biden administration, which is also likely to delay the rule the Trump administration finalized last week (currently slated to take effect March 15) and reissue a new proposed rule, with a new comment period.

A total of 542 comments were submitted to CMS regarding the proposed rule changes for 2022. The comments that pertain to the rule changes that CMS finalized last week are summarized in the final rule, along with the responses from CMS. Notably:

- Although CMS noted that "nearly all commenters on this rulemaking cautioned about potential harmful impacts to consumers" of allowing states to abandon their exchanges and rely entirely on brokers, agents, and insurers for health plan enrollment, the proposed rule change that would allow this was finalized. There would still be a role for an official exchange website in states that choose this option, but it would be minimal. And there are ongoing concerns that a switch to relying on brokers, agents, and insurers, instead of exchanges, will make it harder for Medicaid-eligible enrollees to understand the assistance and coverage that's available to them.

- The Trump administration's 2018 guidance on 1332 waivers, which sharply relaxed the "guardrails" that apply to these waivers, is being officially incorporated into federal regulations.

- The fee that insurers pay HealthCare.gov (and pass on to consumers via premiums) will be reduced in 2022. In states that rely fully on HealthCare.gov, it will be 2.25 percent of premiums; in states that run their own exchanges but use HealthCare.gov for enrollment, it will be 1.75 percent of premiums (down from a current 3 percent and 2.5 percent, respectively).

Many of the proposed rule changes are still under consideration and were not finalized last week, including the premium adjustment percentage (which would affect maximum out-of-pocket amounts and the affordability threshold for catastrophic plan eligibility), special enrollment periods when employer COBRA subsidies cease or a person loses eligibility for premium subsidies, and a rule change that would permanently allow insurers to issue MLR rebates earlier in the year.

At Health Affairs, Katie Keith has an excellent in-depth analysis of the partial final rule.

Lawsuit filed to block Georgia's plan to eliminate its health insurance exchange

Last fall, the Trump administration approved Georgia's 1332 waiver proposal to transition away from HealthCare.gov and instead utilize a system that relies on brokers, agents, and insurers to get people enrolled, without a centralized exchange (the finalized rule change that allows a similar approach nationwide is very reminiscent of Georgia's 1332 waiver).

Last week, Planned Parenthood Southeast and Feminist Women’s Health Center filed a lawsuit against HHS, CMS, the Department of the Treasury, and their respective leaders, alleging that the waiver was unlawfully approved and should be vacated. Democracy Forward, which is representing the plaintiffs in the case, explained that Georgia's 1332 waiver "will do immense damage to Georgia’s health insurance market, force Georgians to shop for insurance through private brokers and insurance companies, lead more residents to enroll in junk plans, and increase premiums."

Bills introduced in Virginia to eliminate state ban on abortion coverage under marketplace plans; study impact of mandating coverage for infertility

Virginia is one of 26 states where health insurance plans sold in the marketplace/exchange are not allowed to provide coverage for abortions. (Virginia's ban includes exceptions for abortion coverage in cases of rape, incest, or the mother's life being in danger.) Legislation was introduced last week in Virginia's Senate that would eliminate this ban, allowing insurers to offer abortion coverage if they choose to do so.

Legislation has also been introduced in Virginia that would direct the Virginia Health Insurance Reform Commission to conduct a study on the impacts of requiring health insurance plans in the state to cover infertility treatment. There are currently 19 states that mandate at least some coverage for infertility treatment.

Legislation introduced in Maryland and Rhode Island to create universal healthcare commissions

Legislation was introduced in Maryland last week that calls for the state to create a Commission on Universal Health Care. The Commission would be tasked with developing a plan for the state to establish a single-payer universal coverage system by 2024.

Legislation was also introduced in Rhode Island last week that calls for the creation of a special legislative commission that would study how the state might go about implementing a single-payer Medicare-for-All type of health coverage program in Rhode Island.

Legislation introduced in Missouri to create a Medicaid work requirement

Missouri has not yet expanded Medicaid eligibility under the ACA, but that will change this summer, thanks to a ballot initiative that voters in the state passed last year. Legislation was introduced this month in Missouri's Senate that calls for a Medicaid work requirement in the state, effective as of January 2022. Under the terms of the bill, non-exempt Medicaid enrollees would have to work (or participate in various other community engagement activities, including volunteering, school, job training, etc.) at least 80 hours per week in order to maintain eligibility for Medicaid.

The Trump administration approved numerous work requirement waivers over the last few years, but due to lawsuits and the COVID pandemic, none are currently in effect. And the Biden administration is very unlikely to approve any additional waivers, meaning that Missouri's legislation is likely a non-starter for the time being, even if it's enacted.

Uncompensated care funding in Florida and Texas extended through 2030

Last Friday, the Trump administration renewed 1115 waivers in Texas and Florida, both of which are now valid through mid-2030. These waivers are for Medicaid managed care, and also provide federal funding for uncompensated care – which is more of a problem in states like Texas and Florida, due to their failure to expand Medicaid and the resulting coverage gap for low-income residents.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.