Home > ACA Marketplace > District of Columbia

Washington, DC Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Washington, DC health insurance Marketplace guide

This guide to health insurance in Washington, DC, including the FAQs below, will help you understand the coverage options available to you and your family, and whether you might be eligible for financial assistance with your health coverage. Having health coverage is especially important in DC, as the District requires residents to maintain health coverage (unless they qualify for an exemption) or pay a penalty on their tax return.1

(Revenue from the penalty is used to fund DC’s Individual Insurance Market Affordability and Stability Fund, used for outreach and education related to health coverage.2)

The District of Columbia runs its own health insurance exchange – DC Health Link. DC residents and business owners can use DC Health Link to shop for individual/family and small-group health plans offered by various private health insurance carriers.

DC Health Link’s individual and family plans are used by people who aren’t eligible for Medicare, Medicaid, or an affordable employer-sponsored health plan. The small-group health plans are used by businesses with up to 50 employees, as well as by members of Congress and their staff.3

Individual/family and small-group health insurance can only be obtained via the exchange (DC Health Link) in Washington, DC.4 In the rest of the country, off-exchange policies are available – albeit without any subsidies. But that’s not the case in DC.

Washington, DC’s exchange is also unique in terms of having more small-group enrollees than individual enrollees.5 In the rest of the country, small-group plans are either not available through the exchange, or account for a minority of total exchange enrollment.

Frequently asked questions about health insurance in Washington, DC

Who can buy Marketplace health insurance in Washington, DC?

To be eligible to enroll in private individual/family health coverage through DC Health Link, you must:8

- Be lawfully present in the United States, and reside in Washington, DC

- Not be incarcerated

- Not be enrolled in Medicare9

So most DC residents can enroll in a health plan through the exchange. But eligibility for financial assistance involves some additional parameters. To qualify for income-based federal Advance Premium Tax Credits (APTC) or cost-sharing reductions (CSR), you must:

- Not be eligible to enroll in an affordable plan offered by an employer. If you have access to an employer’s plan and are wondering whether it’s considered affordable, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies via DC Health Link.

- Not be eligible for DC Medicaid.

- Not be eligible for premium-free Medicare Part A.9

- If married, file a joint tax return with your spouse.10 (with very limited exceptions)11

- Not be able to be claimed by someone else as a tax dependent.10

In addition to those basic parameters, DC Health Link premium subsidy eligibility will depend on your household’s income.

When can I enroll in an ACA-compliant plan in Washington, DC?

In Washington, DC, the open enrollment period begins November 1 and continues through January 31,1213 which is a couple weeks longer than the enrollment window in most states.

After the open enrollment period ends, you may still be able to enroll or make a plan change if you experience a qualifying life event, such as giving birth or losing other health coverage.

DC Health Link is one of several state-based exchanges where pregnancy is considered a qualifying life event, making it easier for someone who is pregnant to obtain health coverage.

Some people can enroll year-round even without a specific qualifying life event. And enrollment in DC Medicaid is available year-round. (You can enroll at districtdirect.dc.gov.)

How do I enroll in a Marketplace plan in Washington, DC?

To enroll in an ACA Marketplace/exchange plan in the District of Columbia, you can:

- Visit DC Health Link – the District’s exchange – to compare the health plans that are available in your area, determine whether you’re eligible for financial assistance, and enroll in coverage during open enrollment or during a special enrollment period.

- Enroll in a DC Health Link plan with the help of an insurance agent or broker, Navigator, or a certified enrollment assister.

How can I find affordable health insurance in Washington, DC?

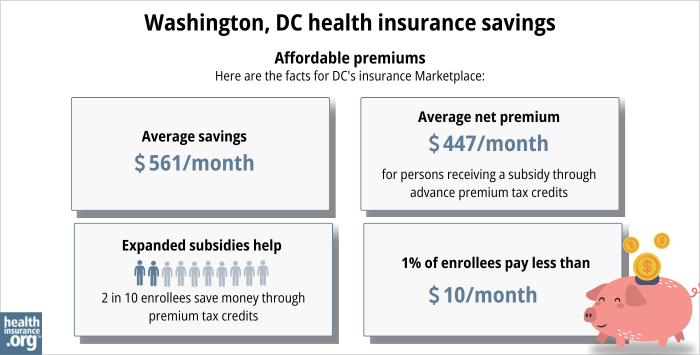

When you enroll in coverage through DC Health Link, you may find that you’re eligible for subsidies that can cover some of your monthly premiums and possibly also reduce your out-of-pocket costs for medical care.

These subsidies are not as common in DC as they are in other states, simply because Medicaid eligibility extends to higher income levels in DC, meaning that many people qualify for Medicaid instead of premium subsidies for private plans. (For adults under age 65, the eligibility limit for Medicaid in DC is 215% of the poverty level, as opposed to 138% in most states.14)

In addition, the fact that there is no “off-exchange” enrollment option in DC also helps to reduce the percentage of subsidy-eligible exchange enrollees. (In other states, people who know they aren’t eligible for subsidies might opt for off-exchange coverage, whereas that’s not possible in DC.)

So only 22% of DC Health Link enrollees were receiving federal premium subsidies as of 2024, versus 93% of Marketplace enrollees nationwide.15

Source: CMS.gov16

Premium subsidy eligibility will depend on how your household income compares with the cost of the second-lowest-cost Silver plan in your area, which will depend on your age. (In most states, it also depends on your location, but DC is one rating area so there are no location-specific rate differences within the District.17)

Applicants with household income up to 250% of the federal poverty level are also eligible for federal cost-sharing reductions (CSR), which will reduce the deductible and other out-of-pocket expenses for Silver-level plans. But only 3% of DC Health Link enrollees were receiving these subsidies as of 2024, versus 50% of Marketplace enrollees nationwide.15Again, this is due in large part to the fact that people with income between 139% and 215% of the poverty level are eligible for Medicaid in DC, whereas they’re eligible for premium subsidies and CSR in other states.

The plans available through DC Health Link include both standardized and non-standardized plans. All of the plans comply with the ACA, but standardized plans also conform to additional District-specific rules that include pre-deductible coverage for various services.18 Starting in 2024, outpatient mental health visits for children with standardized DC Health Link plans have only a $5 copay, with no deductible.19

Learn more about whether you might be eligible for Medicaid in Washington DC.

How many insurers offer Marketplace coverage in Washington, DC?

Are Marketplace health insurance premiums increasing in Washington, DC?

The following average rate changes have been approved for 2025 individual/family coverage, amounting to a weighted average rate increase of 4.7%, before any subsidies are applied:13

Washington, DC’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Group Hospitalization and Medical Services (CareFirst PPO) | 3.6% |

| CareFirst Blue Choice (CareFirst HMO) | 3.6% |

| Kaiser of the Mid-Atlantic States | 9% |

Source: DC Department of Insurance, Securities, and Banking13

Average rate changes apply to full-price premiums, and most DC Health Link enrollees do pay full price (as opposed to most other states, where the large majority of Marketplace enrollees receive subsidies and thus do not pay full price).15

But for those who qualify for premium subsidies, the net rate change from one year to the next will depend on how much the subsidy amount changes, as well as how much their own plan’s rate changes.

For perspective, here’s a summary of how average full-price premiums have changed in DC’s individual/family health insurance market over the years:

- 2015: Average increase of 11%.21

- 2016: Average increase of 4.3%.22

- 2017: Average increase of 7.3%.23

- 2018: Average increase of 15.6%.24 (negligible CSR cost; not added to rates)

- 2019: Average increase of 13%.25

- 2020: Average increase of 7.6%.26

- 2021: Average increase of 0.2%.27

- 2022: Average increase of 5%.28

- 2023: Average increase of 13.6%.29

- 2024: Average increase of 7.8%:30

How many people are insured through DC’s Marketplace?

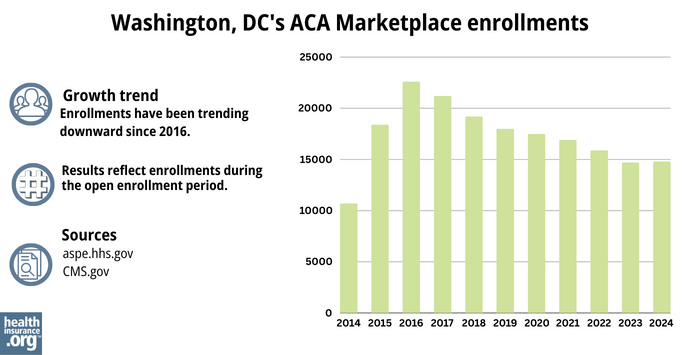

For 2024 coverage, 14,799 people enrolled in individual/family health plans through DC Health Link during the open enrollment period.31

In most states, Marketplace enrollment has trended upward significantly in the last few years, but that has not been the case in the District of Columbia.

Source: 2014,32 2015,33 2016,34 2017,35 2018,36 2019,37 2020,38 2021,39 2022,40 2023,41 202442

In contrast to the rest of the U.S., the majority of DC Health Link’s enrollees have small group coverage. As of June 2024, DC Health Link’s enrollment included more than 14,000 people with individual/family coverage, and more than 86,000 people with small-group coverage.43

What health insurance resources are available to DC residents?

DC Health Link

The District’s health insurance exchange (Marketplace) for small businesses, individuals, and families.

DC Department of Health Care Finance

Administers DC’s Medicaid program and various other social services programs in the state.

District of Columbia Department of Insurance, Securities & Banking

Licenses and regulates health insurance companies, brokers, and agents in the District. Provides assistance and information to consumers who have questions or complaints about regulated entities.

DC Department of Aging and Community Living

A resource for DC Medicare beneficiaries and their caregivers.

Explore our comprehensive guides to coverage in Washington, DC

Dental coverage in Washington, DC

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in DC.

DC’s Medicaid program

Learn about DC's Medicaid expansion, Medicaid enrollment and Medicaid eligibility.

Medicare enrollment in Washington, DC

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in DC as well as the Medicare supplement (Medigap) regulations.

Short-term health insurance coverage in Washington, DC

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in DC.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- Do You Know Your Health Insurance Rights? DC Department of Insurance Securities and Banking. Accessed December 2023. ⤶

- ”Fiscal Year 2019 Budget” Council of the District of Columbia. Accessed February 2024. ⤶

- “What are SHOP and DC Health Link?” Health Questions and Answers, U.S. Office of Personnel Management ⤶

- “Frequently Asked Questions” DC Health Benefit Exchange Authority ⤶

- “DC Health Benefit Exchange Authority Enrollment Summary” DC.gov, January 4, 2024. ⤶

- ”2024 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed Jan. 7, 2025 ⤶ ⤶

- ”DC Announces 2025 Health Insurance Rates, with Rate Increases Smallest in Recent Years” DC Department of Insurance, Securities, and Banking. Sep. 12, 2024 ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶ ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶ ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- “Health Benefit Exchange Authority Executive Board Meeting Minutes” DC Health Benefit Exchange Authority, May 2019 ⤶

- ”DC Announces 2025 Health Insurance Rates, with Rate Increases Smallest in Recent Years” DC Department of Insurance, Securities, and Banking. Sep. 12, 2024 ⤶ ⤶ ⤶ ⤶

- “Uninsured DC Residents Can Apply for Free Health Insurance” DC.gov, Accessed September 2023 ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶ ⤶ ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2024 ⤶

- “Market Rating Reforms State Specific Geographic Rating Areas” CMS.gov, Accessed September 2023 ⤶

- DC HBS Standard Plans 2024. DC Health Benefit Exchange Authority. April 2023. ⤶

- DC Health Benefit Exchange Authority Makes it Easier for Children to Access Mental and Behavioral Health Services. DC Health Benefit Exchange Authority. November 2022. ⤶

- DC Announces 2024 Health Insurance Rates; District Review Nets Almost $3 Million in Savings as 50% of Insurers Decreased Rates. DC Department of Insurance Securities and Banking. October 2023 ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- DISB Approves Rates for 2018 Health Plan Offerings on DC Health Link. Capitol Hill Chamber of Commerce. Accessed December 2023. ⤶

- Information About Approved Rates for January 2019 Health Plan Offerings on DC Health Link. DC Department of Insurance Securities and Banking. Accessed December 2023. ⤶

- Information About Approved Rates for January 2020 Health Plan Offerings on DC Health Link. DC Department of Insurance Securities and Banking. Accessed December 2023. ⤶

- Information About Approved Rates for January 2021 Health Plan Offerings on DC Health Link. DC Department of Insurance Securities and Banking. Accessed December 2023. ⤶

- Information About Approved Rates for January 2022 Health Plan Offerings on DC Health Link. DC Department of Insurance Securities and Banking. Accessed December 2023. ⤶

- Information About Approved Rates for January 2023 Health Plan Offerings on DC Health Link. DC Department of Insurance Securities and Banking. Accessed December 2023. ⤶

- DC Announces 2024 Health Insurance Rates; District Review Nets Almost $3 Million in Savings as 50% of Insurers Decreased Rates. DC Department of Insurance Securities and Banking. October 2023 ⤶

- ”Health Insurance Marketplaces 2024 Open Enrollment Period Report” CMS.gov. March 22, 2024 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “2023 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “DC Health Benefit Exchange Authority Enrollment Data for June 2024” DC.gov, June 24, 2024. ⤶