What is a qualifying life event?

A qualifying life event is an event that triggers a special enrollment period for an individual or family to purchase health insurance outside of the regular annual ACA open enrollment period.

This article will help you understand more about qualifying events, and has detailed information about all of the qualifying events that apply to coverage obtained in the individual/family market (on-exchange or off-exchange).

What types of health insurance use qualifying life events?

Qualifying life events trigger special enrollment periods in all ACA-compliant major medical plans. These types of policies include individual market, small group, and large group insurance plans, as well as Medicare. During a special enrollment period, you can enroll or make a change to your coverage, assuming you meet all other eligibility requirements. The specific qualifying life events that will trigger a special enrollment period are similar across different types of health insurance, but not identical.

Health plans that aren't regulated by the ACA (for example, short-term medical plans) are not required to enroll you in coverage when you experience a qualifying event. These plans generally allow year-round enrollment, but with medical underwriting. This is in contrast to coverage that uses special enrollment periods, during which coverage is guaranteed issue.

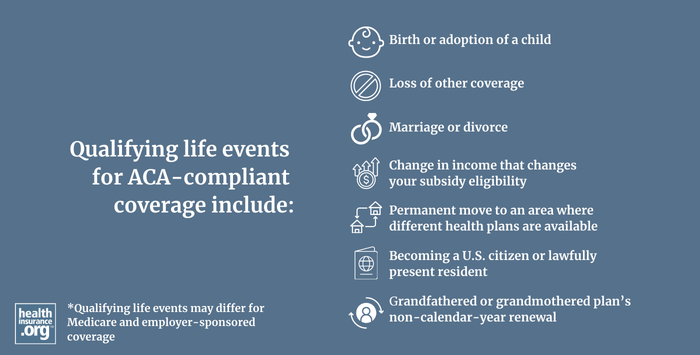

What are examples of qualifying life events?

In the individual/family market (in most cases, this includes on-exchange or off-exchange coverage), qualifying life events include:

- birth or adoption of a child

- marriage (and divorce, if the exchange or insurer counts it as a qualifying event, or if the divorce triggers a loss of other coverage)

- loss of other coverage (as long as the coverage you’re losing is considered minimum essential coverage)

- a permanent move to an area where different health plans are available (as long as you already had coverage prior to the move)

- a change in income that changes your subsidy eligibility (may not apply off-exchange in states that run their own exchanges)

- an increase in income that moves you out of the Medicaid coverage gap

- a grandfathered or grandmothered plan’s non-calendar-year renewal

- becoming a U.S. citizen or lawfully present resident (only applicable in the exchange)

For other types of coverage, the qualifying life events aren't necessarily the same:

How long do I have to select a plan or switch to a different plan if I experience a qualifying life event?

If you experience a qualifying life event, you have 60 days to select a plan in the individual/family market or switch to a different plan (in some cases, the ability to switch from one plan to another is limited during special enrollment periods). Depending on the qualifying event, you may have a special enrollment window that begins 60 days before the event and continues for 60 days after the event.

In most cases, the coverage will be effective the first of the month following your enrollment data. But if the qualifying event is the birth or adoption of a child, the coverage can be backdated to the date of the birth or adoption.

For Medicare coverage, most qualifying events trigger 2-month special enrollment periods, but there are exceptions.

For employer-sponsored health coverage, special enrollment periods usually only continue for 30 days following the qualifying life event.

Have you experienced a qualifying life event?

Get your free quote now through licensed agency partners!