What is a high-deductible health plan (HDHP)?

A high-deductible health plan (HDHP) is a type of health insurance coverage with a high deductible that meets specific Internal Revenue Service (IRS) guidelines. To contribute to a tax-advantaged health savings account (HSA), a person must have coverage under an HDHP.1 HDHPs require policyholders to pay more out-of-pocket expenses before the health plan starts to pay for medical services. To offset these costs, HDHPs can be paired with HSAs, which help enrollees save pre-tax income for medical expenses.

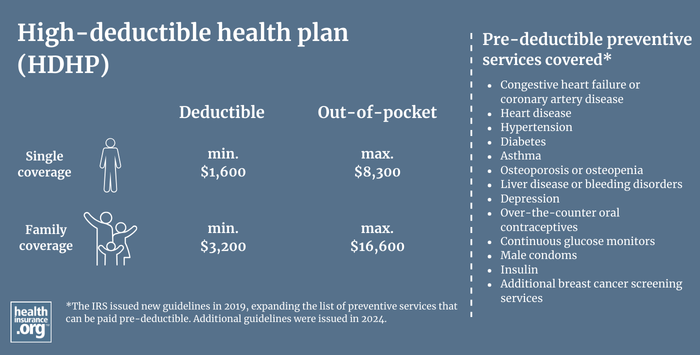

The IRS sets a floor for an HDHP’s deductible; that is, the plan must meet a “minimum deductible” requirement. The plan must also cap out-of-pocket costs at a level set by the IRS each year and may not pay for any non-preventive care before the minimum deductible is met. The impact of each of these requirements are explained in more detail below.

Because of the specific IRS requirements for HDHPs, many plans with high deductibles are not HDHPs.

How do I know if I have a high-deductible health plan?

If your health plan is an HDHP, this will be stated in the policy materials. Many HDHPs have “HSA” or “HDHP” in the plan name, which makes it obvious. But if not, you can ask your employer or health plan for clarification. If you’re shopping in the Marketplace, you can use the filter option so that the results only show available HDHPs.

Do HDHPs have copays?

HDHPs cannot have copays before the minimum allowable deductible is met. When a service is covered with a copay, it means that the enrollee pays a flat-dollar amount and the health plan pays the rest of the cost. But the ACA requires that HDHPs pay for preventive care before the minimum allowable deductible is met.2 And preventive care is covered in full by all non-grandfathered health plans (plans sold on or after March 23, 2010), which means there’s no copay for preventive services.3

After the minimum allowable deductible is met, an HDHP can be designed with any type of cost-sharing until the maximum out-of-pocket is met, as IRS rules do not regulate this. IRS rules for HDHPs do address the minimum deductible, the maximum out of pocket, and the ACA requirement that an HDHP must pay for preventive care before the minimum deductible is met.1 Copays could be used at this point, but it’s much more common for HDHPs to use coinsurance, or a model in which the deductible is equal to the maximum out-of-pocket, thus eliminating any post-deductible cost-sharing.

How much does a high-deductible health plan cost?

The premium for an HDHP will vary from one plan to another, from one location to another, and how the coverage is obtained – either from an employer or via the Marketplace. HDHPs often have lower premiums than traditional (non-HDHP) health plans that have lower copays and lower overall cost-sharing. But HDHPs do not always have lower premiums than non-HDHPs.

As discussed below, the maximum allowable out-of-pocket limit for an HDHP is lower than the maximum allowable out-of-pocket limit for a non-HDHP (note that deductibles are included in the total out-of-pocket exposure, for both HDHPs and non-HDHPs). A person with an HDHP can be required to pay no more than $8,300 in total out-of-pocket costs for in-network care in 2025, whereas a person with a non-HDHP could have an out-of-pocket limit as high as $9,200 for in-network care in 2025. (Higher cost-sharing, including higher total out-of-pocket costs, is often correlated with lower premiums.)4 And policy costs also depend on things like the scope of the provider network, the covered drug list, whether the plan is an HMO or PPO, etc.

If you’re obtaining an HDHP from your employer, the premium you pay will depend on how much of the premium is subsidized by the employer. In 2024, the average, employers pay the majority of their employees’ premiums for single and family coverage, but this varies from one employer to another.5

If you’re obtaining an HDHP in the Marketplace, the premium you pay will depend on your household income (an ACA-specific calculation), which dictates your eligibility for a premium subsidy – and if so, the size of the subsidy.

If you pair your HDHP with an HSA and make contributions to the HSA (see below for details about contribution limits), the money you contribute to your HSA will reduce your ACA-specific modified adjusted gross income (MAGI), which determines your eligibility for premium subsidies in the Marketplace. In some cases, selecting an HDHP and contributing to an HSA could result in larger premium subsidies than you'd otherwise receive.

Although the American Rescue Plan and Inflation Reduction Act have temporarily eliminated the ACA's subsidy cliff (through the end of 2025), subsidies are still not available if the cost of the benchmark plan (second-lowest-cost Silver plan) is less than 8.5% of your MAGI. So reducing your MAGI with HSA contributions could also result in subsidies when you might not otherwise be eligible for them.

As discussed below, there are non-HDHPs available with higher out-of-pocket costs than HDHPs, which can result in lower premiums. But if a non-HDHP is selected, the enrollee will not have the option of contributing to an HSA. If being able to contribute to an HSA is a priority for you, you'll want to focus on the HDHPs available in your area.

But, as described above, if the premium is your primary concern and you don't plan to contribute to an HSA, you may find plans with lower premiums that aren't HDHPs, and that have higher out-of-pocket exposure than the available HDHPs. This is because the maximum allowable out-of-pocket limit for non-HDHPs ($9,200 for a single individual in 2025)6 is higher than the maximum allowable out-of-pocket limit for HDHPs ($8,300 for a single individual in 2025).7

Can I combine a high-deductible health plan with an HSA?

Yes. HDHPs are the only plans that allow an enrollee to contribute to a health savings account (HSA). High-deductible insurance is considered a type of consumer-driven health plan, so you may hear the term CDHP used in conjunction with these plans. The idea is to give patients control over how to spend and invest their money.

Do I have to have an HSA if I have an HDHP?

No, you are not required to open or fund an HSA if you have an HDHP. Some employers that offer HDHPs also provide some HSA funding for their employees who enroll in the HDHP.8 But if you have to fund the HSA yourself, it’s optional to do so. If you have questions about this, you should consult with a tax advisor to understand how funding an HSA might impact your overall financial situation.

The money you contribute to an HSA will reduce your ACA-specific modified adjusted gross income – or MAGI – (which determines your eligibility for premium subsidies in the exchange). In some cases, selecting an HDHP and contributing to an HSA could result in larger premium subsidies than you'd otherwise receive.

Although the American Rescue Plan and Inflation Reduction Act have temporarily eliminated the ACA's subsidy cliff (through 2025), subsidies are still not available if the cost of the benchmark plan (second-lowest-cost silver plan) is less than 8.5% of your MAGI. So reducing your MAGI with HSA contributions could also result in subsidies when you might not otherwise be eligible for them.

Are HDHPs available for purchase in the health insurance Marketplace?

The answer is that it depends on where you live. For example, if you live in Chicago (zip code 60647), there are no HDHPs available for purchase in the Marketplace for 2025. And in Miami (zip code 33101), only two of the 176 available Marketplace plans are HDHPs. But in southwestern Wyoming (zip code 82901), five of the 30 available Marketplace plans are HDHPs.9

The number of available Marketplace HDHPs has declined in recent years, as has enrollment in those plans. In 2019, HDHPs accounted for 7% of all plans available through HealthCare.gov, and that had dropped to 3% by 2023. (Most of the remaining HDHPs are offered at the Bronze level.) And while 8% of all HealthCare.gov enrollees selected HDHPs in 2019, that had dropped to 5% by 2022 . 10

Are HDHPs offered by employers?

Yes, HDHPs are offered by many employers. The availability of employer-sponsored HDHPs has grown over the last decade. Among employees who have access to employer-sponsored health coverage, slightly more than half were offered an HDHP option in 2023.11

What’s the difference between an HDHP and a PPO?

This is a commonly asked question, but comparing HDHPs and PPOs would be like comparing apples and oranges. HMO, PPO, EPO, and POS are acronyms that describe how a plan is managed, including factors like provider network access and whether a referral is necessary to see a specialist. They have no bearing on coverage details such as deductibles or out-of-pocket costs.

HDHP, on the other hand, is a term that describes a specific type of coverage that conforms to IRS rules regarding deductibles, out-of-pocket limits, and what services can be covered pre-deductible. To be clear, an HDHP will also be either an HMO, PPO, EPO, or POS plan.

What do HDHPs cover?

HDHPs pay for certain preventive care before the deductible – the ACA requires this of all major medical plans – but under an HDHP, no other services can be paid for by the health plan until the insured has met the deductible (or at least the minimum deductible that applies to HDHPs, explained below).

So HDHPs cannot have copays for office visits or prescriptions before the deductible is met. This is in contrast to a plan that’s got a high deductible but also offers copays for office visits from the get-go. People might generally consider the latter to be a high-deductible plan, but it’s not an HDHP.

As described below, there is some flexibility related to pre-deductible coverage of certain chronic conditions. In 2024, the IRS expanded the list of preventive services that can be paid for by an HDHP pre-deductible.12 And telehealth benefits can be provided pre-deductible through 2024, if the plan chooses to offer this.13

What are HDHP deductible and out-of-pocket rules?

HDHPs have specific guidelines in terms of allowable deductibles and out-of-pocket costs. These are adjusted annually by the IRS, although there have been some years when there were no changes.

For 2025 coverage, the minimum HDHP deductibles are $1,650 for individual coverage and $3,300 for family coverage. The maximum allowable out-of-pocket limit is $8,300 for single coverage and $16,600 for family coverage.14

(Note that the IRS also clarifies that if a plan has both an individual deductible and a family deductible (wherein a person who meets the individual deductible does not have to meet the family deductible in order to receive post-deductible coverage), “if either the deductible for the family as a whole or the deductible for an individual family member is less than the minimum annual deductible for family coverage, the plan doesn’t qualify as an HDHP.”15 In other words, a plan with family coverage in 2025 will need to have individual deductibles of at least $3,300 to be an HDHP.)

For non-HDHPs, the maximum allowable out-of-pocket limit for a single individual in 2025 is $9,200, and for a family it’s $18,400.16 People are often surprised to learn that Bronze and Silver-level HDHPs often have lower out-of-pocket limits than Bronze and Silver-level plans that aren't HDHPs. This is because the allowable out-of-pocket limits for non-HDHPs are higher than the allowable out-of-pocket limits for HDHPs.

But not all plans that fall within the dollar-limit guidelines for deductibles and out-of-pocket maximums are HDHPs, since HDHPs also cannot pay for non-preventive services before the enrollee has met the deductible. So a plan with a $5,000 deductible and $8,000 out-of-pocket maximum would fail to be an HDHP if it also offers $25 copays for office visits before the deductible is met (as opposed to having the enrollee pay the full cost of the office visit and count it toward the deductible).

What are the contribution limits for an HSA?

To help pay these out-of-pocket costs, you can pair your high-deductible plan with a health savings account (HSA).

For 2025 coverage, the HSA contribution limit is $4,300 if your HDHP covers just yourself, and $8,550 if your HDHP also covers at least one other family member.14 People with HDHP coverage in 2024 have until the April 15, 2026 tax filing deadline to make 2025 contributions to their HSA.

If you’re 55 or older, you can contribute an extra $1,000 a year. This amount is not indexed for inflation. If two spouses are each 55 or older they can each make the additional $1,000 contribution but only if they each have their own HSA. If they make the family-level contribution to a single HSA (owned by either one of them), they can only make the additional $1,000 contribution for one of them.17

How has the IRS expanded HDHPs' allowable preventive care coverage?

The IRS issued new guidelines in mid-2019, expanding the list of preventive services that can be paid pre-deductible by an HDHP, with enrollees retaining their HSA eligibility.18 The IRS issued additional new guidelines in late 2024, again expanding the list of preventive services that an HDHP can pay for before the deductible is met.12

The 2019 rules allow – but do not require – certain treatments for certain chronic conditions to be classified as preventive care for HDHP purposes, and thus paid by the plan pre-deductible without the plan losing its HDHP status. The medical conditions and treatments include:

- Congestive heart failure or coronary artery disease: ACE inhibitors and/or beta blockers

- Heart disease: Statins and LDL cholesterol testing

- Hypertension: Blood pressure monitor

- Diabetes: ACE inhibitors, insulin or other glucose-lowering agents, retinopathy screening, glucometer, hemoglobin A1c testing, and statins (Note that as of 2023, Section 11408 of the Inflation Reduction Act allows HDHPs to pay for insulin pre-deductible regardless of whether the person has been diagnosed with diabetes.)

- Asthma: Inhalers and peak flow meters

- Osteoporosis or osteopenia: Anti-resorptive therapy

- Liver disease or bleeding disorders: International Normalized Ratio (INR) testing

- Depression: Selective Serotonin Reuptake Inhibitors (SSRIs)

The 2024 rules are designed to keep pace with evolving preventive-care coverage rules, allowing HDHPs to pay for several services before the deductible is met. In 2024, the Biden administration proposed a rule change that would require health plans to cover some of these services without cost-sharing.19 They include:

- Over-the-counter oral contraceptives (Opill, approved by the FDA in 2023)

- Male condoms, regardless of whether the HDHP enrollee is male or female

- Continuous glucose monitors

- Insulin “without regard to whether the insulin product is prescribed to treat an individual diagnosed with diabetes or prescribed for the purpose of preventing the exacerbation of diabetes or the development of a secondary condition.”

- Additional breast cancer screening services. (Screening mammograms were already covered, but the new rule allows for pre-deductible coverage of breast MRI and ultrasound.)12

Although male condoms can now be paid for pre-deductible by an HDHP, the IRS does not consider male sterilization to be preventive care, and this is still true as of 2024.12

Some states have begun mandating pre-deductible male contraceptive coverage, including vasectomy coverage, on all plans. So through the end of 2019, the IRS still considered a plan to be HSA-qualified if it covered male contraception before the deductible. That gave states time to modify their requirements to allow an exemption for HSA-qualified plans, to ensure that the male contraceptive mandates wouldn't cause people to lose the ability to contribute to an HSA.

How can HSA funds be used?

The money in your HSA is yours to withdraw, tax-free, at any time, to pay for medical expenses that aren’t paid by your high-deductible policy. You can reimburse yourself after the fact if you prefer – so if you incur a medical expense after your HSA is opened but pay for it without withdrawing money from your HSA, you can opt to reimburse yourself for that spending several years down the road, as long as you keep your receipts and the medical expense isn't reimbursed by any other entity.

If you take money out of your HSA for anything other than a qualified medical expense, you’ll pay taxes on the withdrawal, plus a penalty. But once you turn 65, the HSA functions in much the same way as a traditional IRA: you can pull money out for any purpose, paying only income taxes, but no penalty.20

You also have the option to leave the money in the HSA and use it to fund long-term care later in life. The money is never taxed if you’re withdrawing it to pay for qualified medical expenses, even if you’re no longer covered by an HDHP at the time that you make the withdrawals. But contributions to the HSA can only be made while you have in-force coverage under an HDHP.

You can also withdraw tax-free money from your HSA to pay Medicare premiums (for Medicare Part A, if you don't get it for free, and for Medicare Part B and Part D – but not for Medigap plans).

You can also withdraw tax-free money from your HSA to pay long-term care premiums. There are limits, based on age, on how much you can pull out of your HSA to pay long-term care insurance premiums with pre-tax money. The following limits are for 2025).21 (These limits are indexed for inflation each year by the IRS.)). If your age is:

- 40 or younger, you can withdraw $480 tax-free to pay long-term care insurance premiums

- 41 to 50, you can withdraw $900

- 51 to 60, you can withdraw $1,800

- 61 to 70, you can withdraw $4,810

- 71 or older, you can withdraw $6,020

Footnotes

- “Publication 969 – Health Savings Accounts and Other Tax-Favored Health Plans” Internal Revenue Service. Accessed Dec. 13, 2024 ⤶ ⤶

- “Publication 969 – Health Savings Accounts and Other Tax-Favored Health Plans” Internal Revenue Service. Accessed Dec. 13, 2024. And “IRS Updates Preventive Care Benefits for High-Deductible Health Plans” TaxNotes. Oct. 17, 2024 ⤶

- “Preventive Health Services” HealthCare.gov. Accessed Dec. 13, 2024 ⤶

- “Revenue Procedure 2024-25” Internal Revenue Service (HDHP maximum out-of-pocket for 2025). And ”Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2025 Benefit Year” (non-HDHP maximum out-of-pocket for 2025) Centers for Medicare & Medicaid Services. Nov. 15, 2023 ⤶

- “Employer Health Benefits, 2024 Annual Survey” KFF. Oct. 9, 2024. ⤶

- ”Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2025 Benefit Year” Centers for Medicare & Medicaid Services. Nov. 15, 2023 ⤶

- “Revenue Procedure 2024-25” Internal Revenue Service. Accessed Dec. 23, 2024 ⤶

- “New Research Findings Reveal Employers Who Contribute to HSAs See Double-Digit Growth in Employee Participation” Health Equity. Sep. 26, 2024 ⤶

- “See Plans and Prices” HealthCare.gov. Accessed Dec. 13, 2024 ⤶

- “Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2024” U.S. Department of Health and Human Services. April 27, 2023. ⤶

- “High deductible health plans and health savings accounts” Bureau of Labor Statistics. Accessed Nov. 19, 2024 ⤶

- “Notice 2024-75: Preventive Care for Purposes of Qualifying as a High Deductible Health Plan under Section 223” Internal Revenue Service. Accessed Nov. 19, 2024 ⤶ ⤶ ⤶ ⤶

- “Federal Telehealth Flexibilities in Private Health Insurance During the COVID-19 Public Health Emergency: In Brief” Congressional Research Service. February 2023. ⤶

- “Revenue Procedure 2024-25” Internal Revenue Service. Accessed Sep. 20, 2024. ⤶ ⤶

- “Publication 969 (2023), Health Savings Accounts and Other Tax-Favored Health Plans; Family plans that don’t meet the high deductible rules” Internal Revenue Service. Accessed March 15, 2024 ⤶

- “Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2025 Benefit Year” Centers for Medicare & Medicaid Services. November 15, 2023. ⤶

- “Rules for married people” Internal Revenue Service. Accessed March 24, 2024. ⤶

- ”IRS expands list of preventive care for HSA participants to include certain care for chronic conditions (Notice 2019-45)” Internal Revenue Service. July 17, 2019 ⤶

- “Enhancing Coverage of Preventive Services Under the Affordable Care Act” U.S. Departments of the Treasury, Labor, and Health & Human Services. Oct. 23, 2024 ⤶

- “Publication 969 – Health Savings Accounts and Other Tax-Favored Health Plans” Internal Revenue Service. Accessed Dec. 23, 2024 ⤶

- “2025 Tax Deductible Limits Long-Term Care Insurance” American Association for Long Term Care Insurance. Accessed Dec. 13, 2024 ⤶