In this article

The Affordable Care Act (ACA) created an income-based federal subsidy program for people who buy their own health insurance. In every state, federal premium tax credits (premium subsidies) are available to reduce the amount that most enrollees pay for their coverage, and cost-sharing reductions are available to limit out-of-pocket costs for lower income enrollees.

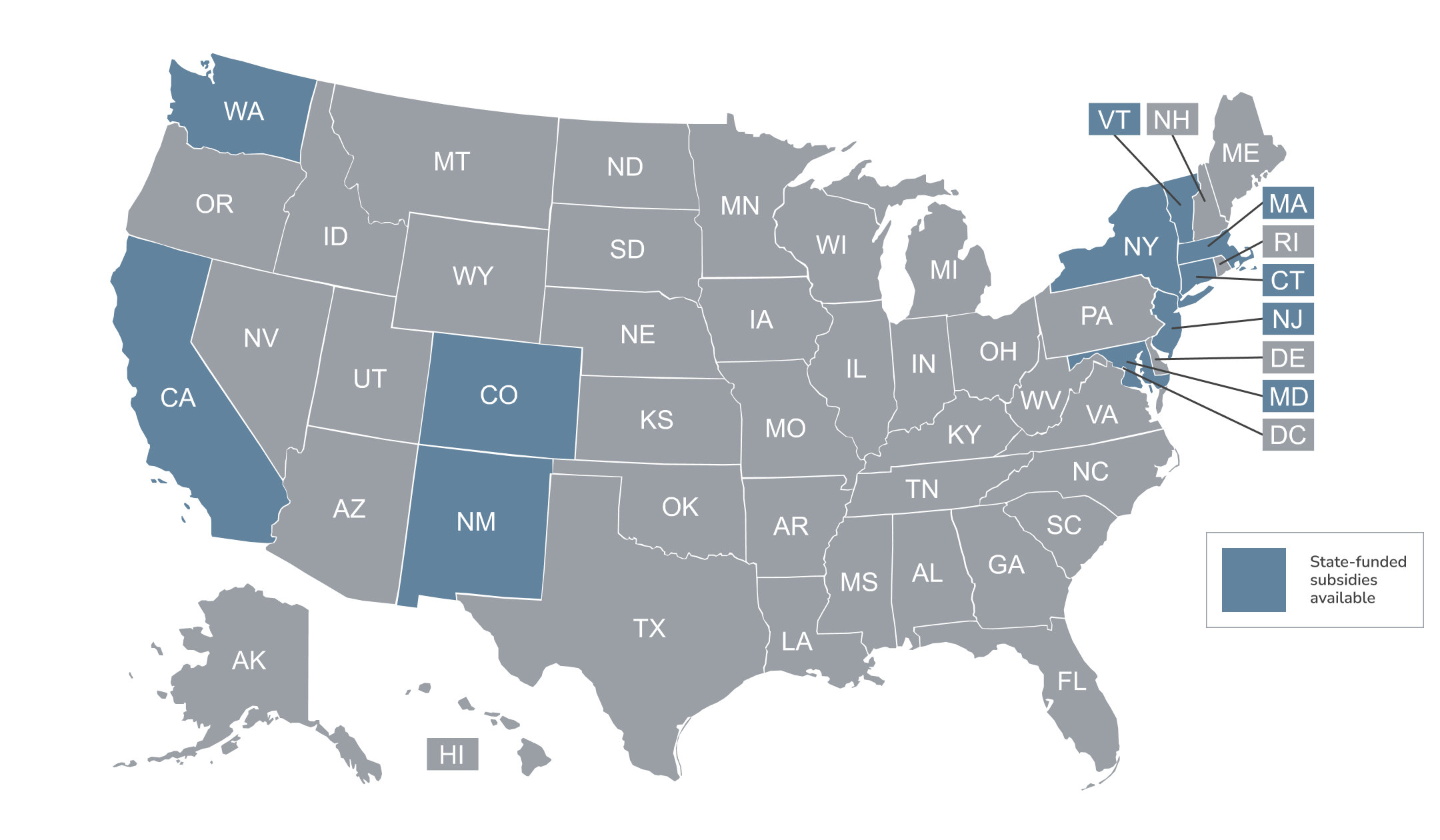

But 10 states have created additional state-funded subsidy programs that make coverage and/or medical care even more affordable than it would be with the federal subsidies alone. Eligibility for these programs varies by state, as does the scope of the available subsidies.

As detailed below, several of the states have modified or enhanced their subsidy programs for 2026, in an effort to mitigate the impacts of the expiration of the federal subsidy enhancements at the end of 2025.

Which states provide health insurance subsidies?

Ten states have state-funded subsidies available in addition to federal subsidies, with specifics that vary from one state to another:

- For 2026, California has allocated $190 million to provide additional state-funded premium subsidies to those with household income up to 150% of the federal poverty level (FPL). However, this will offset only a small portion of the $2.5 billion that California residents are losing in 2026 due to the expiration of the federal subsidy enhancements.1

- Prior to 2026, California's state-funded subsidies were additional cost-sharing reductions.2,3,4

- Starting with the 2026 plan year, Colorado's state-funded subsidy transitioned to an extra premium subsidy, rather than an extra cost-sharing reduction.5 For enrollees with household income up to 400% of the federal poverty level, the state is covering $80/month for the primary applicant (on top of their federal premium subsidies), plus an additional $29/month for other applicants on a family policy.6

- During a special legislative session in August 2025, Colorado enacted legislation to allocate additional funding for the state subsidy program in 2026 due to the impending expiration of federal subsidy enhancements at the end of 20257

- Colorado's state subsidy program debuted for 2023. Through 2025, it provided additional cost-sharing reductions to eligible applicants, reducing their out-of-pocket costs.8 Enrollees with income up to 200% FPL receive Silver plans with 94% actuarial value (under the ACA, the federal government provides this benefit only to applicants with income up to 150% FPL).

- For 2025 and 2026, Colorado's state-funded subsidy program is also paying the $1/month premium fee that is charged (after federal subsidies are applied) for all Marketplace plans in Colorado. This fee is required because Colorado plans must cover abortion, and federal rules require a separate $1/month premium for that coverage. Federal rules also prohibit federal subsidies from covering that cost, so state funds are being used instead (people who don't qualify for any federal premium subsidies must pay this $1/month fee themselves).9

- Colorado also established a new platform (OmniSalud, through Colorado Connect) that undocumented immigrants can use to enroll in coverage, with state-funded premium subsidies for a limited number of enrollees.10 Due to reduced funding, the number of subsidy-eligible spots in this program was reduced to 6,700 for 2026.11

- Via the Covered Connecticut Program, additional premium subsidies and cost-sharing reductions are available to adults with income up to 175% of FPL, as long as they select a Silver plan through the exchange. The state subsidies then pay all of the remaining premiums and cost-sharing that are left after the federal subsidies are applied.12

- In addition to the ongoing Covered Connecticut Program, Connecticut's governor announced that the state will spend $70 million to offset some of the reduction in federal subsidies for 2026, which was announced after the U.S. Senate failed to pass a measure that would have extended the federal subsidy enhancements that are expiring at the end of 2025.13

- In early January 2026, Connecticut's health insurance Marketplace announced the details of the new state subsidy program, and also announced an open enrollment extension to January 31, 2026, to give people more time to sign up. State funds are being used to fully offset the reduced federal subsidies for enrollees with household income between 100% and 200% of FPL (who aren't enrolled in Covered Connecticut). State funds are also being used to offset 50% of the reduction in federal subsidies for enrollees with household income between 400% and 500% of the FPL.14

- Maryland previously offered a state subsidy program only for young adults, but has broadened that for 2026. The Maryland Premium Assistance program is partially mitigating the impacts of the termination of the federal subsidy enhancements, for enrollees of all ages.15,16 Maryland's exchange notes that young adults aged 18-37 are still eligible for additional state subsidies.17

- In September 2025, the Maryland Insurance Administration clarified the details about how the state-funded subsidy program would work in 2026 to partially offset the reduction in federal subsidies:18

- It applies to Maryland Health Connection enrollees of all ages (as opposed to the previous Maryland subsidy program, which was only available to adults up to age 37;19 these young adults still qualify for some additional subsidies on top of the broad subsidy program).17

- It fully covers the reduction in federal subsidies for enrollees with household income under 200% of FPL.

- It covers some of the lost federal subsidy amounts for enrollees with income above 200% of FPL, but only up to 400% of FPL. Above 400% of FPL, there are no state or federal premium subsidies available.

- For 2026, to address the reduction in federal subsidies, Massachusetts has allocated an additional $250 million to make its existing ConnectorCare state subsidy program more robust. As a result, the state notes that approximately 270,000 ConnectorCare enrollees with income below 400% of FPL "will see little to no premium increases because of the expiring federal credits, while also lowering other out-of-pocket costs like co-pays and deductibles."20

- Enrollees with incomes up to 400% of FPL are eligible for state premium subsidies and cost-sharing reductions.21

- Before 2024, the income limit for ConnectorCare was 300% of the poverty level. This was increased to 500% in 2024 and 2025.22,23

- The income limit was scheduled to revert to 300% of FPL in 2026, but the Massachusetts 2026 Fiscal Year budget extended the pilot program through 2026, meaning ConnectorCare would continue to extend to 500% FPL in 2026.24 However, underlying ConnectorCare rules require the enrollee to also be receiving federal premium subsidies. Since those federal subsidies are not available in 2026 due to the return of the "subsidy cliff," ConnectorCare subsidies are also not available above 400% of FPL.25

- Enrollees with incomes up to 600% of FPL are eligible for state-based premium subsidies.26 For 2026 coverage, 600% of FPL amounts to a single person earning up to $93,900 or a family of four earning up to $192,900.

- This program is called New Jersey Health Plan Savings.

- New Mexico has expanded its existing state-funded subsidy program for 2026, to fully offset the reduction in federal subsidies for 2026.27 This includes assistance for enrollees with household income above 400% of FPL28 and for recent immigrants with income below FPL.29 Both populations lost federal subsidies in 2026 (due to the expiration of federal premium subsidy enhancements and the One Big Beautiful Bill, respectively), so New Mexico's program was expanded in an effort to ensure these populations can still obtain affordable coverage.

- New Mexico's HCAF had indicated in 2025 that it had enough surplus funding to provide additional assistance to enrollees if the federal subsidy enhancements were allowed to expire.30 The state enacted legislation in 2025 to codify the use of the state premium funds to offset the reduction in federal subsidies.31

- New Mexico residents are fully insulated from the reduction in federal subsidies, as New Mexico is backfilling the entire difference using state funds.32 Although several states offer state-funded subsidies and some have expanded them for 2026, New Mexico is unique in being able to cover the full amount of the federal subsidy reductions for all enrollees.

- Enrollees with household income up to 400% of FPL were already eligible for state-funded premium subsidies, as well as additional cost-sharing reductions (SOPA, or state out-of-pocket assistance). The SOPA benefits expanded in 2025, so that plans with 90% actuarial value (platinum-level coverage) are available to applicants with household income up to 400% of the poverty level (this limit was previously 300%).33

- Plans with cost-sharing reductions in New Mexico are labeled “turquoise." The state subsidy program is funded by the Health Care Affordability Fund (HCAF).30

- Starting with the 2025 plan year, New York began offering state-funded cost-sharing reductions for Marketplace enrollees with income up to 400% of the federal poverty level, as well as additional cost-sharing reductions for diabetes management and for people who are pregnant or postpartum.34

- New York is continuing the state-funded cost-sharing reduction program in 2026.35,36

- Enrollees with incomes up to 300% of FPL are eligible for state-funded premium subsidies and cost-sharing reductions.37 Both stack on top of federal subsidies, and the state-funded cost-sharing reductions extend to a higher income level than federal cost-sharing reductions, which are only available up to 250% of FPL.

- State-based premium subsidies (Cascade Care Savings) are available for enrollees with income up to 250% of FPL, as long as they select a standardized (Cascade Care) Silver or Gold plan through the exchange. Since 2024, undocumented immigrants have been eligible to enroll in coverage through Washington Healthplanfinder and qualify for Cascade Care Savings based on household income.

- Cascade Care Savings are larger for enrollees who aren't eligible for federal premium subsidies, which includes undocumented immigrants.38

- For 2026, Cascade Care Savings subsidy amounts for those who do qualify for federal subsidies are smaller than they were in 2025 ($55 per member per month, down from $155 per member per month in 2025). But due to the state's new premium alignment approach (silver loading),39 very affordable Gold plans should be available to enrollees who qualify for federal premium subsidies, even with the smaller Cascade Care Savings and the expiration of the federal subsidy enhancements.38

- For those who don't qualify for federal premium subsidies in 2026 (but whose income is no more than 250% of FPL) Cascade Care Savings remain at $250 per member per month, the same as they were in 2025.38

Will more states start to offer state-funded health insurance subsidies?

It's possible that more states might start to offer state-funded health insurance subsidies.

For example, Pennsylvania is working on a state subsidy program authorized by legislation that the state enacted in 2024.40 But this won't be available until state funding is allocated,41 which had not yet happened as of August 2025.

Legislation was introduced in Georgia in early 2026 that aims to mitigate the effect of the expiration of federal subsidy enhancements. If enacted, the legislation calls for Georgia to offer state-funded premium subsidies and cost-sharing reductions by 2027 (assuming Congress doesn't reinstate the federal subsidy enhancements), in an effort to make coverage and care more affordable.42 Legislation to create a state subsidy program was also introduced in Georgia in 2025, although it did not advance (but the bill was still live as of early 2026).43

Legislation introduced in Nebraska in early 2026 would create a refundable state tax credit available to Nebraska Marketplace enrollees, equal to the amount they would otherwise have received if the federal subsidy enhancements had been extended.44

Legislation introduced in Mississippi in early 2026 would create a state-funded (via a tax on insurance premiums) program to provide additional premium subsidies and cost-sharing reductions to enrollees with household income up to 200% of FPL.45

Minnesota lawmakers introduced legislation during the 2025 legislative session (which was still live as of early 2026) that would replace the existing reinsurance program with a new state subsidy program.46

Legislation was introduced in 2025 in Rhode Island to create state-based subsidies, but it did not advance during the 2025 session.47

Legislation introduced in Virginia in 2026 would create a state tax credit, available from 2026 through 2030, that would be available to Marketplace enrollees with household income over 400% of FPL (in other words, those who lost their entire federal subsidy due to the expiration of the federal subsidy enhancements.)48

(Minnesota49 and Rhode Island50 had also considered state-funded subsidies during previous legislative sessions, but the measures did not advance.)

A state needs to run its own exchange to directly provide state-funded subsidies as part of the health insurance enrollment process, since the federally run HealthCare.gov platform isn’t set up to calculate additional subsidies beyond those provided by the federal government. But as noted above with the example of the legislation under consideration in Nebraska and Mississippi, a state that uses HealthCare.gov could use the state tax return to provide a state-funded subsidy when residents file their taxes, or could find another way to provide financial assistance to eligible Marketplace enrollees.

There are a total of 21 state-run exchanges as of the 2026 plan year, although that number has been increasing over time. Illinois is the latest state to debut a fully state-run exchange platform, which went live in the fall of 2025. Oregon plans to be running its own exchange platform by the fall of 2026.51

Which states provide other types of non-subsidy assistance with health coverage?

In addition to the state-funded premium subsidy and cost-sharing subsidy programs described above, some states use other approaches to make affordable health coverage more accessible for their residents:

- Minnesota, Oregon, and Washington DC have Basic Health Programs (BHPs). BHPs are not the same as additional state-funded subsidies, but they provide very comprehensive health coverage, with free or very low premiums, to residents with income up to 200% of FPL.

- New York has a program that used to be a BHP but was modified in 2024 to have a higher income limit for eligibility (otherwise, it retains the same benefit structure it had previously).52 New York's program increased the eligibility limit to 250% of FPL, starting in April 2024,52 but the state plans to revert the program to a BHP, with an income limit of 200% of FPL, starting in mid-2026.53

How can I tell if I'm eligible for state-funded health insurance subsidies?

Just like federal subsidies, eligibility for state-funded subsidies is typically based on how your household income compares with the federal poverty level (FPL). For 2026 coverage, states use 2025 FPL numbers. As noted above, the eligibility limits differ from one state to another, but this chart is a good reference that shows the incomes that correlate with various percentages of the 2025 FPL, depending on family size.

To get federal cost-sharing reductions, you have to select a Silver plan, and that’s also typically true of the state-funded cost-sharing reductions (as noted above, these plans are labeled "turquoise" in New Mexico). In most cases, state-funded premium subsidies can be used for plans at any metal level, although that’s not always the case. (For example, the Covered Connecticut program only applies to Silver-level plans, and it subsidizes both premiums and cost-sharing; Washington's state-funded subsidies are only available on certain Silver and Gold plans)

If my state offers state-funded health insurance subsidies, can I also get federal ACA subsidies?

Yes, if you’re eligible for federal subsidies, you’ll receive them in addition to the state-funded subsidies. The state-based subsidies described above are designed to work in conjunction with the ACA’s federal subsidies. They provide additional benefits, resulting in lower premiums and/or lower cost-sharing amounts than you would have with just the federal subsidies.

But states can design their subsidy programs so they can be used even by people who aren’t eligible for federal subsidies. Examples are the Colorado and Washington programs that provide state-funded premium subsidies to undocumented immigrants, who are not eligible for federal subsidies.

Where can I get state-funded health insurance subsidies?

The states that provide state-funded subsidies all run their own exchange/marketplace platforms. If you’re in a state that offers state-funded health insurance subsidies, you’ll need to obtain your health coverage through the exchange to take advantage of the subsidies.

This is true for both state and federal subsidies, as subsidies are not available for off-exchange plans. (One caveat: Colorado uses a separate platform to provide state-subsidized coverage to a limited number of people who are undocumented immigrants and are thus not eligible to use the exchange.)

How much could I save on health insurance with state subsidies?

The savings from state-funded health insurance subsidies vary considerably from one state to another. In most cases, the exact amount of the savings will vary depending on your income, age, and location. In each of the states that have their own subsidy programs, you can use the state-run exchange’s plan comparison tool to get an anonymous price quote that will include any available state-funded subsidies as well as federal subsidies.

Can I use a state subsidy to pay for Marketplace coverage?

Yes, if you’re in a state that offers state-funded subsidies and you meet the eligibility guidelines. As described above, each state that offers these subsidies has its own rules in terms of income limits and whether the subsidies apply to all Marketplace/exchange plans or only certain plans. (For example, Washington's state-funded subsidies are only available to offset costs for people who select standardized Silver or Gold plans).

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- "Covered California’s Open Enrollment 2026: Here to Help Connect Californians to Care Despite Uncertainty Around Federal Tax Credits" Covered California. Oct. 30, 2025 ⤶

- “Covered California to Launch State-Enhanced Cost-Sharing Reduction Program in 2024 to Improve Health Care Affordability for Enrollees. CoveredCA. July 2023. ⤶

- “Covered California Policy and Action Items” Covered California Board Meeting. May 16, 2024 ⤶

- “Covered California’s Rates and Plans for 2025: The Most Financial Support Ever to Help More Californians Pay for Health Insurance” Covered California. July 24, 2024 ⤶

- "Amended Regulation 4-2-78" Colorado Division of Insurance. Adopted Sep. 29, 2025 ⤶

- "Amended Regulation 4-2-78" Colorado Division of Insurance. Accessed Oct. 7, 2025 ⤶

- "Colorado HB1006" BillTrack50. Enacted Aug. 28, 2025 ⤶

- “Colorado Health Insurance Affordability Board Meeting Minutes” Colorado Health Insurance Affordability Enterprise. April 19, 2024 ⤶

- "Revised Bulletin No. B-4.148 — Concerning Payments to Carriers Related to Abortion Coverage for On-Exchange Individual Health Plan Enrollees Receiving Subsidies" Colorado Division of Insurance. Oct. 22, 2025 ⤶

- "OmniSalud" Connect for Health Colorado. Accessed Aug. 26, 2025 ⤶

- "SilverEnhanced Savings" Connect for Health Colorado. Accessed Jan. 5, 2026 ⤶

- “Covered Connecticut Program” Connecticut Social Services. Accessed Jan. 5, 2026 ⤶

- "Lamont pledges $70M for health care after US Senate deadlocks" CT Mirror. Dec. 11, 2025 ⤶

- "Deadline to Enroll in Health and Dental Coverage Through Access Health CT Has Been Extended to Jan. 31" Access Health CT. Jan. 2, 2026 ⤶

- "Maryland HB1082" BillTrack50. Enacted May 13, 2025 ⤶

- "2026 State-Based Subsidy: Program Parameters Discussion and Proposed and Emergency Regulations" Maryland Health Benefit Exchange. May 19, 2025. And "Standing Advisory Committee Meeting" MHBE Policy Department, Maryland Health Benefit Exchange, July 17, 2025 ⤶

- "Maryland Premium Assistance" Maryland Health Connection. Accessed Jan. 5, 2026 ⤶ ⤶

- "Maryland Insurance Administration Approves 2026 Affordable Care Act Premium Rates" Maryland Insurance Administration. Sep. 19, 2025 ⤶

- "Report on the Young Adult Subsidy Program" Maryland Health Benefit Exchange. Dec. 18, 2024. And Maryland SB601, Maryland HB814, and Maryland HB297. BillTrack50. Accessed Jan. 5, 2026 ⤶

- "Governor Healey Details Strongest Plan in the Country to Protect Against President Trump’s ACA Cost Hikes" Massachusetts Health Connector. Jan. 8, 2026 ⤶

- "ConnectorCare Overview" Massachusetts Health Connector. Accessed Jan. 8, 2026 ⤶

- “Massachusetts Expands Access to Affordable Health Care” Massachusetts Health Connector. Accessed January 2024. ⤶

- “ConnectorCare Health Plans” Massachusetts Health Connector. Accessed Apr. 11, 2025 ⤶

- "Governor Healey Signs $60.9 Billion Fiscal Year 2026 Budget" Mass.gov. July 4, 2025 ⤶

- "Preliminary Eligibility: What does it mean and what do you need to do?" Massachusetts Health Connector. Sep. 2025 ⤶

- “Lower Your Monthly Premiums with the NJ Health Plan Savings” GetCoveredNJ. Accessed Apr. 11, 2025 ⤶

- "New Mexico's amazing emergency ACA policies take it ANOTHER step further..." ACA Signups. Dec. 2, 2025 ⤶

- "Addendum #1 to the New Mexico Health Insurance Marketplace Affordability Program Policy and Procedures Manual for the 2026 Plan Year" New Mexico Health Care Authority. Accessed Dec. 12, 2025 ⤶

- "Addendum #2 to the New Mexico Health Insurance Marketplace Affordability Program Policy and Procedure Manual for the 2026 Plan Year" New Mexico Health Care Authority. Accessed Dec. 12, 2025 ⤶

- "The Health Care Affordability Fund" New Mexico Legislative Finance Committee. June 25, 2025 ⤶ ⤶

- "New Mexico HB2" BillTrack50. Enacted Oct. 3, 2025 ⤶

- "New Federal Changes" BeWell New Mexico's Health Insurance Marketplace. Accessed Dec. 12, 2025 ⤶

- “2025 Plan Year Health Insurance Marketplace Affordability Program, Policy and Procedures Manual” New Mexico Office of the Superintendent of Insurance. April 26, 2024 ⤶

- “Section 1332: State Innovation Waivers, New York” and "Letter from New York to CMS” CMS.gov. June 28, 2024. And "State Health Department's NY State of Health Announces Approval of State's Innovation Waiver Amendment In Time for 2025 Enrollment Period” New York State Department of Health. Oct. 2, 2024 ⤶

- "Attachment U: 2026 Cost Sharing Reduction Initiatives" New York State of Health. Accessed Aug. 26, 2025 ⤶

- "Extra Cost-Savings Through NY State of Health" NY State of Health. Accessed Jan. 5, 2026 ⤶

- “33 V.S.A. § 1812” Vermont General Assembly. Accessed Nov. 15, 2025 ⤶

- "Final Cascade Care Savings amounts for plan year 2026 released" Washington Health Benefit Exchange. Sep. 30, 2025 ⤶ ⤶ ⤶

- "Washington State also jumps on the Premium Alignment bandwagon to mitigate tax credit expiration" ACA Signups. Sep. 15, 2025 ⤶

- “Pennie Board of Directors Strategic Planning Session” (pages 27-30). Pennie Board of Directors. February 22, 2024, AND "Pennie Board of Directors Meeting” Pennie.com. May 16, 2024 ⤶

- “Pennie Board of Directors Meeting, March 2025” Pennie. Mar. 12, 2025 ⤶

- "Georgia SB379" BillTrack50. Introduced Jan. 12, 2026 ⤶

- “Georgia SB192” BillTrack50. In committee, Feb. 19, 2025 ⤶

- "Nebraska LB931" BillTrack50. Introduced Jan. 9, 2026 ⤶

- "Mississippi HB590" BillTrack50. Introduced Jan. 13, 2026 ⤶

- “Minnesota HF2506” and “Minnesota SB1024” BillTrack50. In committee Mar. 17, 2025 ⤶

- “Rhode Island H5996” and “Rhode Island S707” BillTrack50. In committee Feb./Mar. 2025 ⤶

- "Virginia HB405" BillTrack50. Introduced Jan. 12, 2025 ⤶

- “Minnesota SF49” and "Minnesota HF4571” BillTrack50 ⤶

- “Rhode Island S2345” BillTrack50. Introduced February 12, 2024. ⤶

- “Oregon Senate Bill 972” BillTrack50. Enacted August 2023 ⤶

- “New York State Department of Health and NY State of Health Announce the Essential Plan Expansion Increasing Access to Affordable Health Insurance Begins Today” New York State Department of Health. April 1, 2024. ⤶ ⤶

- "Timeline of the Waiver" New York State of Health. Accessed Jan. 5, 2026 ⤶