Key takeaways

- Both you and the IRS will get a tax form showing whether you had health coverage during the previous year.

- Health insurance exchanges track enrollees and report the information to the IRS.

- There is no longer a penalty for being uninsured in most states, but the IRS will continue to receive enrollment and coverage offer reports from exchanges and employers.

Who is keeping track of whether I buy health insurance through the exchange/Marketplace?

If you get your health insurance through the Marketplace (or from a large employer), you (and the IRS) will receive a tax form from the exchange or your employer each year showing that you had coverage during the previous year.

If you had Marketplace coverage, you'll need the information on that form to reconcile your advance premium tax credit (subsidy) on your tax return — or to claim the subsidy in full, if you paid full price for Marketplace coverage throughout the year and ended up being eligible for the premium tax credit.

The health insurance exchanges keep track of who gets exchange-based coverage, and report that information to the IRS. But health insurers and employers also report information to the IRS, for people who get their coverage elsewhere. This information is used by the IRS to ensure that large employers are complying with the employer mandate, and that premium subsidies in the exchange aren't provided to people who have access to employer-sponsored coverage.

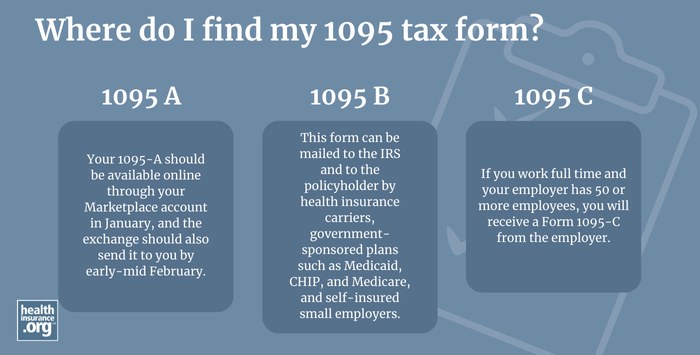

Starting with 2019 tax returns (filed in early 2020), tax filers no longer face a federal penalty if they were uninsured during the year, but Forms 1095-A, B, and C are still distributed to exchange enrollees, health plan members, and employees (Form 1095-B is no longer sent out by some health plans, including small employers and some states’ Medicaid agencies,1 so you may not receive any version of a Form 1095, depending on where you get your health insurance). And Form 8962 is still used to reconcile premium subsidies that are provided via the exchanges.

Although there is no longer a penalty (in most states) for being uninsured, health insurance reporting to the IRS has continued for many Americans. Large employers still have to report coverage offers to the IRS and employees, as subsidy eligibility is based in part on whether the person has access to an employer-sponsored plan (and large employers are still subject to a penalty if they don't offer affordable, minimum value coverage to their full-time workers). And exchanges still have to provide the information that individuals and the IRS need in order to reconcile subsidy amounts.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- "Information Reporting of Health Insurance Coverage and Other Issues" Federal Register, Internal Revenue Service. Dec. 6, 2021 ⤶