Home > Health insurance Marketplace > Georgia

Georgia Marketplace health insurance in 2026

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Georgia ACA Marketplace quick facts

Georgia health insurance Marketplace guide

We created this Georgia health insurance guide, including the FAQs below, to help you understand the health insurance options and possible financial assistance available for you and your family.

Georgia’s ACA Marketplace (exchange) is a platform where a variety of private health insurers offer health insurance for people who need to buy their own individual or family health coverage. This includes people who don’t qualify for Medicare or Medicaid, and also don’t have an offer of health insurance from an employer.

Eight insurers offer plans through Georgia’s Marketplace for 2026. There were nine in 2025, but Aetna is exiting at the end of 2025 (as is the case in all states where Aetna offers Marketplace coverage in 2025), and all Aetna enrollees need to select new plans for 2026. You can see more details below about the participating insurers and their premium changes for 2026.

From 2014 through 2024, Georgia used the federally-facilitated health insurance Marketplace, HealthCare.gov. But starting with the 2025 plan year – for enrollments beginning in November 2024 – Georgia has a state-based Marketplace, known as Georgia Access.

Depending on your income and other circumstances, you may be eligible for financial assistance that will reduce your monthly insurance premium (the amount you pay to enroll in the coverage) and possibly your out-of-pocket expenses. These subsidies are available through Georgia Access for 2025 and future years.

Nothing changed about subsidy eligibility or how the subsidies are calculated when Georgia began running its own Marketplace, since the subsidies are still provided entirely by the federal government. But as it always the case, subsidy amounts change from one year to the next, and it’s important to comparison shop during open enrollment.

Who can buy health insurance on Georgia's Marketplace?

To enroll in private health coverage through the Marketplace in Georgia, you must:3

- Be a resident of Georgia

- Be lawfully present in the United States

- Not be incarcerated

- Not have Medicare coverage

Those are the only qualifications you need to meet in order to enroll in a Marketplace plan, but qualifying for financial assistance (premium subsidies and cost-sharing reductions) is a little different, and does have some additional parameters.

Eligibility for Marketplace financial assistance depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area. In addition, to qualify for Marketplace financial assistance you must:

- Not have access to affordable employer-sponsored health coverage. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or PeachCare for Kids (Georgia CHIP).

- Not be eligible for premium-free Medicare Part A.4

- If married, file a joint tax return.5

- Not be able to be claimed by someone else as a tax dependent.5

When can I enroll in an Affordable Care Act (ACA)-compliant health plan in Georgia?

Georgia residents use the Georgia Access platform to enroll in Marketplace coverage (HealthCare.gov is no longer used, but if you begin at HealthCare.gov and enter a Georgia zip code, it will direct you to Georgia Access).

You can sign up for an ACA-compliant individual or family health plan in Georgia between November 1 and January 15. This is the annual open enrollment period.6

So Georgia residents can enroll in 2026 coverage anytime between November 1, 2025 and January 15, 2026 (enrollments must be submitted by December 15, 2025 to have coverage effective January 1, 2026).7

But starting in the fall of 2026, for coverage effective in 2027, open enrollment will be required to end in every state no later than December 31. HealthCare.gov will end open enrollment on December 15, 2026. Since Georgia runs its own exchange, the state will have the option to extend the enrollment window, but not past December 31. And all plan selections made during open enrollment will take effect January 1, starting with the 2027 plan year.

After the annual open enrollment period ends, your opportunity to enroll or make a plan change will be limited. It’s generally only available if you experience a qualifying life event, such as giving birth or losing other health. But some people can enroll year-round even without a specific qualifying life event.

Enrollment in Georgia Medicaid and PeachCare for Kids (CHIP) is available year-round, so if you’re eligible for either of these programs, you can enroll anytime.

Frequently asked questions about health insurance in Georgia

How do I enroll in a Marketplace plan in Georgia?

In Georgia, you can sign up for ACA Marketplace coverage through Georgia Access, which is the new state-based Marketplace in Georgia.

Georgia had intended to make the transition to a fully-state-based exchange in the fall of 2023, but the federal government pushed that out by a year.8

To enroll in an ACA Marketplace plan in Georgia, you can:

- Visit Georgia Access, which is Georgia’s health insurance Marketplace. This platform will let you compare the available plans, determine your eligibility for financial assistance, and enroll in the coverage that best meets your needs.

- Purchase individual and family health coverage with the help of an insurance agent or broker, a Navigator or certified application counselor, or an approved enhanced direct enrollment entity.

- Even now that Georgia has transitioned from HealthCare.gov to Georgia Access, enhanced direct enrollment entities can still enroll people in Marketplace coverage in Georgia. None of the other fully state-based exchanges use EDEs, so Georgia is unique in this regard.9

You can reach the Georgia Access call center by dialing 1-888-687-1503.

How can I find affordable health insurance in Georgia?

You may find affordable health insurance options in Georgia by enrolling in a plan through Georgia Access – especially if you’re eligible for financial assistance.

Income-based subsidies called Advance Premium Tax Credits (APTC) are available due to the Affordable Care Act. APTCs can help lower your premium payments each month, and most enrollees are eligible for these subsidies.

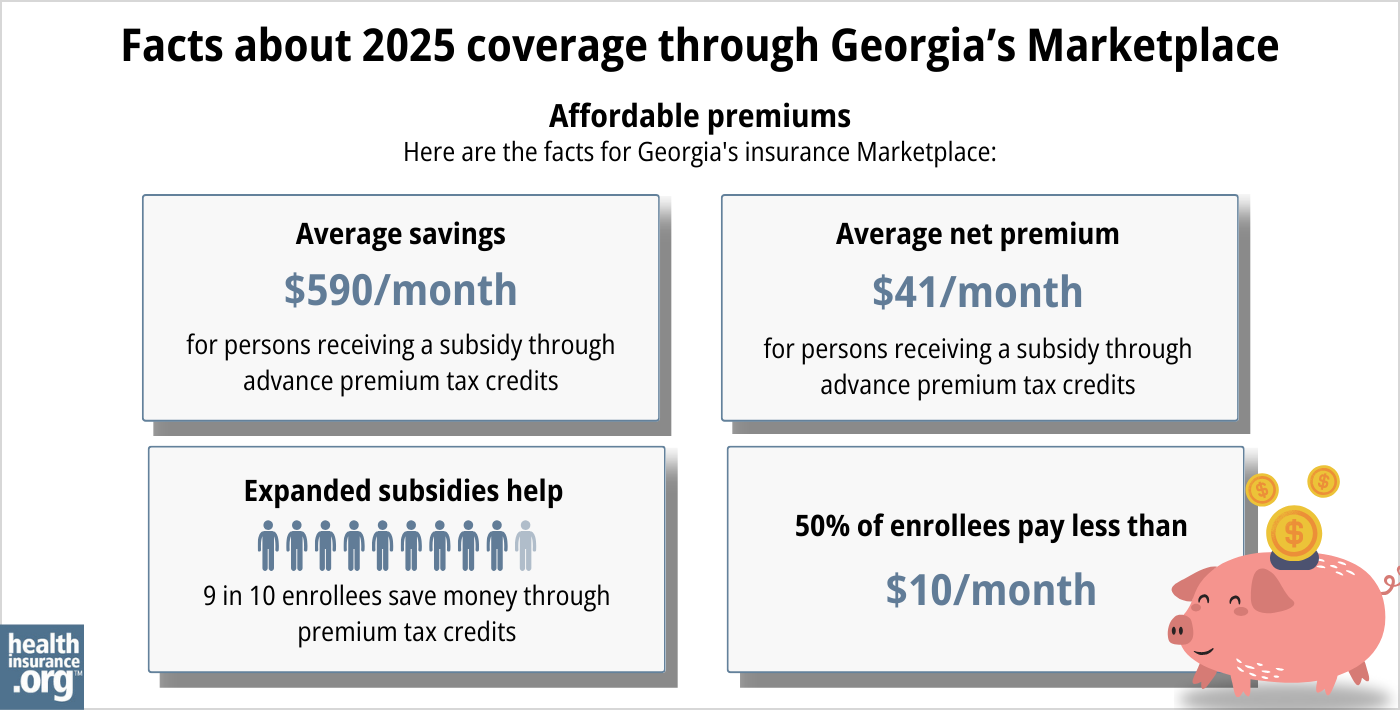

Ninety-three percent of the people who enrolled in coverage through Georgia’s Marketplace for 2025 were receiving premium subsidies.10 Those subsidies saved them an average of $590/month. After subsidies were applied, the average enrollee’s monthly cost (including those who paid full price) was about $74/month.11

Source: CMS.gov12

Although most Georgia Marketplace enrollees are eligible for premium subsidies, the state’s reinsurance program, which took effect in 2022, helps to keep premiums lower than they would otherwise be for people who aren’t subsidy-eligible.13

If your household income isn’t more than 250% of the federal poverty level, you may also qualify for cost-sharing reductions (CSR), which are another type of ACA subsidy. These subsidies can lower your deductibles and out-of-pocket expenses as long as you select a Silver-level plan. Two-thirds of Georgia’s Marketplace enrollees were receiving CSR benefits as of 2025.14

Depending on your income and circumstances, you may find that you’re eligible for free or low-cost health coverage through Medicaid or PeachCare for Kids (Georgia CHIP).

Georgia partially expanded Medicaid in mid-2023 (up to 100% of the poverty level) but imposed a work requirement for eligibility. This has significantly limited the number of people who are newly eligible for coverage under the program, which is called Georgia Pathways to Coverage. As of June 2025, only 8,087 people were enrolled in the Pathways program.15

Learn more about whether you might meet the criteria for Medicaid in Georgia.

How many insurers offer Marketplace coverage in Georgia?

Eight insurers are offering coverage through Georgia Access for 2026, with varying service areas:16

- Alliant

- Ambetter from Peach State Health Plan (Centene)

- Anthem Blue Cross and Blue Shield

- CareSource

- Cigna

- Kaiser

- Oscar

- UnitedHealthcare

There were nine participating insurers for 2025, but Aenta is exiting the Marketplace at the end of 2025, in all states where they offer coverage.

Mending (formerly Taro Health) had planned to join the Georgia Marketplace for 2026,17 but confirmed via email in October 2025 that they would not enter Georgia for 2026, and were reconsidering that as a possibility for 2027.

Coverage areas vary from one insurer to another. But in 2025, nearly all Georgia counties have Marketplace plans available from at least three insurers.6

Are Marketplace health insurance premiums increasing in Georgia?

For 2026, the following average rate increases were approved for Georgia’s Marketplace insurers, amounting to a weighted average increase of 34.6%, calculated before subsidies are applied.18

Georgia’s ACA Marketplace Plan 2026 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Aetna | Exiting market |

| Alliant | 19.5% |

| Ambetter from Peach State Health Plan (Centene) | 40% |

| AMGP Georgia Managed Care, dba Anthem Blue Cross and Blue Shield | 34.6% |

| Anthem Blue Cross and Blue Shield | 25.4% |

| CareSource | 31.3% |

| Cigna | 39.9% |

| Kaiser | 15.6% |

| Oscar | 32% |

| UnitedHealthcare | 40.2% |

Source: ACA Signups18 and RateReview.HealthCare.gov.19

Average rate increases are for full-price plans, but almost 93% of Georgia Marketplace enrollees receive premium tax credits that help reduce their monthly payments.10

However, those subsidy amounts will decrease significantly in 2026, unless Congress takes action to extend the subsidy enhancements that are scheduled to expire at the end of 2025. The expiration of the subsidy enhancements was a driving factor for the large rate increases that were approved for 202618 (healthy enrollees are more likely to drop their coverage when it becomes more expensive, leading to an overall risk pool that’s less healthy).

If the cost of your current plan increases, you can explore other plans in the exchange that may be less expensive and offer similar benefits. Plan changes are possible during open enrollment, or with certain qualifying life events.

For perspective, here’s a summary of how average rates have changed over the years for Georgia’s ACA-compliant individual/family market:

- 2015: Average increase of 1%20

- 2016: Average increase of 10.3%21

- 2017: Average increase of 32.8%22

- 2018: Average increase of 54.2%23 (federal funding for cost-sharing reductions was eliminated)

- 2019: Average increase of 3.9%24

- 2020: Average decrease of 0.9%25

- 2021: Average increase of 4.8%26

- 2022: Average decrease of 2.2%27

- 2023: Average increase of 10.1%28

- 2024: Average increase of 17.4%29

- 2025: Average increase of 9.9%30

How many people are insured through the Georgia Marketplace?

During the open enrollment period for 2025 coverage, 1,510,852 people enrolled in private plans through Georgia’s health insurance Marketplace.31

That was a significant record high. The chart below shows Georgia’s Marketplace enrollment over time. For several years, it hovered a little above or a little below 500,000 people, but has increased drastically in the last few years.

The increase is driven in large part by the enhanced premium subsidies created by the American Rescue Plan and the Inflation Reduction Act (scheduled to sunset at the end of 2025, likely leading to a significant enrollment decrease for 2026).

And the additional enrollment growth for 2024 is also driven by the fact that people are once again being disenrolled from Medicaid, after that was paused for three years during the pandemic. CMS reported that by April 2024, more than 265,000 people who had been disenrolled from Georiga Medicaid had transitioned to Marketplace coverage.32

Source: 2014,33 2015,34 2016,35 2017,36 2018,37 2019,38 2020,39 2021,40 2022,41 2023,42 2024,43 202544

What health insurance resources are available to Georgia residents?

Georgia Access: The Marketplace in Georgia starting with 2025 plans (enrollment began November 1, 2024). This is the platform where residents can enroll in coverage and obtain income-based financial assistance.

Georgia Department of Community Health (DCH) – Administers Georgia Medicaid and PeachCare for Kids.

Georgia Office of Insurance and Safety Fire Commissioner – Regulates and licenses health insurance products sold in the state, as well as the brokers and agents who sell them.

Georgia SHIP – A resource for Medicare beneficiaries and their caregivers, providing counseling and assistance with various Medicare issues.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Georgia?

Explore more resources for options in GA including short-term health insurance, dental, Medicaid and Medicare.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- ”2025 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed May 13, 2025 ⤶ ⤶

- ”Part III Actuarial Memorandum, Mending Health, Georgia individual market 2026” ACA Signups. Accessed July 23, 2025 *The above is based on the most current data available. ⤶

- ”A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit – The Basics. Internal Revenue Service. Accessed May 10, 2024 ⤶ ⤶

- ”Georgia’s 2025 Open Enrollment Period Begins as New State-Based Exchange, Georgia Access, Goes Live” Georgia Access. Nov. 1, 2024 ⤶ ⤶

- ”Important Dates” Georgia Access. Accessed Oct. 13, 2025 ⤶

- ”Georgia Marketplace Conditional Approval Letter” Centers for Medicare and Medicaid Services. July 27, 2023 ⤶

- ”Enhanced Direct Enrollment Partners” Georgia Access. Accessed Aug. 15, 2024 ⤶

- ”2025 Marketplace Open Enrollment Period Public Use Files” (Columns H and AJ) Centers for Medicare & Medicaid Services. Accessed July 23, 2025 ⤶ ⤶

- ”2025 Marketplace Open Enrollment Period Public Use Files” (Columns AB and AK) Centers for Medicare & Medicaid Services. Accessed July 23, 2025 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶

- Georgia: State Innovation Waiver under section 1332 of the PPACA. Centers for Medicare and Medicaid Services. November 1, 2020. ⤶

- ”2025 Marketplace Open Enrollment Period Public Use Files” (Columns H and AE) Centers for Medicare & Medicaid Services. Accessed July 23, 2025 ⤶

- ”Georgia Pathways Data Tracker” GeorgiaPathways.org. Accessed July 23, 2025 ⤶

- “Georgia Rate Review Submissions” RateReview.HealthCare.gov, Accessed Oct. 13, 2025 ⤶

- ”Part III Actuarial Memorandum, Mending Health, Georgia individual market 2026” ACA Signups. Accessed July 23, 2025 ⤶

- ”2026 Gross Rate Changes – Georgia: +34.6%; ~1.3 million enrollees are in for a hell of a shock this fall (updated)” ACA Signups. Oct. 16, 2025 ⤶ ⤶ ⤶

- ”Georgia Rate Review Submissions” RateReview.HealthCare.gov. Accessed Sep. 10, 2025 ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- Georgia: APPROVED 2019 #ACA Rate Hikes: 3.9%…Would Likely Have DROPPED ~8% Without #ACASabotage. ACA Signups. August 2018. ⤶

- Georgia: *Final* Avg. 2020 #ACA Premiums Rate Change: 0.9% Decrease. ACA Signups. October 2019. ⤶

- Georgia: Approved Avg. 2021 #ACA Premiums: +4.8% (Was -1.3%). ACA Signups. September 2020 ⤶

- 2022 Rate Changes. ACA Signups. October 2021. ⤶

- UPDATED: FINAL Unsubsidized 2023 Premiums: +6.2% Across All 50 States +DC. ACA Signups. Accessed November 2023. ⤶

- Georgia: Final Avg. Unsubsidized 2024 #ACA Rate Changes: +17.4%. ACA Signups. August 2023. ⤶

- ”Georgia: Preliminary avg. unsubsidized 2025 #ACA rate changes: +9.9%; Aetna pulling out of sm. group market?” ACA Signups. Aug. 29, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” (Column H). CMS.gov, Accessed July 23, 2025 ⤶

- ”HealthCare.gov Marketplace Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through April 2024; Accessed Aug. 15, 2024 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” CMS.gov, May 2025 ⤶