What is an advance premium tax credit?

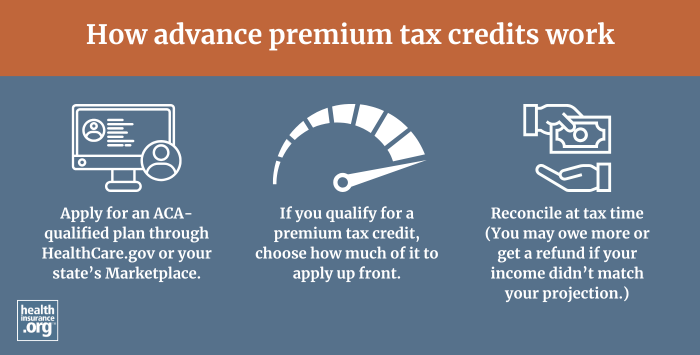

An advance premium tax credit, often just called APTC, refers to a premium tax credit (premium subsidy) that's paid throughout the year, directly to the insurer on behalf of an enrollee. This means it's paid in advance, as opposed to the person having to wait and claim it on their tax return the following spring the way most other tax credits work.

Most people who enroll in health coverage through the exchange are eligible for income-based premium tax credits as a result of the Affordable Care Act, the American Rescue Plan, and the Inflation Reduction Act. And the vast majority of those enrollees choose to receive their premium tax credits in advance, rather than waiting until they file their tax return and claiming it all at that point. As of early 2024, 93% of Marketplace enrollees nationwide were receiving APTC.1

When APTC is paid to an insurer on behalf of an exchange/marketplace enrollee, the enrollee must reconcile that when they file their tax return. Their actual premium tax credit is based on the amount that they earned during the year, whereas their advance premium tax credit was based on a projection of what they thought they would earn. If those amounts end up being different, the person might have to repay some or all of the APTC that was paid on their behalf, or they might end up receiving an additional amount of premium tax credit from the IRS.

Footnotes

- "Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average" CMS.gov, July 2, 2024 ⤶

Will you owe or get a refund on your APTC?

Use our advance premium tax credit repayment & refund calculator