What is an annual limit?

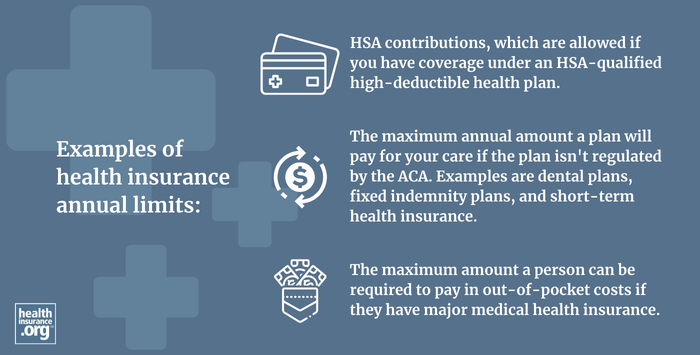

The term annual limit is used in several ways when talking about health insurance. An annual limit can refer to the maximum amount that a person will have to pay in out-of-pocket costs when they need medical care. As a result of the Affordable Care Act (ACA), all major medical health plans that aren't grandfathered or grandmothered (or excepted from ACA-compliant regulation altogether) are required to cap annual out-of-pocket costs for essential health benefits received from in-network medical providers.

The concept of annual limit can also refer to the amount that a health insurance plan will pay for covered health care benefits in any given year. If an individual reaches the annual limit, he or she is responsible for paying out of pocket for further care. While the Affordable Care Act (ACA) banned annual dollar limits for essential health benefits as of 2014 (with the exception of grandfathered individual market plans), short-term insurance plans can and typically do have an annual limit. And dental insurance plans also almost always include annual limits. Fixed indemnity plans also include annual limits on how much the plan will pay, as well as per-incident or per-service limits.

And even on health plans that are prohibited from applying annual dollar limits on benefits (ie, the majority of health plans), the ACA does allow plans to impose annual limits on the number of visits the plan will cover. So for example, you might see an ACA-compliant health plan that will pay for a maximum of 20 physical therapy visits in a year.

How do annual limits apply to HSA contributions?

Annual limits also apply to health savings account (HSA) contributions. Many people use HSAs in conjunction with high-deductible health plans. In this context, the annual limit means the maximum dollar amount you and/or your employer can put into a health savings account in a given year.

The Internal Revenue Service (IRS) updates and publishes contribution limits every year. In 2025, the annual limit on HSA contributions is $4,300 if you have HDHP coverage for just yourself, or $8,550 if your HDHP covers at least one additional family member.1 People age 55 or over can contribute up to an additional $1,000 in “catch-up” contributions. Tax filers who utilize HSAs file Form 8889 to report on HSA activity, such as contributions and distributions.

How does the concept of annual limit apply to premiums for employer-sponsored plans?

Finally, an annual limit is set each year by the IRS to address the ACA’s affordability requirement. The annual limit is a cap on an employee’s premium contribution for employer-sponsored health insurance.

The annual limit is expressed as a percentage of the employee’s household income, and the lowest cost option for employee-only coverage is used in determining affordability. The affordability requirement applies to employers with more than 50 employees. For 2025, the annual limit is 9.02% of household income.2 (this limit is adjusted annually; see question 40 of the IRS ACA affordability FAQs). If the employee would have to pay more than 9.02% of their household income for self-only coverage under the lowest-cost plan the employer offers (assuming the plan provides minimum value), the employee would be able to reject that coverage and potentially qualify for an income-based premium subsidy in the Marketplace/exchange instead.

Footnotes

- "Revenue Procedure 2024-25" Internal Revenue Service. Accessed May 21, 2024 ⤶

- “Revenue Procedure 2024-35”. Internal Revenue Service. Accessed Oct. 28, 2024. ⤶