Key takeaways

- What is a benchmark plan?

- Why is the second-lowest-cost Silver plan called a benchmark plan?

- How can I find the cost of the benchmark plan (SLCSP)?

- Why is the state's standard plan for essential health benefits (EHB) called a benchmark plan?

- What states have made changes to their EHB benchmark plans?

- What states are considering changes to their EHB benchmark plans?

- Do benchmark plan requirements apply to large-group health plans?

What is a benchmark plan?

There are two different meanings for the term benchmark plan. Both have to do with the Affordable Care Act (ACA), although they have very different purposes.

- Benchmark plan is the term used to describe the second-lowest-cost Silver plan (SLCSP) available in the exchange/Marketplace.

- Benchmark plan is also the term for the plan that each state designates as the standard for essential health benefits (EHBs). For this usage, you’ll often see the term “EHB-Benchmark Plan,” although that’s not always the case. (Here’s an example from an insurance carrier just using “benchmark plan” and another from a state insurance department using the term “ACA Benchmark Plan.”)

It can be a bit confusing that the term “benchmark plan” can be used to describe two entirely different concepts. But we’ll explain each concept in greater detail below.

Why is the second-lowest-cost Silver plan called a benchmark plan?

The price of the second-lowest-cost Silver plan (SLCSP) is used to calculate a Marketplace enrollee’s premium subsidies. The relationship between the cost of the second-lowest-cost Silver plan and the percent of a subsidy-eligible enrollee’s income that they’re expected to use (an “applicable percentage”) to pay premiums dictates the subsidy amount for that individual when they enroll on the exchange.

For each subsidy-eligible Marketplace enrollee, an exact “applicable percentage” of household income is determined. The percentage currently varies between 0% and 8.5%, depending on income. The second-lowest-cost-Silver plan is thus called a benchmark plan because it’s the plan that the enrollee will be able to purchase for exactly that percentage of their income; the subsidy amount is benchmarked based on that plan’s price. The enrollee can pick a lower-cost plan and pay a smaller amount in premiums, or they can pick a higher-cost plan and pay the difference in additional premiums.

The benchmark plan will vary from one part of a state to another, depending on the rating area and plan availability. And the benchmark plan will vary from one year to the next, sometimes being offered by different insurers in different years. This is because the benchmark plan is determined solely based on price: The Marketplace looks at all of the available plans for a given applicant (these will vary depending on where the applicant lives), arranges them in order by premiums, and the benchmark plan is whatever plan ends up in the second-lowest-cost spot among all the available Silver plans.

How can I find the cost of the benchmark plan (SLCSP)?

If you’re enrolling in a health plan through the Marketplace in your state, the cost of the benchmark plan (SLCSP) will determine how much your premium subsidy or advance premium tax credit will be.

The Marketplace will make this calculation for you, determine your advance premium tax credit amount, and then send you IRS Form 1095-A early the following year, showing the amount of the SLCSP, the amount of your plan, how much you paid, and how much was paid on your behalf via the advance premium tax credit Form 1095-A can be obtained online in your Marketplace account, but will also be mailed to you by the Marketplace.

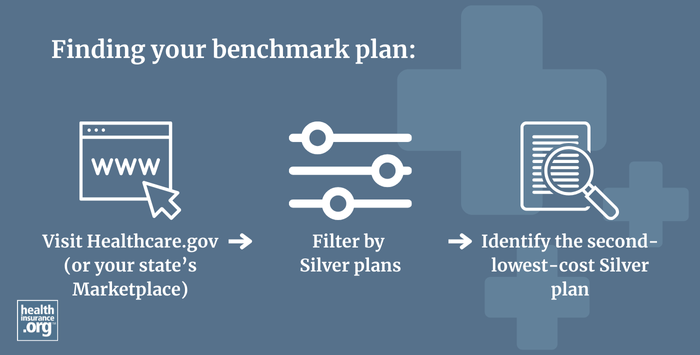

But if you want to determine the cost of the SLCSP yourself, you can simply use the plan comparison tool on your state’s exchange or HealthCare.gov, order the plans from lowest to highest premium (the default in most states), and then filter to only see the Silver plans.

From there, the second-lowest-cost plan on the list will be the SLCSP and its price will be displayed. Note that the process is slightly different if you have children and some of the available plans have embedded pediatric dental coverage while others do not. In that case, the cost of the second-lowest-cost pediatric dental plan has to be added to the cost of the medical plans that don’t have embedded pediatric dental benefits, before the plans are ordered by price.

If you’re trying to determine the SLCSP for a prior year and you don’t have your 1095-A handy, you can use this tool if you’re in one of the states that use HealthCare.gov. If you’re in a state that runs its own Marketplace, you may be able to find a similar tool on the exchange website, or you may need to contact the state Marketplace directly and ask them for assistance.

Why is the state's standard plan for essential health benefits called a benchmark plan?

The ACA lists ten general categories of essential health benefits (EHB) that all individual and small-group health plans are required to cover to qualify as minimum essential coverage under the ACA if they have effective dates of 2014 or later.

But the ACA’s EHB list is very general (e.g. “ambulatory patient services”). The law delegated to the Department of Health and Human Services (HHS) the determination of exactly what has to be covered, and HHS created a framework under which each state would determine the specific services that have to be covered under each EHB.

States accomplish this by selecting a benchmark plan from among various options allowed by HHS. Individual and small-group health plans are required to cover at least the services that the EHB benchmark plan covers. But the specifics of exactly what has to be covered varies from state to state.

States select their own EHB benchmark plan from a list of options allowed by HHS:

- The small-group plan with the largest enrollment, selected from among any of the three largest products in the state, by enrollment. (Product refers to network type, meaning HMO, PPO, EPO, etc., so the selected plan might not actually have the largest enrollment in the state, but it must have the largest enrollment for its product type.) or

- one of the three largest (by enrollment) state employee plans, or

- one of the three largest (by enrollment) federal employee health plan options, or

- the HMO plan with the largest enrollment in the state’s commercial market.

Health insurance carriers in the individual and small-group markets in each state use the benchmark plan as a guide for creating their own benefit designs to provide coverage of the EHBs. If the benchmark plan covers a particular service, then all individual and small-group plans in the state must also cover that service. This is why the plan is referred to as a benchmark.

For the period from 2014 to 2016, the benchmark plan was a plan that was sold in the state in 2012 plus supplementation if there were any EHBs that weren’t covered by the plan that was chosen as the benchmark. HHS clarified that in that case, the coverage for the missing EHB could be added to the benchmark plan’s coverage. This is accomplished by using the coverage details for that EHB provided by another one of the state’s benchmark plan options, and adding i to the selected plan for the purpose of creating the overall EHB requirements. For the period from 2017 through 2019, the benchmark plan was a plan that was sold in the state in 2014.

Starting with the 2020 plan year, states could continue to use their existing benchmark plans or make modifications under new guidelines that were designed to give states more flexibility in setting their EHB benchmark plans. Under the updated rules, states could continue to use one of the options described above, or they could:

- Use a benchmark plan that was used by another state in 2017.

- Create a new benchmark plan by essentially combining portions of their existing benchmark plan with portions of another state’s benchmark plan, replacing one or more essential health benefit categories with the applicable coverage from another state’s benchmark plan.

- Design their own plan by “otherwise selecting a set of benefits that would become the State’s EHB-benchmark plan.”

As was the case with the benchmark plans for the period from 2014 to 2016, a state must supplement the benchmark plan to bring it up to scratch if it’s lacking in any of the essential health benefit categories.

You can see each state’s benchmark plan details here.

What states have made changes to their EHB benchmark plans?

Several states have made modifications to their benchmark plans over the years:1

- Starting with the 2020 plan year: Illinois

- Starting with the 2021 plan year South Dakota

- Starting with the 2022 plan year: Michigan, New Mexico, and Oregon

- Starting with the 2023 plan year: Colorado

- Starting with the 2024 plan year: Vermont

- Starting with the 2025 plan year: Virginia and North Dakota

- Starting with the 2026 plan year: Alaska, Washington, and the District of Columbia2

- Starting with the 2027 plan year: Colorado

What states are considering changes to their EHB benchmark plans?

Several states are considering changes to their EHB benchmark plans:

- California considered legislation in 2024 requiring the state to review and update its EHB benchmark plan for 2027 and future years; both bills passed in their respective chambers in May 2024.3 California is now in the process of updating its EHB benchmark plan for 2027, with various new additional benefits under consideration.4

- Nevada is considering amending its EHB benchmark plan to add coverage for drugs used to treat and prevent HIV, drugs to treat opioid use disorder, and drugs to treat and prevent hepatitis B and C. In early 2025, the Nevada Division of Insurance was seeking public comments on those proposed coverage revisions.5

- Louisiana enacted legislation in 2024 that calls for the Louisiana Department of Health to evaluate various weight loss treatments, including bariatric surgery, to see if they should be included in the next update to Louisiana's EHB benchmark plan.6 (The law specifically notes that it does not require health plans to cover drugs to lower glucose or aid in weight loss.)

- Virginia enacted legislation in 2024 that calls for the Virginia Health Insurance Reform Commission to consider doula coverage as part of its 2025 review of the state's EHB benchmark plan, and "include such coverage in its recommendation to the General Assembly for a new essential health benefits benchmark plan unless the Commission identifies a compelling reason to exclude such coverage."7 Virginia lawmakers are also considering legislation in 2025 that would call for the Commission to consider adding various fertility-related services to the state's EHB benchmark plan.8

Do benchmark plan requirements apply to large-group health plans?

No, the ACA’s essential health benefits rules do not apply to the large-group market (with the exception of preventive care, which applies across the board). But for any essential health benefits that a large-group or self-insured plan covers, it cannot have any annual or lifetime caps on how much the plan will pay for those services.

Footnotes

- "Information on Essential Health Benefits (EHB) Benchmark Plans" CMS.gov. Accessed Feb. 10, 2025 ⤶

- "CMS Approves Essential Health Benefits Benchmark Plans for Two States and DC" CMS Newsroom. Oct. 18, 2024 ⤶

- "California SB1290" and "California AB2914" BillTrack50. Accessed June 26, 2024 ⤶

- "Public Meeting on California’s Essential Health Benefits and Updating the Benchmark Plan" California Department of Managed Health Care. June 27, 2024 ⤶

- "Nevada Division of Insurance Seeking Public Input on Essential Health Benefits" Nevada Division of Insurance. Feb. 10, 2025 ⤶

- "Louisiana SB106" BillTrack50. Enacted June 10, 2024 ⤶

- "Virginia HB935" and "Virginia SB118" BillTrack50. Accessed June 26, 2024 ⤶

- "Virginia HB1609" BillTrack50. Crossed over, Jan. 30, 2025 ⤶