What is coinsurance?

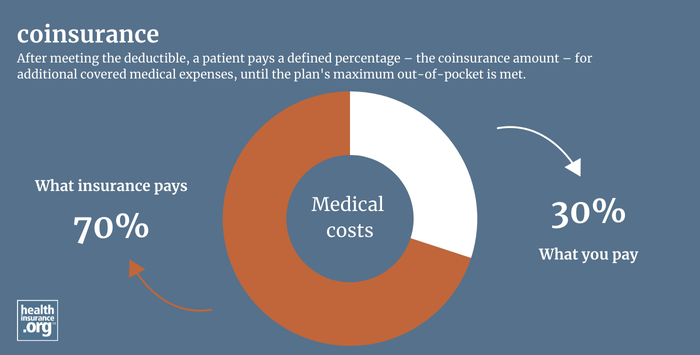

Coinsurance is the percentage of costs a patient pays for medical expenses – such as a hospital stay, office visit, medical device, or prescription drug. With some health insurance plans, a patient pays 100% of costs out-of-pocket until they have met their deductible. After meeting the deductible, a patient pays a defined percentage – the coinsurance amount – for additional covered medical expenses.

What is the difference between copayment and coinsurance?

Both copayment and coinsurance refer to a patient’s responsibility for a portion of healthcare costs. A copayment is a set dollar amount that the patient must pay for a specific treatment or medication. Coinsurance is a percentage of the total cost.

For example, a very common coinsurance arrangement is that the medical insurance company pays 80% of costs for a given therapy, with the patient paying 20%. But you may also see a patient's coinsurance responsibility set at 10%, 30%, 40%, or some other amount (typically higher for out-of-network care, discussed below).

Copayments and coinsurance, along with deductibles, are examples of cost sharing. (FYI, while premiums are paid by the consumer, they are typically NOT considered cost-sharing.)

Does coinsurance vary if I go to an in-network vs. out-of-network provider?

Yes, almost all health insurance plans require the patient to pay more for an out-of-network service. Check your certificate of insurance, certificate of coverage, or summary plan description (SPD) to understand what portion of a given medical expense you will be responsible for paying.

Some plans will not cover any out-of-network care unless it is an emergency. When plans do cover out-of-network care, they typically have a higher deductible for out-of-network care and the patient is also responsible for a larger coinsurance percentage. It's also common for out-of-network medical providers to balance bill patients for the amount of their charges above what the health plan considers reasonable and customary.

The No Surprises Act provides consumer protections against surprise out-of-network balance billing in emergencies and situations in which the patient receives care from an out-of-network provider while at an in-network facility.