What is a copayment?

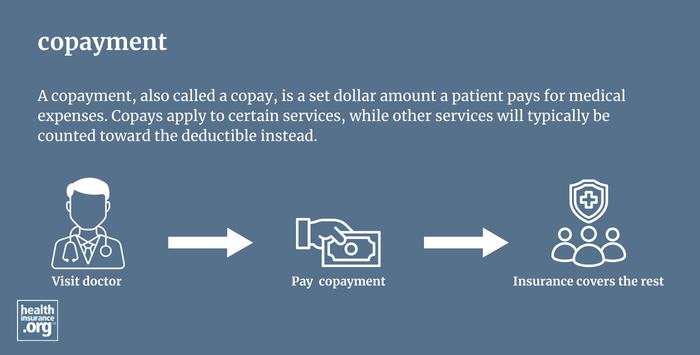

A copayment, also called a copay, is a set dollar amount a patient pays for medical expenses. Not all health plans use copays. For those that do, copays apply to certain services, while other services will typically be counted toward the deductible instead. After meeting the deductible, the patient will switch to paying coinsurance for the services that were previously subject to the deductible. But they will generally keep paying copays for the services that are subject to copays. Both copays and coinsurance continue to be paid until the patient reaches their out-of-pocket maximum.

What is the difference between copayment and coinsurance?

Both copayment and coinsurance refer to a patient’s responsibility for a portion of healthcare costs. A copayment is a set dollar amount that the patient must pay for a specific service, treatment, or medication. Coinsurance is a percentage of the total cost of a healthcare service. Copayments and coinsurance, along with deductibles, are examples of cost sharing.

In general, you will need to pay any applicable copay at the time you receive the care. So you'll pay this directly to the doctor's office or pharmacy. But coinsurance is usually billed to you after the claim has been sent to your health plan. That allows the amount to be adjusted to account for the network-negotiated rates between your medical provider and your health plan. The details of what you owe will be communicated to you in an explanation of benefits and you should receive a bill for the coinsurance (and your deductible, if you owe it) from the medical provider. The bill should match what you see on the EOB; if it doesn't, reach out to your health plan and medical provider's office for clarification.

Do I pay the same copayment for all types of healthcare services?

No. Health insurance plans set different copay amounts for different types of services, such as an emergency room visit vs. an office visit. For prescription drugs, most plans define different copayments for different categories (formulary tiers) of drugs. For example, a plan might have a $10 copay for a generic drug, $25 for a preferred brand-name drug, $50 for a non-preferred brand-name drug, and $100 for a specialty drug.

Plans may also require a mixture of copayments, coinsurance, and a deductible. For example, you may have a copayment for prescription drugs, but a deductible plus coinsurance for a hospital stay. Or your plan might have a $25 copay to see your primary care provider, but lab services are counted toward the deductible. In that case, you would pay the $25 when you go to your provider's office, but you would receive a bill later on for any lab work that was done. The bill would be for your deductible and/or coinsurance, depending on how much you've already spent in out-of-pocket costs.

Do copayments vary if I go to an in-network vs. out-of-network provider?

Yes, almost all health insurance plans require the patient to pay more for an out-of-network service. Check your certificate of insurance, certificate of coverage, or summary plan description (SPD) to understand what portion of a given medical expense you will be responsible for paying. Keep in mind that some plans don't cover non-emergency care received out-of-network. And if coverage is provided, the out-of-network provider might balance bill you for the difference between what they charge and what your plan allows.