What is a defined-benefit plan?

A defined benefit plan is most often used to describe a type of retirement benefit,1 but it can also be used in reference to health insurance benefits provided by an employer or the government.2

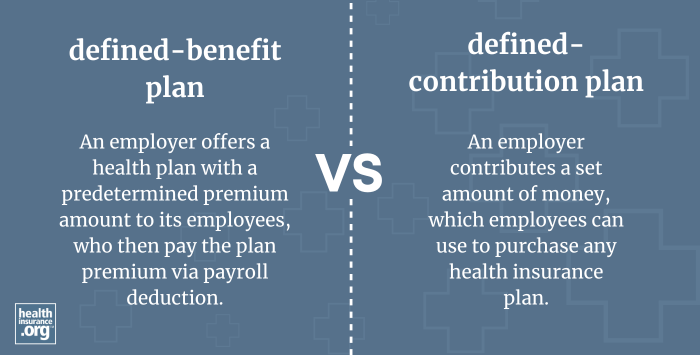

In the context of health insurance, it refers to the type of health insurance benefits that employers have traditionally offered their employees. The employer picks a plan or plans, and offers them to the employee, with a predetermined premium amount that the employee will have to contribute via payroll deduction (this amount can change each year, and is communicated to employees in their initial eligibility packet and annual open enrollment information). The employer pays the rest of the premiums, and employees' coverage choices are limited to the plan or plans that the employer offers.

The alternative is a defined contribution plan, in which the employer gives the employee a set amount of money, and the employee can use it towards the purchase of any health insurance plan. Prior to the Affordable Care Act, some employers used this sort of arrangement to allow employees to purchase individual market coverage, with a portion of the premium reimbursed by the employer. This practice was banned by the ACA, but the 21st Century Cures Act allowed small businesses (fewer than 50 employees) to once again reimburse employees for individual health insurance premiums, as of January 2017, using a QSEHRA. And starting in 2020, employers of all sizes could start to use ICHRAs to reimburse employees for some or all of the cost of individual market coverage. With a QSEHRA or ICHRA, the employer provides a predetermined reimbursement amount, and employees are free to use that toward the purchase of any individual market health plan available to them.

Footnotes

- "Defined Benefit Plan" Internal Revenue Service. Accessed Nov. 13, 2024 ⤶

- "Defined benefit vs. defined contribution" Association of Health Care Journalists. Accessed Nov. 13, 2024 ⤶