What is a health reimbursement arrangement (HRA)?

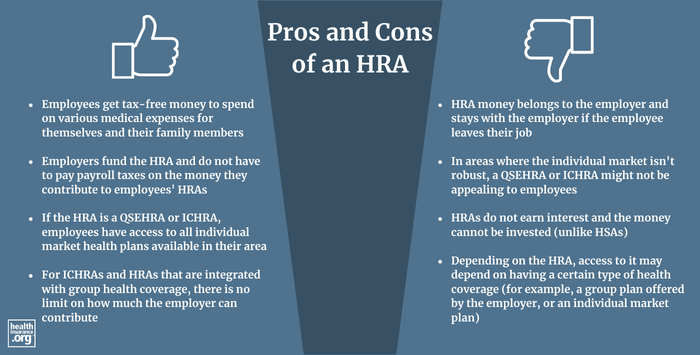

An HRA (health reimbursement arrangement) is a pre-tax way for employers to reimburse employees for qualified medical expenses incurred by the employee or their spouse or dependents.1 The rules for HRAs are outlined in IRS Publication 969.2 HRAs are sometimes referred to as health reimbursement accounts.

Who funds an HRA?

HRAs must be funded entirely by the employer, so nothing is deducted from the employee's paycheck.2 The HRA contribution that the employer makes is not counted in the employee's income.

What are the different types of HRAs?

There are five main types of HRAs, each with its own rules:3

- Group Health Plan HRAs (also known as Integrated HRAs). Can only be used by employees who are enrolled in the employer's group health plan.

- Qualified Small Employer HRAs (QSEHRA). Can be offered by small employers, with fewer than 50 employees, be used to reimburse premiums for individual market coverage.

- Individual Coverage HRAs (ICHRA). Can be offered by employers of any size, to reimburse premiums for individual market coverage.

- Excepted Benefit HRAs (EBHRA). Can be used to reimburse premiums for coverage such as dental/vision or short-term health insurance. Quite limited contribution caps.

- Retiree-only HRAs. If an employer offers this type of HRA, it can only be used by the employer's retirees.

Is there a limit on how much can be reimbursed with an HRA?

This depends on the type of HRA. In general, there's no upper limit on how much employers can contribute to their employees' HRA (unlike FSAs and HSAs, which do have limits), although non-discrimination rules apply.4 But some types of HRAs, including QSEHRAs and excepted benefit HRAs,5 do have contribution limits. On the other end of the spectrum, there are no minimum contribution requirements for HRAs.

Can HRA funds be used to pay for individual health insurance?

Yes, if it's a QSEHRA or an ICHRA. Under federal rules related to the implementation of the ACA, employers were not allowed to offer an HRA unless it was integrated with an employer-sponsored group health insurance plan. But these rules were relaxed in 2017 to allow small employers to offer QSEHRAs, and in 2020 to allow employers of any size to offer ICHRAs.

What can be reimbursed with an HRA?

Although the IRS defines what constitutes qualified medical expenses, employers can further limit the expenses for which employees can seek reimbursement under their HRA. To be reimbursed, an employee has to provide documentation showing that they incurred an eligible expense.

As of 2011, the ACA prohibited the purchase of over-the-counter medications with HRA funds, unless a doctor prescribed them. But Section 4402 of the 2020 Coronavirus Aid, Relief, and Economic Security (CARES) Act changed that.

The CARES Act, signed into law in March 2020, allows over-the-counter medications to be a reimbursable expense under an HSA, if the employer allows it. It also allows menstrual product purchases to be reimbursed with HRA funds, if the employer allows it. And new guidelines were issued in 2024 that allow condoms to be a reimbursable expense under an HRA, if the employer allows it.6

In June 2020, the IRS proposed regulations to allow employers to use HRAs to reimburse employees for direct primary care fees and health care sharing ministry fees, but the proposed rules were never finalized.

Can I have an HRA together with an HSA?

In most cases, an HRA benefit makes an employee ineligible to contribute to an HSA, even if they have an HSA-compliant high-deductible health plan. But some limited types of HRAs can be used in conjunction with an HSA.2

Footnotes

- "26 U.S. Code § 213 - Medical, dental, etc., expenses" Legal Information Institute. ⤶

- "Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans" Internal Revenue Service. Accessed Dec. 20, 2024 ⤶ ⤶ ⤶

- "Health Reimbursement Arrangements (HRAs): Overview and Related History" Congressional Research Service. Mar. 7, 2022 ⤶

- "Nondiscrimination Rules: Summary of IRC 105(h) Eligibility and Benefits Rules" Leavitt Group. November 24, 2014. ⤶

- "What is an excepted benefit Health Reimbursement Arrangement (HRA)?" Centers for Medicare and Medicaid Services, December 2022. ⤶

- "Notice 2024-71" Internal Revenue Service. Accessed Dec. 20, 2024 ⤶