In this article

- What is an HSA?

- What are the HSA contribution limits for 2026?

- How do HSA deposits work?

- The health plan that pairs with an HSA (including all Bronze and Catastrophic Marketplace plans)

- IRS expands preventive care umbrella to cover some chronic care treatments and new preventive care

- Using your HSA funds

- Frequently asked questions about HSAs

What is an HSA?

A health savings account (HSA) is a federally tax-deductible savings account that’s used in conjunction with an HSA-eligible high-deductible health insurance plan (HDHP). Most states offer deductions on contributions to these accounts as well.

HSA regulations allow you to legally reduce federal income tax by depositing pre-tax money into a health savings account, as long as you’re covered by an HSA-eligible high-deductible health plan (HDHP). As discussed below, more plans are HSA-eligible as of 2026. Just like IRAs, HSA contributions can be made until the tax filing deadline, which is roughly April 15 of the following year.1

What are the HSA contribution limits for 2026?

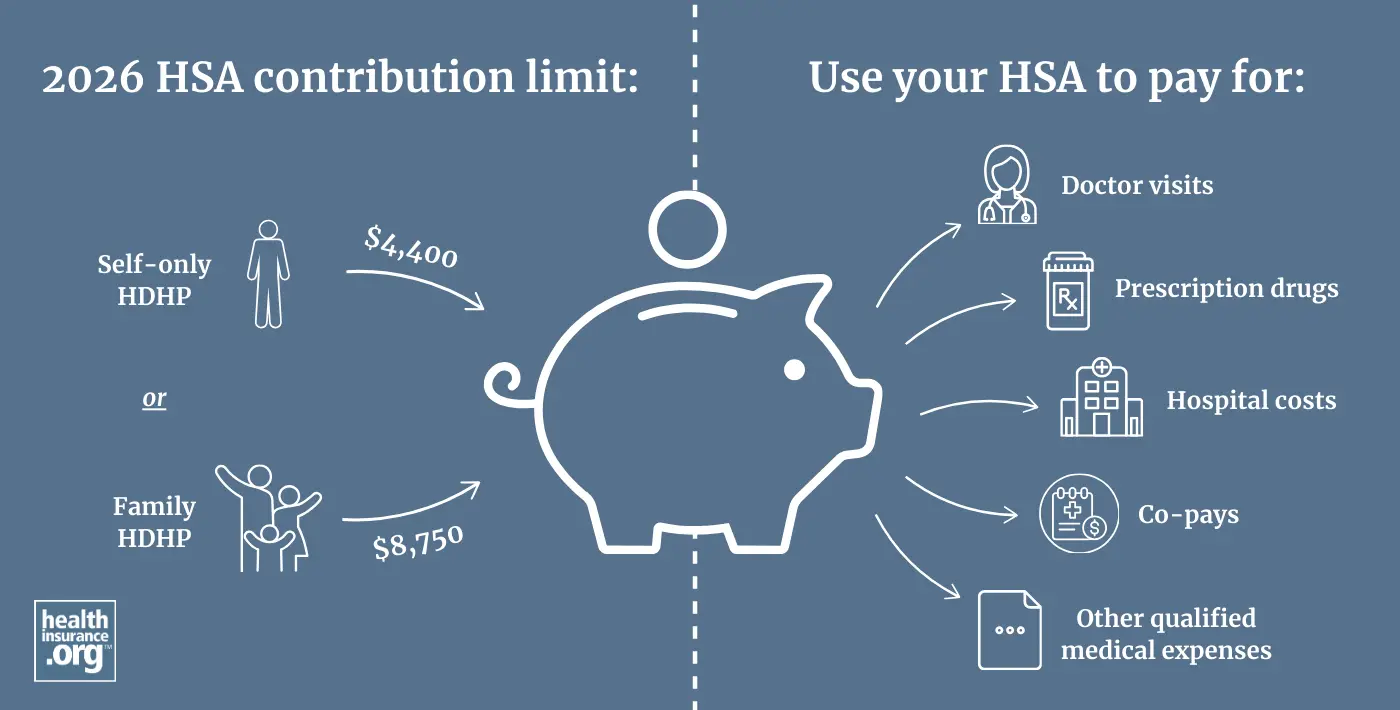

For 2026, you can deposit up to $4,400 if you have HDHP coverage for just yourself, or $8,750 if your HDHP covers at least one additional family member.2 (“Family” coverage does not have to cover an entire family.) You have until April 15, 2027 to contribute some or all of this amount if you have HDHP coverage in 2026.

Account holders who are 55 or older are allowed to deposit an additional $1,000 in catch-up contributions. (This amount is not adjusted for inflation; it’s always $1,000 per year.)3 HSA contributions can be made throughout the year, or all at once – it's up to the account holder.

How do HSA deposits work?

There’s no minimum deposit, but whatever you put into your account is an “above-the-line” tax deduction that reduces your adjusted gross income. If you make your HSA contributions via your employer – as a payroll deduction (salary reduction) – the money will be taken out of your check before taxes, so you'll avoid both income tax and payroll tax on the contributions.4

Contributions to your HSA can be made by you or by your employer, and they’re yours forever – there’s no “use it or lose it” provision with HSAs, and the money rolls over from one year to the next.5 HSA funds can be stored in a variety of savings vehicles, including bank accounts and brokerage accounts (ie, the funds can be invested in the stock market if you prefer that option and your HSA administrator allows it), and there are numerous HSA custodians/administrators from which to choose.6

The health plan that pairs with an HSA

To make contributions to an HSA, a person must have coverage under an HDHP (and no additional coverage, unless it's certain allowable supplemental coverage). Before 2026, only plans that conformed to strict IRS guidelines could be considered HDHPs. But as of 2026, under the "One Big Beautiful Bill Act," (OBBBA), HDHPs have been expanded to include all Bronze and Catastrophic plans purchased through the health insurance Marketplace. So an HDHP can be either:

- A Bronze or Catastrophic plan obtained through the health insurance Marketplace (exchange)7 OR

- A plan that meets the regular IRS guidelines for HDHPs (this includes minimum deductibles, caps on maximum out-of-pocket costs, and a requirement that the plan not pay for any non-preventive services before the minimum deductible is met)

The expansion of HDHPs to include all Bronze and Catastrophic Marketplace plans made HDHPs much more widely available to Marketplace enrollees starting in 2026.

In 2025, almost 7.3 million people enrolled in Bronze Marketplace plans, out of 24.3 million Marketplace enrollees nationwide.8 Relatively few of them were eligible to contribute to HSAs in 2025, since most Bronze plans were not HDHPs under 2025 rules. But starting in 2026, all Bronze plan enrollees are eligible to contribute to HSAs, as long as they don’t have any additional health coverage in place (except for certain limited benefit plans that the IRS allows in conjunction with an HSA-eligible plan).9

Catastrophic plans are also considered HDHPs starting in 2026, and the federal government took steps to make Catastrophic plans more accessible for 2026.10 But Catastrophic plans are not available in all areas,11 and the federal premium subsidies that reduce most Marketplace enrollees’ premiums cannot be used with Catastrophic plans.12 As a result, only about 54,000 people selected these plans in 2025, out of 24.3 million Marketplace enrollees.13

IRS expanded preventive care umbrella to cover some chronic care treatments and new preventive care

The ACA requires all non-grandfathered health plans to pay for certain preventive care before an insured meets their deductible. This rule applies to HDHPs as well. But an HDHP cannot pay for most other, non-preventive services until the insured has met the minimum deductible.14 (As noted below, the definition of preventive care has been expanded for HDHPs, and the OBBBA also permanently allows HDHPs to pay for telehealth services before the deductible is met.)15

So unless the plan is a Marketplace Bronze or Catastrophic plan, HDHPs cannot have copays for office visits or prescriptions before the deductible is met. This is one of the ways they differ from other health plans that have high deductibles but are not HDHPs.

But under guidelines that the IRS issued in mid-2019, the list of preventive services that can be covered pre-deductible on an HDHP has been expanded to include certain treatments for certain specific chronic conditions.16 It's optional for insurers to classify these services as preventive, but if they do, the insurer can cover them (partially or in full) before the enrollee meets the deductible, and the health plan will continue to have its HDHP status. In late 2024, the IRS issued additional guidelines to further expand the list of preventive services that an HDHP can pay for before the deductible is met.17 These rule changes are explained in more detail in our overview of HDHPs.

Using your HSA funds

You can use the pre-tax savings in your HSA to pay for doctor visits, hospital costs, deductibles, co-pays, prescription drugs, or any other qualified medical expenses. Once the out-of-pocket maximum on your health insurance policy is met, your health insurance plan will pay for your remaining covered medical expenses that year, the same as any other health plan.

If you switch to a health insurance policy that’s not HSA-qualified, you’ll no longer be able to contribute to your HSA. But you’ll still be able to take money out of your HSA at any time to pay for qualified medical expenses, with no taxes or penalties assessed. If you don’t use the money for medical expenses and still have funds available after age 65, you can withdraw them for non-medical purposes with no penalties, although income tax would be assessed at that point, with the HSA functioning much like a traditional IRA.18

In 2024, the IRS issued guidance to add male condoms to the list of qualified medical expenses, thus allowing them to be purchased with pre-tax HSA (or HRA or FSA) funds.19

Starting in 2026, under the OBBBA, a person with an HDHP who also has a direct primary care (DPC) membership (with fees of no more than $150/month for a single person or $300/month for a family, and certain benefit limitations) is allowed to contribute to an HSA and can use HSA funds to pay the DPC membership fees.20

You can also withdraw money from your HSA without paying taxes to pay Medicare premiums (for Medicare Part A, if you have to pay premiums for it – although most people don't – and for Medicare Part B and Medicare Part D prescription drug coverage, but not for Medicare supplement (Medigap) plans).

HSA funds can also be used to pay long-term care premiums. There are limits on how much you can withdraw from your HSA without incurring income tax to pay long-term care insurance premiums. (These limits are for 2026; the IRS indexes them for inflation annually.) If your age is:21

- 40 or younger, you can withdraw $500 tax-free to pay long-term care insurance premiums

- Older than 40, but not older than 50, you can withdraw $930

- Older than 50, but not older than 60, you can withdraw $1,860

- Older than 60, but not older than 70 you can withdraw $4,960

- Older than 70, you can withdraw $6,200

Frequently asked questions about HSAs

- How does a health savings account work?

- Who should consider a high-deductible health plan?

- Can I buy HSA-compatible health insurance through the exchange?

- What's the difference between an FSA and an HSA?

- Can I use my HSA to pay for COVID testing and treatment?

- Can I use my HSA to purchase over-the-counter medications?

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written hundreds of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Publication 969 (When to Contribute)“ Internal Revenue Service. Accessed Jan. 21, 2026 ⤶

- “Revenue Procedure 2025-19” Internal Revenue Service. Accessed July 8, 2025 ⤶

- “HSA contributions and limits” Priority Health. July 3, 2025 ⤶

- “The Deductibility of HSA Contributions” HSA Store. Accessed Apr. 18, 2025 ⤶

- “Publication 969” (What are the benefits of an HSA?). Internal Revenue Service. Accessed Jan. 21, 2026 ⤶

- “Potential Long-Term Benefits of Investing Your HSA” Charles Schwab. Mar. 12, 2025 ⤶

- “H.R.1 - One Big Beautiful Bill Act” (Section 71307). Congress.gov. Enacted July 4, 2025 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” (State-level public use files, Columns BR and H). Centers for Medicare & Medicaid Services. Accessed July 8, 2025 ⤶

- ”Publication 969, Other Health Coverage” Internal Revenue Service. Accessed Aug. 8, 2025 ⤶

- "HHS Expands Access to Affordable Health Insurance" U.S. Department of Health & Human Services. Sep. 4, 2026 ⤶

- "Policy Changes Bring Renewed Focus on High-Deductible Health Plans" KFF.org. Jan. 5, 2026 ⤶

- “Explaining Health Care Reform: Questions About Health Insurance Subsidies” KFF.org. Oct. 25, 2024 ⤶

- “2025 Marketplace Open Enrollment Period Public Use Files” (State-level public use files, Columns BQ and H). Centers for Medicare & Medicaid Services. Accessed July 8, 2025 ⤶

- “Publication 969, High deductible health plan (HDHP)” Internal Revenue Service. Accessed July 8, 2025 ⤶

- ” H.R.1 - One Big Beautiful Bill Act” (Section 71306) Congress.gov. Enacted July 4, 2025 ⤶

- “Notice 2019-45: Additional Preventive Care Benefits Permitted to be Provided by a High Deductible Health Plan Under § 223” Internal Revenue Service. Accessed July 8, 2025 ⤶

- “Notice 2024-75: Preventive Care for Purposes of Qualifying as a High Deductible Health Plan under Section 223” Internal Revenue Service. Accessed Nov. 19, 2024 ⤶

- “About Publication 969, Health Savings Accounts and Other Tax-Favored Health Plans“ Internal Revenue Service. Accessed May 21, 2024 ⤶

- “Notice 2024-71. Expenses Treated as Amounts Paid for Medical Care“ Internal Revenue Service. Accessed Nov. 20, 2024 ⤶

- “H.R.1 - One Big Beautiful Bill Act” (Section 71308). Congress.gov. Enacted July 4, 2025 ⤶

- “2026 Tax Deductible Limits For Long-Term Care Insurance Increase 3 Percent" American Association for Long Term Care Insurance. Accessed Jan. 21, 2026 ⤶

Explore HSA-qualified high-deductible health plans

Get your free quote now through licensed agency partners!