What is long-term care insurance?

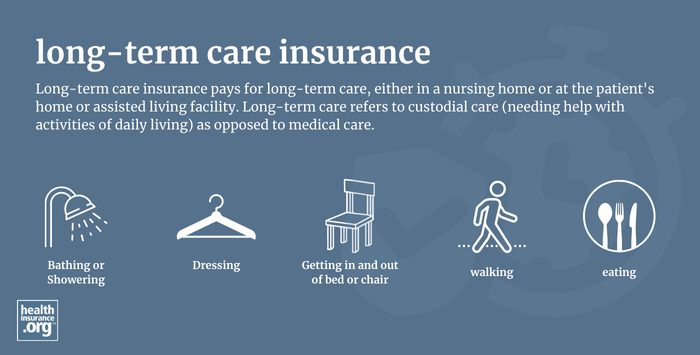

A long-term care insurance pays for long-term care, either in a nursing home or at the patient's home. Long-term care refers to custodial care as opposed to medical care (in other words, the patient may not be sick, but needs help with activities of daily living). Long-term care policies vary significantly in both their premiums and the coverage they provide.

It's important to note that Medicare does not cover most long-term care services. Medicaid does, for people who qualify based on their financial circumstances (generally a combination of low income and very low assets, with some variation by state). But for people with higher incomes or assets, a private long-term care policy is needed in addition to Medicare, if the person wants to avoid having to pay out-of-pocket for long-term care needs.