What is medical underwriting?

Medical underwriting refers to the process of evaluating the risk that an applicant presents, determining whether their insurance application should be approved, and if so, how much the premium should be.1

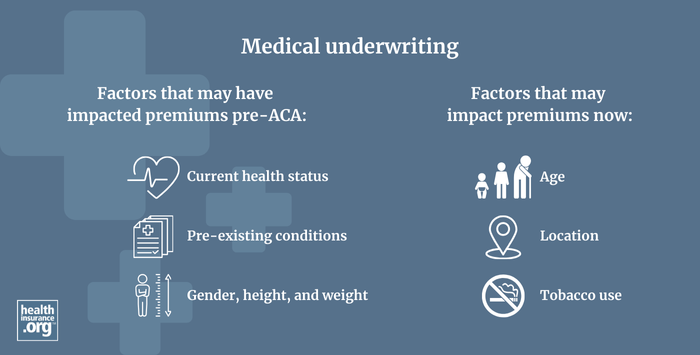

Before the Affordable Care Act (ACA) reformed the individual insurance market, medical underwriting was used to determine applicants' eligibility for individual health insurance in nearly every state. The underwriters would consider factors such as age, height/weight, medical history, and even the person's profession, to determine whether they were an acceptable risk.2 Medical underwriting was also used in many states to determine premiums for small group plans, with the overall medical history of the group factoring into the premiums.

Since 2014, however, medical underwriting is no longer used in the individual or small group markets, due to ACA rules. Instead, all individual and small group plans are guaranteed issue, and premiums only vary based on age, location, and tobacco use.

Is medical underwriting still used?

Yes, some life/health insurance products are still medically underwritten, including most individual life insurance policies, health coverage that isn't subject to the ACA (such as short-term health insurance), and Medigap (Medicare Supplement) plans in most states after a person's initial enrollment window ends. And in the large group market, insurance companies can still consider the group's overall medical history when setting premiums3 (many large employers choose to self-insure rather than purchasing large group coverage from an insurance company).

Footnotes

- "Insurance Underwriters" U.S. Bureau of Labor Statistics. Accessed Oct. 8, 2024 ⤶

- "Pre-Existing Condition Prevalence for Individuals and Families" KFF.org. Oct. 4, 2019 ⤶

- "Consumer Guide to Group Health Insurance" NABIP.org. Feb. 26, 2022 ⤶