What are premium subsidies?

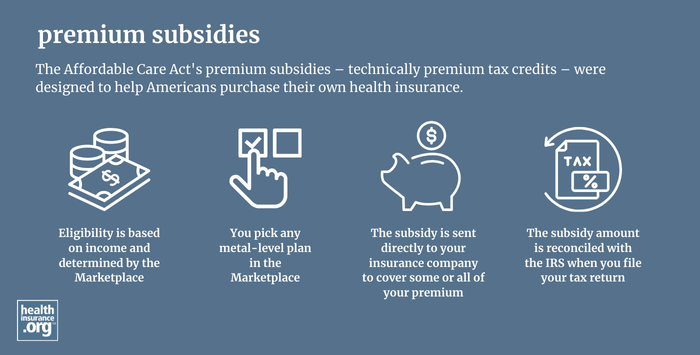

The Affordable Care Act's premium subsidies – technically premium tax credits – were designed to help Americans purchase their own health insurance. They became available as of 2014, and for most people who enroll in coverage through the exchange/Marketplace, the premium subsidies cover the majority of the monthly premiums.1

The ACA premium subsidies are tax credits, but they can be – and typically are – taken upfront, paid directly to your health insurance company each month to offset the amount you have to pay in premiums (as opposed to other tax credits that can only be claimed on a tax return). The premium subsidy is then reconciled on your tax return, to make sure that the correct amount was paid on your behalf.

Some states also offer additional subsidies, on top of the federal subsidies.

How many people receive premium subsidies?

As of early 2025, 93% of all Marketplace enrollees were receiving premium subsidies. The average full-price premium was $619/month at that point, and the average subsidy covered $550 of that.1

Are premium subsidies smaller than they used to be?

In 2026, due to the expiration of the American Rescue Plan's subsidy enhancements, premium subsidies are available to fewer enrollees and don't cover as much enrollees' premiums as they did in 2025. This issue is still under consideration in Congress in early 2026, so it's still subject to change.

Do I qualify for premium subsidies?

To qualify for premium subsidies, you must:2

- Enroll in coverage through the Marketplace. (This requires you to be lawfully present in the United States, not incarcerated, and not enrolled in Medicare.)3

- Earn at least 100% of the federal poverty level (FPL)

- Not be eligible for Medicaid/CHIP

- Not be eligible for premium-free Medicare Part A

- Not be eligible for employer-sponsored coverage that's considered affordable and that provides minimum value

- Not be eligible to be claimed as a dependent on someone else's tax return

- File a tax return, including Form 8962 to reconcile your premium tax credit. If married, you must file jointly with your spouse.

In addition, Marketplace subsidy eligibility (and subsidy amount) depends on your income.

- As noted above, you must earn at least 100% of FPL to qualify for subsidies.

- But Marketplace subsidies also aren't available if you're eligible for Medicaid, and Medicaid eligibility has been expanded in most states to cover adults with income up to 138% of the federal poverty level. So in most states, premium subsidy eligibility starts above that level.

- There is an upper cap of 400% of the federal poverty level. This cap was eliminated by the American Rescue Plan and Inflation Reduction Act from 2021 through 2025, but those provisions expired at the end of 2025. Congress could still make a change to this in early 2026.

The “family glitch" used to prevent some families from accessing affordable health coverage, but IRS rules were finalized to fix the glitch as of 2023. That made some families potentially newly eligible for subsidies in the Marketplace, but not all of them are actually eligible for subsidies.

Can I get premium subsidies with any insurance?

Premium subsidies are available nationwide, but only if you purchase coverage through the exchange/Marketplace. In most states, HealthCare.gov is the exchange, but 21 states and DC run their own exchange platforms. Regardless of where you live, coverage purchased outside the exchange is not subsidy-eligible.

Read more details about eligibility for ACA premium subsidies, and use our subsidy calculator to determine the size of your subsidy.

Footnotes

- “Effectuated Enrollment: Early 2025 Snapshot and Full Year 2024 Average” CMS.gov, July 24, 2025 ⤶ ⤶

- “The Premium Tax Credit – The basics” Internal Revenue Service. Accessed Jan. 7, 2025 ⤶

- “A quick guide to the Health Insurance Marketplace” HealthCare.gov. Accessed Jan. 7, 2026 ⤶