What is a premium tax credit?

A premium tax credit – often referred to as a premium subsidy – is a tax credit that offsets some or all of the amount that policyholders would otherwise have to pay to purchase individual or family health insurance. Premium tax credits are one of many Affordable Care Act provisions designed to make individual market health insurance coverage affordable.

As a result of the American Rescue Plan and Inflation Reduction Act, premium subsidies are larger and more widely available than they normally are, and this will continue to be the case through 2025 (an extension of the subsidy enhancements past 2025 would require Congressional approval; that had not happened as of late August 2025).

Premium subsidies are only available to use with health insurance purchased through the Marketplace/exchange in your state. (In other words, you forfeit the premium tax credit if you shop off-exchange, even if you’d otherwise be eligible to claim it).

How many people receive premium tax credits?

As of early 2025, CMS reported that more than 21.8 million people — 93% of all Marketplace enrollees at that point — were receiving premium tax credits.1

When do I receive the premium tax credit?

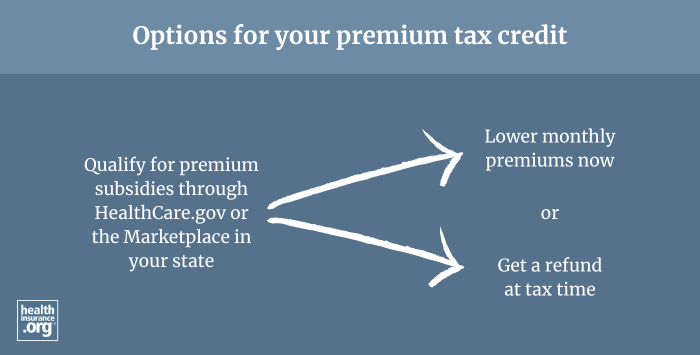

Unlike other tax credits, the premium tax credit can be (and usually is) provided upfront, throughout the year. The IRS sends it to your health insurer each month, so that you don’t have to pay as much yourself. The premium tax credit is then reconciled on the policyholder's tax return the following spring.

Alternatively, policyholders can choose to pay full price for a health plan in their state’s exchange, and then claim the entire premium tax credit on their tax return. However, few people do that, as the cost of coverage without the advance premium tax credit is generally out of reach for those who do end up qualifying for the premium tax credit.

What is an advance premium tax credit?

An advance premium tax credit, or APTC, is the name for a premium tax credit when it is paid in advance each month to an enrollee’s insurance carrier. The alternative is to pay full price for health insurance through the exchange/Marketplace and then claim the premium tax credit from the IRS when you file your taxes.

What factors affect an enrollee's premium tax credit (PTC)?

Premium tax credit eligibility depends on income (an ACA-specific calculation of modified adjusted gross income — MAGI), and how the cost of the benchmark plan (second-lowest-cost Silver plan) in the Marketplace compares with your household's MAGI.

Although the rules are different from 2021 through 2025, premium tax credits are normally only available to people with income between 100% and 400% of the federal poverty level. And the lower bound in most states is actually income above 138% of the federal poverty level, due to Medicaid expansion (if you're eligible for Medicaid, you won't be eligible for a premium tax credit, and most states have expanded Medicaid to cover adults with MAGI up to 138% of the poverty level).

For 2021 through 2025, the income cap (400% of the poverty level) for premium tax credit eligibility does not apply. So depending on the cost of the benchmark plan relative to a household's income, some people can qualify for a premium tax credit even with an income well above 400% of the poverty level. This is due to the American Rescue Plan (ARP), which temporarily changed the rules for ACA subsidy eligibility. These provisions were extended through 2025 by the Inflation Reduction Act (IRA).

Under the ARP and IRA, premium tax credit eligibility for households with MAGI over 400% of the poverty level is based on keeping the cost of the benchmark plan at no more than 8.5% of household income.

So through 2025, there is no specific income limit for subsidy eligibility — instead, it depends on what percentage of your income you'd otherwise have to pay for the benchmark plan. (To be clear, there is still an income above which each applicant will no longer qualify for a premium tax credit. But it's different for each applicant since it depends on how much their coverage will cost relative to their MAGI.)

The cost difference between the benchmark plan and an enrollee’s selected plan determines their monthly premium. In 2025, the full-price premiums for plans purchased via the Marketplaces nationwide averaged $619 a month, but 93% of enrollees received advance premium tax credits that averaged $550 per month.1 For those enrollees, the average tax credit covered the majority of the average premium, although the specifics vary considerably from one person to another and from one area to another.

Because premium tax credits are usually paid in advance, they are reconciled against your actual income when the year is over. This means enrollees who underestimate their income may have to pay back some or all of their subsidy when filing their taxes. Starting with the 2026 plan year, there will no longer be a cap on how much excess APTC will have to be repaid to the IRS. This change is due to the "One Big Beautiful Bill" that was enacted in 2025.

Will being offered employer-sponsored coverage make me ineligible for tax subsidies?

You won’t qualify for premium subsidies if you’re eligible – including as a spouse or dependent – for an employer-sponsored plan that meets comprehensiveness and affordability requirements.

In 2025, an employer-sponsored plan is considered affordable if it costs the employee no more than 9.02% of household income. An affordable employer-sponsored plan will disqualify a taxpayer from receiving a tax subsidy if it also provides minimum value (i.e., it covers at least 60% of an average enrollee’s costs and provides “substantial coverage” for inpatient and outpatient services).

Before 2023, this affordability test was based only on the employee’s coverage costs, and the entire family was ineligible for premium tax credits if the employee's offer of group health insurance was considered affordable (regardless of the cost to add the family members to the group plan). This situation was known as the family glitch.

However, the Biden administration implemented a fix for the family glitch that took effect in 2023. Under the new rules, the cost of the whole family's coverage under the group plan is taken into consideration, and the family members can potentially be eligible for a premium tax credit in the Marketplace if the group plan isn't affordable.

Can I receive a tax subsidy if I'm eligible for Medicaid because of the ACA's Medicaid expansion?

No. As discussed earlier, taxpayers aren't eligible for premium tax credits if they're eligible for Medicaid or CHIP.

Eligibility for premium tax credits begins at 100% of the federal poverty level in states that did not implement the ACA's Medicaid expansion. However, the ACA allowed states to expand Medicaid to adults under 65 with incomes up to 138% of the poverty level.

In the 40 states that have adopted the Medicaid expansion, premium subsidies are available beginning above 138% of the poverty level (in Washington DC, Medicaid eligibility extends much higher, to 215% of the poverty level;2 premium tax credit eligibility starts above that).

Eligibility limits for Medicaid/CHIP are much higher for children, and can be above 300% of the poverty line in some states.3 This means that in many households, adults qualify for premium subsidies and children qualify for Medicaid or CHIP.

How is my eligibility impacted if my state didn’t expand Medicaid?

Your household income must equal at least 100% of the poverty level to qualify for a premium subsidy. Low-income adults who live in states that didn’t expand Medicaid can fall into a Medicaid coverage gap – where they are ineligible for Medicaid because their state hasn't expanded eligibility, but do not earn enough to qualify for premium tax credits.

There is no coverage gap for recent immigrants who are legally present in the U.S., as the ACA allows recent immigrants to access premium subsidies even if their income is below the poverty level. This is because they aren't eligible for Medicaid until they've been in the U.S. for five years, and Congress didn't want them to fall into a coverage gap, so these provisions were written into the ACA (but lawmakers had no way of knowing that the Supreme Court would make Medicaid expansion optional, which is why the Medicaid expansion coverage gap exists). However, the "One Big Beautiful Bill" removes that provision starting in 2026. At that point, recent immigrants will no longer qualify for premium subsidies if their household income is below the federal poverty level.

How did the elimination of federal funding for cost-sharing reductions affect premium tax credits?

In late 2017, the federal government stopped reimbursing insurers for providing cost-sharing reductions (CSRs) – which lower co-pays, deductibles, and other out-of-pocket expenses in silver plans. (American Indians and Alaskan Natives receive CSRs on any Marketplace plan.)

Silver plan enrollees with incomes up to 250% of the poverty line are legally entitled to CSRs regardless of whether the government reimburses insurers for providing them. As a result, insurers in most states began incorporating the costs of providing CSRs into all silver plans. This practice is called “Silver loading,” and it increases the premium subsidies available to all enrollees.

Indiana and Mississippi still require insurers to incorporate costs from CSRs using a different method – called “broad loading” – which does not significantly increase premium subsidies for enrollees in those states.

Footnotes

- ”Effectuated Enrollment: Early 2025 Snapshot and Full Year 2024 Average” Centers for Medicare and Medicaid Services. Published July 24, 2025 ⤶ ⤶

- "Adults without Dependent Children (Childless Adults)" DC Department of Health Care Finance. Accessed Aug. 27, 2025 ⤶

- ”Medicaid, Children's Health Insurance Program, & Basic Health Program Eligibility Levels” Centers for Medicare and Medicaid Services. December 2023. ⤶