What is reinsurance?

Reinsurance is essentially insurance for insurance companies. Just like individuals count on their insurance company to cover a portion of their medical bills if and when they have a claim, reinsurance programs pay a portion of the insurer's bills when enrollees have high-cost claims. Although reinsurance can be used in any insurance market, the programs we're discussing here are focused on the individual/family health insurance market.

Does reinsurance help lower costs for health insurance plan buyers?

Because reinsurance covers part of the cost of expensive claims, insurers don't have to pay as much. That results in lower total premiums and increased enrollment – but mostly among people who pay full price.

However, reinsurance can sometimes result in higher net (after-subsidy) premiums for enrollees who get premium subsidies. This is because the reinsurance program results in lower premiums, which in turn results in lower premium subsidies. Depending on the actual reduction in the person's premium as well as their premium subsidy, net premiums might be higher with reinsurance.1

About 93% of all Marketplace enrollees were receiving premium subsidies in early 2025.2 For the other 7% of Marketplace enrollees, as well as people who purchase off-exchange coverage, reinsurance helps to keep premiums lower than they would otherwise be.

The American Rescue Plan (ARP) and the Inflation Reduction Act (IRA) have diminished the need for reinsurance programs, at least through the end of 2025. That's because the ARP/IRA have eliminated the ACA's "subsidy cliff" from 2021 through 2025, ensuring that people with income above 400% of the poverty level can qualify for premium subsidies if the second-lowest-cost Silver plan would otherwise be more than 8.5% of their household income.

If that provision is extended again by Congress, reinsurance programs would not be as important going forward. But if it isn't, reinsurance will regain its importance in 2026 as a means of keeping coverage more affordable for households that earn more than 400% of the poverty level (as of early August 2025, Congress had taken no action to extend the subsidy enhancements; legislation introduced to that effect in early 2025 had not advanced).3

Reinsurance programs are sometimes referred to as "invisible high-risk pools" because the reinsurance program is covering a portion of the claims for people with expensive medical needs, but the enrollees are still covered under their regular health insurance plan, and are not interacting with the reinsurance program at all. There are other types of coverage that are also referred to as invisible high-risk pools, but some are not using a reinsurance approach. In other words, not all "invisible high-risk pools" are reinsurance programs.

Why did states create their own reinsurance programs?

The ACA included a temporary reinsurance program for the individual insurance market; it existed nationwide from 2014 through 2016. Eighteen states have since received federal approval to create their own reinsurance programs (see list below). Other states may follow suit in the future, using 1332 waivers to fund reinsurance with the federal money that would have otherwise been spent on premium subsidies.

1332 waivers for reinsurance are approved for five years at a time. So some of the early adopter states have already requested and received their first extension, granting another five years of federal approval.4

Reinsurance reduces premiums, and subsidies are based on the cost of the benchmark plan premium. So the amount the federal government spends on premium subsidies is reduced when a state implements a reinsurance program. By using a 1332 waiver, the state can recapture and use that money, instead of letting the federal government keep it.

The result is fairly minimal state spending and unchanged federal spending, but lower full-price premiums that result in more people being able to afford coverage.

How might different states approach reinsurance programs for their individual markets?

States have some flexibility in terms of how their reinsurance programs are designed and how much of an impact they have on premiums and enrollment. The most common approach is to cover a certain percentage of claims costs that are between two pre-determined amounts. For example, a state might say that the reinsurance program will cover 75% of claims that fall between $50,000 and $500,000.

In that case, insurers start to receive funding from the reinsurance program if and when a member's claims exceed $50,000, and the program continues to reimburse the insurer 75% of that member's approved claims expenses until if and when they hit $500,000. (After that point, the insurer would be responsible for the full amount for the rest of the year.)

States using this approach have implemented varying dollar ranges for the reinsurance program, and cover varying percentages of the costs while claims are in the applicable range. States can also design their reinsurance programs so that they cover a larger percentage of claims in high-cost areas. (Colorado's is an example of this, and so is Georgia's program.)

Reinsurance programs can also be based on specific diagnoses (Alaska's is an example of this), with claims for members with certain high-cost medical conditions covered by the reinsurance program. Maine also used this model in prior years, but switched to the retrospective model (ie, based on claims costs rather than specific medical conditions) as of 2022.

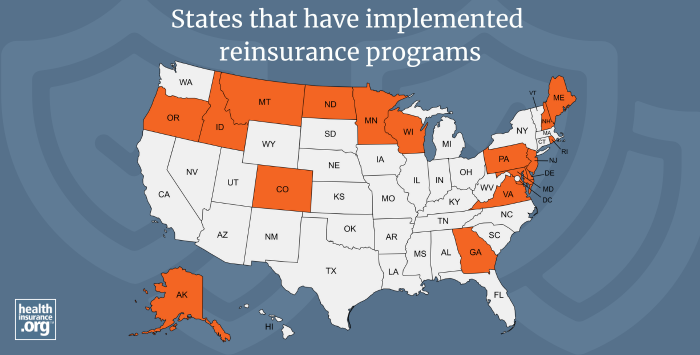

Which states have created reinsurance programs for their individual markets?

The following states have created reinsurance programs, relying in large part on federal pass-through funding secured via 1332 waivers:

- Alaska's reinsurance program took effect in 2018. Rates began to decrease at that point, and by 2022, average unsubsidized premiums in Alaska's individual market were more than 38% lower than they would have been without the reinsurance program.5

- Minnesota's reinsurance program took effect in 2018. Rates decreased in 2018, 2019, and 2020, but increased for 2021. The program had only been slated to run through 2021, but was extended (albeit with less robust coverage) for 2022. Rates increased in 2022, due in part to the less generous coverage provided by the reinsurance program. The state reverted to the previous reinsurance parameters starting in 2023.6 Legislation under consideration in 2025 would end the reinsurance program in Minnesota and replace it with a state-funded 20% premium subsidy for people who don't receive federal premium tax credits.7

- Oregon's reinsurance program took effect in 2018. Rates have generally increased since then, although the 2020, 2021, and 2022 increases were minimal.

- Wisconsin's reinsurance program took effect in 2019. Rates decreased in 2019, 2020, 2021, and 2022.

- Maine's reinsurance program (MGARA) took effect in 2019. Rates decreased slightly in 2019 and 2020, sharply in 2021, and slightly in 2022. Maine expanded its reinsurance program as of 2023, to include the small group market.8 MGARA's payment rate was updated from 55% to 75% for 2025 due to larger-than-expected federal pass-through funding the state received in 2024,9 which allowed the state to ultimately approve rates for 2025 than were lower, on average, than the insurers had initially proposed.10

- Maryland's reinsurance program took effect in 2019. Rates decreased in 2019, 2020, and again in 2021, although they increased slightly for 2022.

- New Jersey's reinsurance program took effect in 2019. Rates decreased in 2019, but increased in 2020, 2021, and 2022.

- North Dakota's reinsurance program took effect in 2020. Rates decreased in 2020, and stayed relatively flat for 2021 and 2022 (the state enacted legislation in 2021 that directs the insurance department to conduct a study on the impact of combining the individual and small group markets for reinsurance).

- Montana's reinsurance program took effect in 2020. Rates decreased in 2020, increased slightly in 2021, and stayed mostly flat for 2022.

- Delaware's reinsurance program took effect in 2020. Rates decreased sharply in 2020, decreased again in 2021, and increased modestly in 2022.

- Colorado's reinsurance program took effect in 2020. Rates decreased sharply in 2020 and increased slightly in 2021 and 2022.

- Rhode Island's reinsurance program took effect in 2020. Rates decreased slightly in 2020 but increased in 2021 and 2022.

- Pennsylvania's reinsurance program took effect in 2021. Rates decreased for 2021 and stayed mostly flat for 2022.

- New Hampshire's reinsurance program took effect in 2021. Rates decreased for 2021, but increased slightly for 2022.

- Georgia's reinsurance program took effect in 2022. Rates decreased modestly for 2022.

- Virginia's reinsurance program took effect in 2023. Rates decreased significantly for 2023. Funding for 2024 was not secured until late summer of 2023. Once it was eventually secured, it kept premiums for 2024 fairly flat, whereas insurers had initially proposed average rate increases of 28% without the reinsurance program.

- Idaho's reinsurance program took effect in 2023. Rates decreased modestly for 2023.

- Nevada's reinsurance program takes effect in 2026.11 Insurers have proposed an overall average rate increase of 17.5%.12 But rates are increasing sharply nationwide for 2026, due to factors including the impending expiration of subsidy enhancements and the Marketplace rule changes that will reduce enrollment.13

It's noteworthy that Idaho and Virginia, both of which implemented reinsurance programs in 2023, are the only states where overall average premiums decreased for 2023. Reinsurance was the driving factor for the rate decreases in both states.

Lawmakers in Connecticut have repeatedly considered reinsurance legislation, but none of the bills have ever passed (the latest Connecticut reinsurance legislation is SB188, which did not advance in 2025).14

Legislation to create a reinsurance program in Michigan passed the Senate in June 2024 but did not advance in the House.15 Legislation to create a reinsurance program was also introduced in Texas in 2023, but did not advance. Kansas lawmakers have also considered reinsurance, but have not approved legislation to implement it.

Footnotes

- "Programs intended to reduce health insurance premiums may make coverage less affordable for the middle class" University of Pittsburg School of Public Health. Accessed Sep. 9, 2024 ⤶

- "Effectuated Enrollment: Early 2025 Snapshot and Full Year 2024 Average" CMS.gov, July 24, 2025 ⤶

- "S.46 - Health Care Affordability Act of 2025" and "H.R.247 - Health Care Affordability Act of 2025" Congress.gov. Introduced January 2025 ⤶

- Section 1332: State Innovation Waivers. Centers for Medicare and Medicaid Services. Accessed Aug. 2, 2025 ⤶

- Alaska Section 1332 Waiver Extension Application. State of Alaska, Division of Insurance. March 2022. ⤶

- 2023 Health Insurance Rates. Minnesota Commerce Department. Accessed November 2023. ⤶

- "Minnesota HF2506" BillTrack50. In committee Mar. 17, 2025 ⤶

- Maine: State Innovation Waiver - Amendment. Centers for Medicare and Medicaid Services. July 15, 2022. ⤶

- "Maine Guaranteed Access Reinsurance Association, Minutes of the Board of Directors" MGARA. June 17, 2024 ⤶

- "Maine Bureau of Insurance Approves 2025 Health Insurance Rates for Individuals and Small Groups" Maine Bureau of Insurance. Aug. 26, 2024 ⤶

- "Nevada: State Innovation Waiver under Section 1332 of the ACA" Centers for Medicare & Medicaid Services. Jan. 10, 2025 ⤶

- "July 31, 2025 - Nevadans Get a Preview of 2026 Proposed Health Insurance Rate Changes for Upcoming Open Enrollment" Nevada Division of Insurance. July 31, 2025 ⤶

- "Individual Market Insurers Requesting Largest Premium Increases in More Than 5 Years" KFF.org. July 18, 2025 ⤶

- "Connecticut SB188" BillTrack50. Legislation died June 4, 2025 ⤶

- "Michigan SB637" BillTrack50. Accessed Aug. 27, 2024. ⤶