What are metal plans?

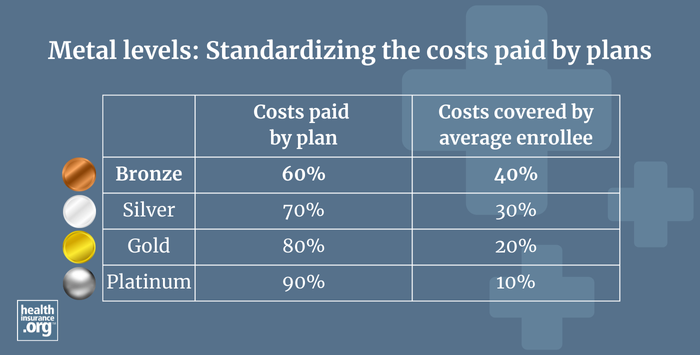

Under the Affordable Care Act (ACA), all individual and small-group health plans with effective dates of 2014 or later must fit into one of four metal plan levels (in the individual market, catastrophic plans are also allowed), based on their actuarial value – the percentage of medical costs the plan will pay across a standard population, not on a per-enrollee basis; this is explained in more detail below. All individual and small group plans must cover all of the ACA's essential health benefits, regardless of their metal level.

What is a Bronze plan?

Bronze plans pay roughly 60% of medical costs across a standard population, (again, not on a per-enrollee basis) with the enrollees paying the other 40%. The actuarial value of a Bronze plan must be between 58% and 62%, although Expanded Bronze plans can have actuarial value as high as 65%.1

Bronze plans tend to have the lowest monthly premiums, but also the highest overall out-of-pocket costs. Most Bronze plans have out-of-pocket caps at or very near the maximum amounts allowed under federal rules.

During the open enrollment period for 2024 coverage, 6.7 million Marketplace enrollees selected Bronze plans.2

What is a Silver plan?

Silver plans pay roughly 70% of medical costs across a standard population, with the enrollees paying the other 30%. But most Marketplace enrollees who buy Silver plans are receiving cost-sharing reductions (CSR), which make their coverage more robust. In 2024, out of 11.7 million Silver plan enrollees, 10.6 million were receiving CSR benefits.2 In other words, only a small segment of Marketplace enrollees are in Silver-level plans with 70% actuarial value.

CSR variations of Silver plans are commonly referred to as CSR73, CSR87, and CSR94. The numbers represent the actuarial value of the plans, so a CSR73 plan will have an actuarial value of about 73% – a little better than a regular Silver plan. But a CSR94 plan will have an actuarial value of about 94%, which makes it better than a Platinum plan. Due in large part to CSR benefits, Silver plans are by far the most common choice, accounting for more than half of all Marketplace enrollees.2

Cost-sharing reductions are only available on Silver plans, and are automatically incorporated into all available Silver plans in the Marketplace when the enrollee's income is CSR-eligible3 (between 100% and 250% of the federal poverty level in states that haven't expanded Medicaid, and between 139% and 250% of the federal poverty level in states that have expanded Medicaid).

Non-CSR Silver plans in the individual market must have an actuarial value between 70% and 72%. But if the plan has built-in CSR benefits, the allowable de minimus range is only +1/0. So for example, that means a CSR94 plan must have an actuarial value between 94% and 95%.

In the small group market, Silver plans can have an actuarial value between 68% and 72% (there are no CSR benefits in the small group market).

What is a Gold plan?

Gold plans pay roughly 80% of medical costs across a standard population, with the enrollees paying the other 20%. The actuarial value of a Gold plan must be between 78% and 82%.

Gold plans historically tended to have higher premiums than Silver plans, but that isn't always the case anymore. This has to do with how insurers have handled the loss of federal funding for cost-sharing reductions (CSR), and is explained in more detail below.

During the open enrollment period for 2024 coverage, 2.9 million Marketplace enrollees selected Gold plans.2

What is a Platinum plan?

Platinum plans pay roughly 90% of medical costs across a standard population, with the enrollees paying the other 10%. These tend to be the most expensive plans, with the lowest out-of-pocket costs. But as noted above, Silver plans with the most robust CSR benefits have lower overall out-of-pocket costs than a Platinum plan.

The actuarial value of a Platinum plan must be between 88% and 92%.

Platinum plans are not available in most areas in the individual market, and are not commonly selected by enrollees. During the open enrollment period for 2024 coverage, fewer than 127,000 enrollees in 17 states selected Platinum plans, out of more than 21.4 million enrollees nationwide. 2

How is actuarial value is calculated?

The actuarial value amounts described above are calculated across an entire standard population of enrollees. For an individual person, the percentage of costs covered by the plan in a given year will depend on how much health care the person needs.

A person with significant claims may pay only a tiny fraction of the total costs, whereas a person who only has a few doctor visits in the year may pay all or most of the costs, depending on the plan structure. And a person who is healthy enough to only need preventive care during the year might end up with 100% of their health care costs covered by the plan, regardless of what metal level they have, since specific preventive care is covered with no out-of-pocket costs regardless of the metal level.4)

Do out-of-pocket limits apply to all plans?

The metal designations apply to plans both in and out of the exchanges. Regardless of the metal level, non-grandfathered, non-grandmothered private plans regulated by the ACA cannot have out-of-pocket maximums that exceed $9,450 for an individual and $18,900 for a family in 2024 (those limits drop to $9,200 and $18,400, respectively, in 20255).

Plans can have lower out-of-pocket limits, and it's common to see that on Gold and Platinum plans. Silver plans with built-in cost-sharing reductions will also have lower out-of-pocket limits, as that's one of the key aspects of how cost-sharing reductions work.

Cost-sharing reductions are designed to increase the actuarial value of a Silver plan, in some cases making it better than a Platinum plan. If your income is modest (no more than 250% of the federal poverty level, but especially if it's no more than 200% of the federal poverty level) and you're shopping in the health insurance Marketplace/exchange, it's highly recommended that you carefully consider the available Silver plans. You might find that they provide better coverage than the Gold or even Platinum plans.

Do premiums increase with each increasing metal level?

In the first few years of ACA implementation, plan pricing and out-of-pocket costs were fairly intuitive: In general, the higher a plan's metal level, the higher its premiums would be, and the lower its out-of-pocket costs would be.

But that changed starting in the fall of 2017, when the federal government stopped reimbursing insurers for the cost of cost-sharing reductions (CSR). To address this, insurers in most states started adding the cost of CSR to Silver plan premiums. Some states now mandate that insurers add a certain percentage to all Silver plans to account for the cost of CSR, while other states leave the details up to each insurer. But the general result has been higher premiums for Silver plans relative to the other metal levels.

So in many areas, it's now common to see a significant number of Gold plans priced lower than a significant number of Silver plans. If a person is eligible for CSR, the Silver plan might still provide more robust benefits. But if they're not eligible for CSR, they might find that they can enroll in a Gold plan (with actuarial value of roughly 80%) that has a lower premium than the available Silver plans (which have actuarial values of roughly 70%).

The takeaway point is that comparison shopping can be a bit counter-intuitive, as you might see more robust plans with lower premiums. So it's important to compare the plan details as well as the premium, and select the plan that provides the best overall value.

Both on-exchange and off-exchange, metal-level plans are available for purchase during the annual open enrollment period for the individual market, which runs from November 1 to January 15 in most states. In the small group market, employers can set their own open enrollment windows for their employees, although employers can purchase a plan for their business at any point during the year.

Footnotes

- "Final 2025 Actuarial Value Calculator Methodology" CMS.gov. April 2, 2024 ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶ ⤶ ⤶ ⤶ ⤶

- ”APTC and CSR Basics” Centers for Medicare & Medicaid Services. June 2024. ⤶

- Health benefits & coverage. Healthcare.gov. Accessed October 9, 2024. ⤶

- Premium Adjustment Percentage, Maximum Annual Limitation on Cost Sharing, Reduced Maximum Annual Limitation on Cost Sharing, and Required Contribution Percentage for the 2025 Benefit Year. Centers for Medicare and Medicaid Services. November 15, 2023. ⤶