Guide to special enrollment periods

Depending on your circumstances, you may be able to enroll in an ACA-compliant plan outside of the annual open enrollment period.

Not everyone who’s eligible to enroll in ACA-compliant health insurance bought coverage during the most recent open enrollment period.1 Some people may have missed the annual enrollment deadline. Others may have decided that coverage was too expensive – perhaps unaware that they were eligible for premium subsidies if they enrolled on the Marketplace. Others may have felt they didn’t have enough information to make a decision.

But depending on the circumstances, many people can still enroll in ACA-compliant health coverage – even after the annual open enrollment period has ended – during a special enrollment period. There’s a lengthy list of qualifying life events that make consumers eligible for special enrollment, and this guide will walk you through all the qualifying life events and the specific rules for how they trigger special enrollment periods.

What is a special enrollment period?

Normally, ACA-compliant coverage is only available for purchase during the annual open enrollment period, but a special enrollment period allows people to sign up for coverage outside of that annual window. In most cases, this requires a qualifying life event.

In many cases, a special enrollment period is only available if an applicant already had minimum essential coverage prior to the qualifying life event. Other restrictions prevent people from using special enrollment periods (SEPs) to upgrade to better coverage during the year, though some of those restrictions have been relaxed in recent years.

During most SEPs, an individual (and dependents) can enroll in any health plan available in their Marketplace / exchange, although some SEPs limit current enrollees to a replacement plan at the same metal level as their current coverage. Most of the SEPs also apply to health plans available outside the exchange, giving people an option to pick off-exchange coverage if that’s their preference.

Have a qualifying life event?

See what kind of ACA compliant coverage is available outside of open enrollment. Compare health plans and check available subsidy savings with the help of a licensed agent.

How long are special enrollment periods?

Most of the qualifying life events trigger a special enrollment period that begins on the date of the qualifying life event and continues for 60 days (or 90 days in most states if the qualifying event is the loss of Medicaid2).

However, in the case of involuntary loss of coverage, the non-calendar-year renewal of an existing health plan, or advance notice of an ICHRA or QSEHRA offer from your employer, the special enrollment period begins 60 days before the qualifying event, allowing for seamless coverage.

In most cases, the earliest that coverage can take effect is the first of the month after the enrollment is completed, although retroactive coverage is available in the case of a new baby or newly adopted child.

Qualifying life events that trigger special enrollment

-

Involuntary loss of coverage that meets the definition of minimum essential coverage

-

A permanent move to a place where different health insurance plans are available

-

Divorce, death, or legal separation that results in the loss of coverage

-

A change in eligibility for ACA premium subsidies or cost-sharing reductions

-

A change in citizenship or lawful immigrant status

-

Your employer-sponsored health insurance is unaffordable or stops providing minimum value

-

Non-calendar renewal of your health plan

-

A change in household income that causes the applicant to leave the Medicaid coverage gap

-

A change in your household due to marriage, birth, adoption or foster care

-

Exceptional circumstances, including natural disasters

-

You’ve been offered a health reimbursement arrangement through your employer

-

Your income doesn’t exceed 150% of the federal poverty level

I think I qualify for special enrollment. Now what?

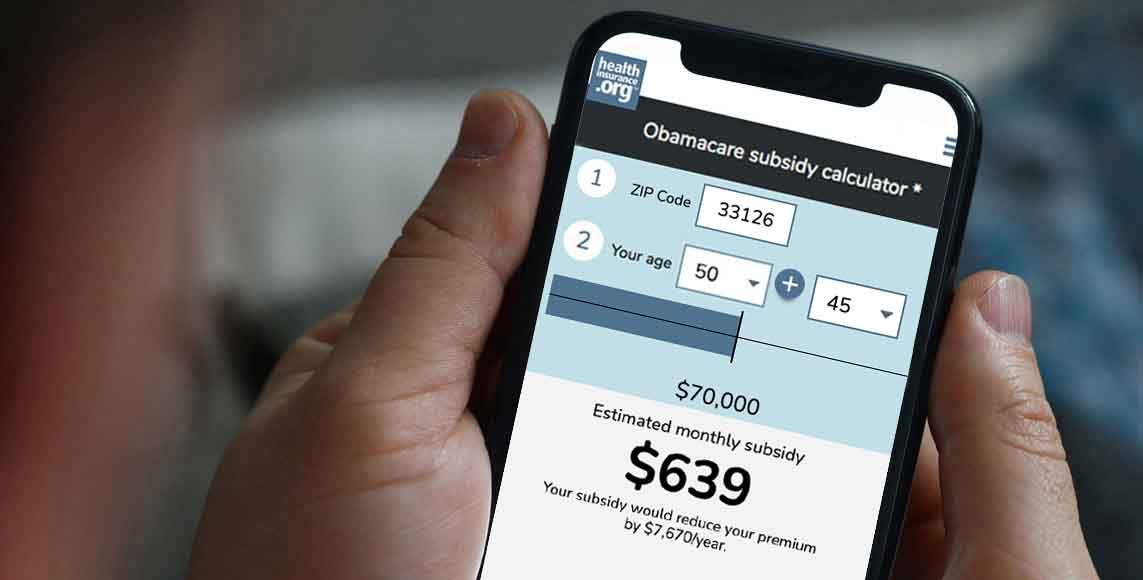

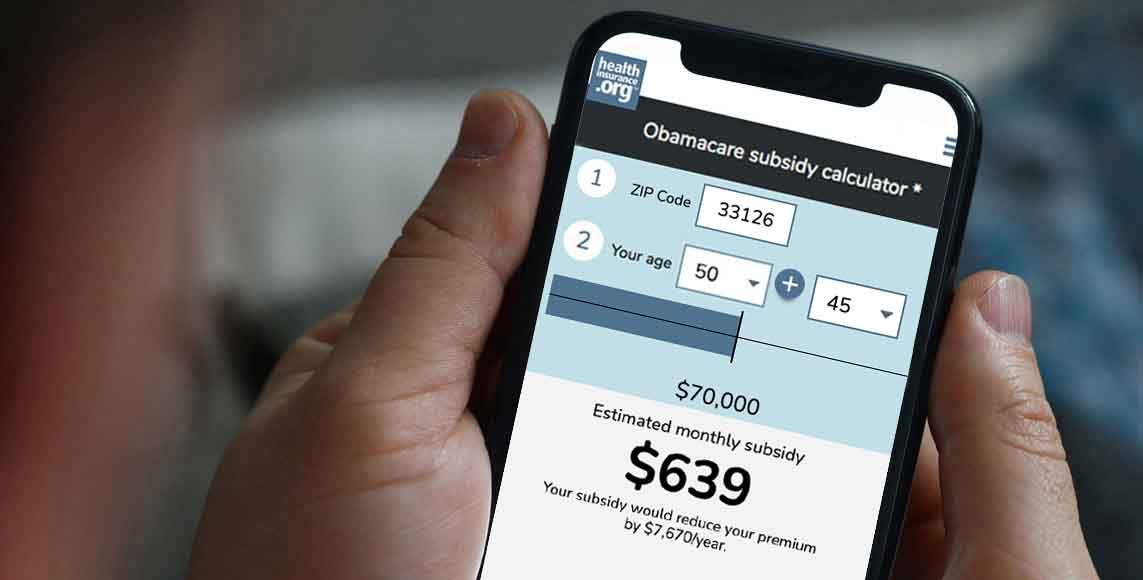

Use our updated calculator to see if you’re eligible for Affordable Care Act (ACA) health insurance premium subsidies.

Qualifying events and SEPs aren’t always necessary. Enrollment continues year-round in some cases, and you don’t need a qualifying event if you’re eligible for certain health plans.

When it comes to selecting a health insurance plan, the premium is the most important factor for many shoppers – especially those who are currently healthy. But price shouldn’t be the only factor upon which you base your selection, even if your primary concern is financial.

Starting in 2023, HealthCare.gov scaled back eligibility verification protocols for special enrollment periods, although proof of the qualifying event is still necessary for a loss of coverage SEP. State-run exchanges can continue to require proof of any qualifying events.

Frequently asked questions about special enrollment periods and qualifying life events

Footnotes

- “Key Facts about the Uninsured Population” KFF.org, December 2023 ⤶

- ”Are there special timelines for enrolling in the Marketplace for people who lose Medicaid or CHIP?” KFF.org. Accessed Jan. 29, 2025 ⤶