What are subsidies?

Subsidies for individual health insurance were included in the Affordable Care Act (ACA) to help ensure that coverage and care would be affordable. Subsidies are only available if you shop in the Marketplace/exchange in your state. There are no subsidies available off-exchange. There are two types of ACA subsidies:

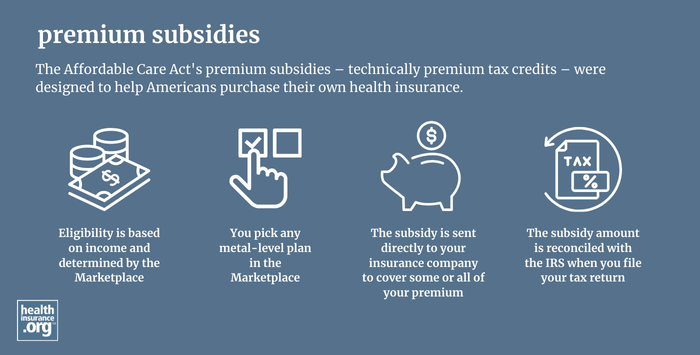

Premium tax credits, also known as premium subsidies are provided based on a Marketplace enrollee’s household income relative to the cost of the benchmark (second-lowest-cost) Silver plan.

- Premium subsidies can be applied to any metal-level plan.

- As of early 2025, 93% of Marketplace enrollees were receiving premium subsidies, and the average after-subsidy premium was about $106/month.1

- Under ACA rules, premium subsidies are only available if household income doesn’t exceed 400% of the federal poverty level (FPL). This limit was removed from 2021 through 2025 by the American Rescue Plan (ARP) and Inflation Reduction Act (IRA). But it returned for 2026 due to the expiration of the subsidy enhancements, meaning the “subsidy cliff” is once again in place as of 2026. (This could still change in 2026, but it would take an act of Congress to reinstate the APR subsidy enhancements.)

Cost-sharing reductions, also known as cost-sharing subsidies, help eligible Marketplace enrollees reduce their out-of-pocket costs for healthcare.

- Cost-sharing subsidies are available to enrollees with household income up to 250% of FPL, although the most robust benefits are provided to those whose household income doesn’t exceed 200% of FPL.

- Cost-sharing subsidies are only available on Silver plans, and are automatically incorporated into all available Silver plans if an enrollee is eligible for these subsidies.

- As of early 2025, more than half of all Marketplace enrollees were receiving cost-sharing subsidies.1

Some states provide additional premium subsidies and/or cost-sharing subsidies, on top of the ACA’s federal subsidies.

Footnotes

- “Effectuated Enrollment: Early 2025 Snapshot and Full Year 2024 Average” CMS.gov, July 24, 2025 ⤶ ⤶

See if you are eligible for an ACA premium subsidy

Most Marketplace enrollees are eligible for subsidies.