Guide to self-employed health insurance

Learn about health insurance for freelancers, gig workers and solo entrepreneurs. Explore your options, costs, tax benefits and more.

Three ways to get self-employed health insurance

Whether you’re a freelance writer, Uber driver, DoorDasher, independent contractor, consultant or otherwise self-employed, you will likely need to purchase your own health insurance – unless you’re covered by a spouse or a parent (if you’re under 26). Your options for comprehensive coverage include enrolling in an ACA Marketplace plan, COBRA, or Medicaid (if you’re eligible).

Click below for a snapshot of each:

Health insurance coverage options for the self-employed

If you’ve left a job and as a result, you’ve lost your health insurance benefits, you’re likely eligible for a special enrollment period in the individual market.

If you worked for an employer group of 20 or more employees, federal legislation called the Consolidated Omnibus Budget Reconciliation Act (COBRA) allows you to continue to purchase your group health insurance coverage for up to 18 months if you lose your job or your employer-sponsored coverage otherwise ends.

If you live in one of the 40 states that have implemented the ACA’s Medicaid expansion and you earn up to 138% of the federal poverty level, you may be eligible for Medicaid. You can use the calculator on this page to determine your eligibility for Medicaid.

Find affordable health insurance coverage that best suits your needs.

Get a quote through a licensed insurance agent!

How do I know which health insurance is the best fit for my freelance lifestyle and budget?

There are several factors to consider when comparing plans, including whether you’re temporarily self-employed, between jobs, or freelancing for the foreseeable future.

Take a closer look at your options:

The ACA Marketplace

If you’re self-employed, you should know that the Affordable Care Act (ACA) opened up new self-employed health insurance opportunities. Here are the key points to know:

- Essential health benefits: All ACA-compliant individual/family plans cover the ACA’s 10 essential health benefits (EHBs), ensuring comprehensive coverage.

- Subsidies available: You can get income-based premium tax credits (subsidies) to lower your monthly premiums if you’re eligible and enroll through the ACA Marketplace in your state.

- No medical underwriting: Your medical history won’t affect your eligibility, coverage, or premiums.

- Enrollment periods: You can sign up during the annual open enrollment (Nov. 1 through Jan. 15 in most states) or during a special enrollment period triggered by qualifying life events, such as losing employer-based coverage when you quit your job to become self-employed.

Read our guide to special enrollment periods.

Coverage under your spouse’s plan

If your spouse’s employer offers health insurance, you are likely eligible to be covered under that plan since almost all employer-sponsored plans offer spousal coverage.1 This option may provide a way to get coverage. Here’s what else you should know:

- Enrollment periods: You can enroll during your spouse’s employer’s open enrollment period (set by the employer) or a special enrollment period triggered by a qualifying life event. (Rules for these are specific to employer-sponsored coverage.)2

- Special enrollment timing: If you lose coverage from your own employer, you have 30 days to join your spouse’s plan through a special enrollment period – half the time allowed for individual-market plans.3

COBRA

If you’re leaving a job where you’ve had group health insurance and the plan is subject to COBRA, you can extend your group coverage for up to 18 or 36 months, depending on the circumstances. COBRA coverage cannot continue indefinitely. But it can be a good temporary solution if you’re just testing the self-employment waters, or if you plan to transition to another type of coverage later on.

Financial factors to consider:

- Continuation of benefits: If you’ve already paid some out-of-pocket medical costs (deductibles, copays, etc.) for the year, electing COBRA will continue your existing coverage (including any amounts paid toward your deductible and out of pocket maximum) and prevent those costs being reset to $0 under a new plan.

- Higher costs: You’ll pay the full premium, which includes both your share and the portion your employer used to cover, plus a 2% administrative fee.4 This can result in a significant cost increase. (Some employers may offer COBRA subsidies as part of a severance package.)

Read: Deciding between COBRA and a Marketplace policy

Medicaid

Low-income freelancers might qualify for Medicaid, a joint federal and state program that provides access to free or low-cost health coverage for children and adults.

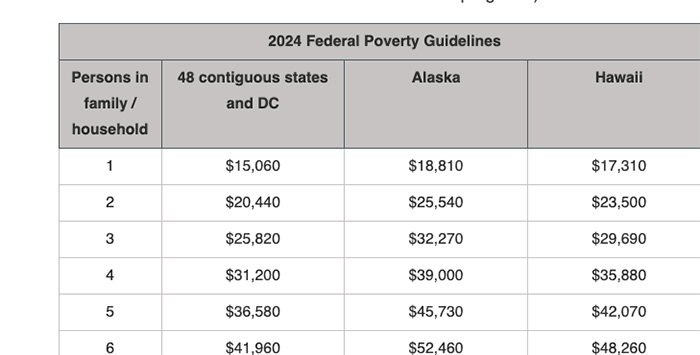

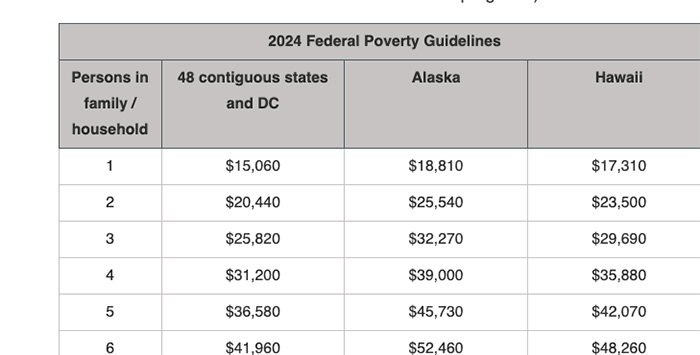

Most states have expanded Medicaid under the ACA, 5 making coverage available to adults under age 65 with household income up to 138% of the federal poverty level (coverage under Medicaid/CHIP for children extends to higher income levels in every state).6

Here’s what to know:

- Eligibility: In most states, adults under 65 with household income up to 138% of the federal poverty level can qualify for Medicaid. In 2024, that’s $20,782 for a single adult and $43,056 for a household of four (higher in Alaska and Hawaii).7 Coverage for children extends to higher income levels in every state, either under Medicaid or CHIP.6

- Enrollment: If you’re eligible for Medicaid, you can apply anytime.

- Flexibility: Medicaid can serve as a temporary or long-term solution, depending on changes in your income. If your income increases in the future to a level that makes you ineligible for Medicaid, the loss of Medicaid will trigger a special enrollment period that will allow you to enroll in a private individual/family plan.

Estate recovery: If you’re 55 or older, be aware of your state’s Medicaid estate recovery rules, as this could impact how your estate is handled after you die. Some states recoup all costs that were incurred by Medicaid, while others limit it to only long-term care costs.

Health insurance through trade organizations

Depending on the type of work you do and where you live, you may find professional associations or membership organizations that will offer you access to health benefits or help to arrange your enrollment in a health insurance plan. But it’s important to pay close attention to the details of the coverage.

Keep in mind:

- Types of coverage: Some associations help members enroll in ACA Marketplace plans, while others may offer non-ACA-compliant options like short-term insurance or fixed indemnity plans. Associations may also provide access to discount medical programs, which are not health insurance.

- ACA protections: Ensure you understand the coverage details and whether the plan offers ACA consumer protections like essential health benefits or if premium subsidies are available.

Short-term health insurance

Short-term health insurance is not a substitute for ACA-compliant major medical health coverage and is not an adequate self-employed health insurance solution. But if you need to bridge a short gap between other policies, here’s what to know:

- Limited duration: Starting in September 2024, short-term health insurance is limited to initial duration of three months, and total duration of four months, including any renewals.

- Coverage limitations: These plans often have caps on benefits, do not cover essential health benefits (EHBs), and usually exclude coverage for pre-existing conditions.

- Use case: They can be used for bridging gaps if you missed ACA open enrollment, and don’t qualify for a special enrollment period, or need temporary coverage before your next enrollment period.

How to boost your protection

After selecting a primary health insurance plan, think about whether supplemental coverage might offer additional coverage for medical expenses that your primary health insurance plan might not cover.

If you have an active lifestyle, vision or dental needs, or a family history of critical illness, supplemental insurance can help protect your finances – especially in case of an unexpected medical emergency.

Accident insurance

Accident insurance is a type of supplemental insurance that pays cash benefits to the policyholder, up to a predetermined limit, if the policy holder experiences an accidental injury that’s covered by the plan.

Critical illness insurance

Critical illness insurance is a type of supplemental insurance that pays cash benefits to a policyholder if they’re diagnosed with a medical condition that’s covered by the policy. The benefit amount will vary depending on the covered illness and the policy specifics.

Cancer insurance

Cancer insurance is supplemental insurance that pays cash benefits for cancer diagnoses and treatments, out-of-pocket expenses and other related expenses.

Vision insurance

Vision insurance is designed to pay some of the costs that a policyholder would otherwise have to pay out-of-pocket for routine vision care, including optometry exams, glasses, and contact lenses.

Travel insurance

Travel insurance can help protect from unexpected costs during a trip, including not only medical expenses but costs related to trip cancellation or delays, lost luggage and rental car damage.

Frequently asked questions about health insurance for freelancers

How much is health insurance for self-employed people?

The cost of medical insurance if you’re self-employed will depend on the type of coverage you obtain.

- If you’re eligible for Medicaid, there’s a good chance you won’t pay any premiums at all. (Some states have modest Medicaid premiums for some enrollees.)

- If you enroll in your spouse’s employer-sponsored plan, the cost will depend on the plan specifics and how much of the premium (if any) the employer pays for spousal coverage.

- If you enroll in a Marketplace plan, your cost will depend on the plan you select and whether you’re eligible for an income-based advance premium tax credit (commonly referred to as a premium subsidy). The average full-price premium for Marketplace coverage in 2024 was $605 per month, but most Marketplace enrollees are eligible for advance premium tax credits and the average premium after the tax credits was $111/month. But those are just averages of the entire country. There is significant variation in the cost of full-price plans and subsidy amounts, depending on where you live, how old you are, and your household income.

- If you opt for COBRA, the premium will generally be the full cost of the group coverage (the premium amount you paid and the amount your employer paid), plus an administrative fee of up to 2%. But your former employer may offer to subsidize some of the cost of COBRA for a certain amount of time. The details will be communicated to you in the COBRA election notice you receive.

- If you opt for a plan offered through an association or trade group membership, the cost will depend on the specific plan that’s offered to you, and whatever underwriting parameters the plan uses.

- If you opt for short-term health insurance, the cost will depend on the plan you select, with premiums that typically vary based on age, gender, and location. You may have the option to pay for a predetermined period of time in advance, or to pay monthly. Keep in mind that for short-term plans sold or issued starting Sept. 1, 2024, the coverage cannot last for more than four months, including renewals. It’s also important to understand that short-term plans are not required to meet the coverage requirements of the ACA, can exclude coverage for pre-existing conditions, and have annual and lifetime benefit maximums.

Do I qualify for an Obamacare subsidy (premium tax credit)?

Most Marketplace enrollees qualify for premium tax credits (subsidies). But your eligibility for these tax credits will depend on where you live, how old you are, and your household income.

Of the 21.4 million people who enrolled in Marketplace plans for 2024, 92% were eligible for premium subsidies worth an average of $536/month.

Premium tax credits used to be unavailable to households with income over 400% of the poverty level, but that limit was temporarily eliminated in 2021. Unless Congress extends the current subsidy enhancements, the income limit will return in 2026. If that happens, people applying for 2026 coverage with a projected income above 400% of the 2025 federal poverty level would be ineligible for subsidies, regardless of the percentage of income they’d have to pay to enroll in coverage.

For now, premium tax credits are available if the cost of the second-lowest-cost Silver plan in your area would be more than a specific percentage of your household income. (See Figure 1.)

You can use our calculator to get an idea of whether you’re eligible for a premium subsidy, and if so, an estimate of how much it will be.

What should I consider when shopping for health insurance?

There are several factors to keep in mind when you’re considering the self-employed health insurance options described above:

- How much will you have to pay in monthly premiums?

- How much is the total out-of-pocket cost exposure?

- How much is your out-of-pocket cost exposure likely to be in an average year? (This will depend on your expected medical needs.)

- Are your current medical providers in-network with the plans you’re considering?

- Will the plans you’re considering cover the prescription drugs you currently take? If not, does your doctor have recommendations for similar drugs that are covered?

- If your job involves a lot of travel – or if you just like to travel – how extensive are the provider networks of the plans you’re considering? Rest assured that both group and individual plans will provide emergency coverage even outside the network,8 and the No Surprises Act will protect you from surprise balance billing in those scenarios.9

Learn more:

How can I choose the best health insurance to meet my needs?

What health insurance can I get if I drive for Uber, Lyft, or a food delivery service?

If you’re driving for a service like Uber, Uber Eats, or Lyft, you’re likely considered an independent contractor rather than an employee.10 This means you’ll need to obtain your own health insurance, just like anyone else who is self-employed.

As discussed above, various sources of coverage are available to ride-sharing and food-delivery drivers. You might be able to enroll under a spouse’s plan (or a parent’s plan, if you’re under 26), or you might qualify for Medicaid, depending on your income and where you live.

If these options aren’t available, a Marketplace plan can provide your health coverage. Depending on your income, you may qualify for subsidies in the Marketplace. The available subsidies include federal premium tax credits and cost-sharing reductions, as well as additional state-funded subsidies that are offered in some states.

What is the self-employed health insurance deduction?

Since 2003, the IRS has allowed self-employed people to deduct up to 100% of the amount they pay for health insurance for themselves, their spouse, and their dependents.11 Qualified long-term care premiums can also be deducted, up to certain limits that vary with age. (See Line 2(b) for the 2023 limits.)

As of 2023, the self-employed health insurance deduction is claimed on Form 7206. The self-employed health insurance deduction is an adjustment to income, as opposed to an itemized deduction.12 This means it will reduce a person’s ACA-specific MAGI, which is used to determine eligibility for financial assistance in the Marketplace.

(In contrast, itemized deductions do not reduce ACA-specific MAGI, as they are not adjustments to income listed on Schedule 1 of Form 1040.)13 If you have question or want guidance about your particular circumstances, consult a tax advisor or other professional.

Learn more:

- Self-employed health insurance deduction

- I’m self-employed. Can we deduct my husband’s Medicare premiums?

- How does the IRS calculate premium tax credits for self-employed people when their AGI depends on their health insurance premium amount?

Do I need a health insurance agent or broker?

You are not required to use a health insurance broker when you’re enrolling in self-employed health insurance. But there is no cost to use a broker, so your premiums will be the same regardless of whether you have a licensed insurance professional help you with the plan selection and enrollment process.

A broker may be able to assist before and after you’re enrolled. For example, brokers can help with understanding the benefits available to you, and can contact the carrier on your behalf to assist with difficulties with a claim, prior authorizations, addressing billing errors, etc.

In general, a broker will be able to show you a wide range of plan options and help you select the one that will best fit your needs and budgets. Be aware, however, that some brokers only work with a limited range of health insurers. And although it’s not the norm, insurers can require their agents to have an exclusive contract, meaning they cannot also sell other insurers’ products.

If you’re working with a broker, you can ask them whether they work with all of the insurers that offer ACA Marketplace plans in your area. If they don’t, you might want to check the other available options via the Marketplace website or another broker who works with other or more carriers.

Learn more:

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Employer Health Benefits 2023 Annual Survey” KFF.org. Accessed May 9, 2024 ⤶

- “ 2590.701-6 Special enrollment periods.” ecfr.gov. Accessed May 9, 2024 ⤶

- “§ 155.420 Special enrollment periods.” ecfr.gov. Accessed May 9, 2024 ⤶

- “FAQs on COBRA Continuation Health Coverage for Workers” dol.gov. Accessed May 9, 2024 ⤶

- “Status of State Medicaid Expansion Decisions: Interactive Map” KFF.org, May 9, 2024 ⤶

- “Medicaid, Children’s Health Insurance Program, & Basic Health Program Eligibility Levels” Medicaid.gov. Accessed May 9, 2024 ⤶ ⤶

- “2024 Poverty Guidelines: 48 Contiguous States (all states except Alaska and Hawaii)” HHS.gov May 9, 2024 ⤶

- “Know your rights when using health insurance” CMS.gov. Accessed May 9, 2024 ⤶

- “No Surprises Act” CMS.gov. Access May 9, 2024 ⤶

- “Are Uber and Lyft Drivers Employees or Independent Contractors?” Marzzacco Niven & Associates. Nov. 27, 2023 ⤶

- “Medical and Dental Expenses (Including the Health Coverage Tax Credit)” IRS.gov. Accessed May 9, 2024 ⤶

- “Topic no. 502, Medical and dental expenses” IRS.gov. Accessed May 9, 2024 ⤶

- “Reporting income deductions” HealthCare.gov. Access May 9, 2024 ⤶