Home > ACA Marketplace > Virginia

Virginia Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Virginia health insurance Marketplace guide

This guide, including the FAQs below, was developed to help you choose the right health insurance plan for you and your family. The coverage options found in Virginia’s ACA Marketplace may be a good choice for many consumers, and we’re here to help explain the choices available. Scroll down to see frequently asked questions about health insurance in Virginia.

Prior to 2024, Virginia residents enrolled in individual/family health coverage through HealthCare.gov. But the state debuted a new state-based Marketplace plaftorm, called Virginia’s Insurance Marketplace, in the fall of 2023. This platform is where residents shop for coverage effective in 2024 and future years.1

Virginia’s Insurance Marketplace offers plans from 11 insurers for 2024, down from 12 in 2023.2 Ten of the carriers will continue to offer coverage for 2025 (details below; there are two Aetna entities in 2024, but only one for 2025).

The federal government helps consumers pay for insurance through an advance premium tax credit (premium subsidy) if they buy coverage from the exchange. Depending on your income and other circumstances, you may also get help to lower your out-of-pocket expenses.

Reinsurance, easy enrollment, benchmark plan changes

In addition to developing its own state-based exchange platform that debuted in the fall of 2023, Virginia also has a reinsurance program that took effect in 2023 and helped to reduce premiums for people who don’t get subsidies. Ongoing funding for this program was instrumental in preventing large rate increases for 2024.

Virginia also implemented an easy enrollment program in 2021, which helps to get people enrolled in Medicaid as part of the tax filing process. Now that Virginia is running its own Marketplace, the state has the option to use the easy enrollment program to connect people to Marketplace coverage as well, with a special enrollment period. But the 2023 Virginia tax return (filed in early 2024) still only asked uninsured filers if they’d like their eligibility for Medicaid (Medical Assistance) to be considered.

Virginia has received federal approval to update its essential health benefits benchmark plan starting in 2025. The benchmark plan is used to determine specific benefits that must be covered by individual and small-group health plans. The updates include additional coverage for certain prosthetic devices, and coverage of formula and enteral nutrition products for inherited metabolic disorders.3

Frequently asked questions about health insurance in Virginia

Who can buy Marketplace health insurance?

To qualify for health coverage through the Virginia Marketplace, you must: 6

- Live in Virginia

- Be lawfully present in the United States

- Not be incarcerated

- Not be enrolled in Medicare

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area – which depends on your age and location. In addition, to qualify for financial assistance with your Marketplace plan you must:

- Not have access to affordable health coverage through your employer. If your employer offers coverage but you feel it’s too expensive, you can use our Employer Health Plan Affordability Calculator to see if you might qualify for premium subsidies in the Marketplace.

- Not be eligible for Medicaid or CHIP.

- Not be eligible for premium-free Medicare Part A.7

- File taxes jointly with your spouse, if you’re married8 (with very limited exceptions)9

- Not be able to be claimed as a tax dependent by someone else.10

When can I enroll in an ACA-compliant plan in Virginia?

The open enrollment period for individual/family health coverage runs from November 1 to January 15 in Virginia.11

If you need your coverage to start on January 1, you must apply by December 15. If you apply between December 16 and January 15, your coverage will begin on February 1.12

Outside of open enrollment, a special enrollment period (generally linked to a specific qualifying life event) is necessary to enroll or change your coverage.

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment. We also have a comprehensive guide to special enrollment periods.

How do I enroll in a Marketplace plan in Virginia?

To enroll in an ACA Marketplace plan in Virginia, you can:

- Visit Virginia’s Insurance Marketplace to access an online platform to shop, compare, and choose the best health plans.

- Purchase individual and family health coverage with the help of an insurance agent or broker, a Navigator or certified application counselor.

- Call Virginia’s Insurance Marketplace at 888-687-1501.

How can I find affordable health insurance in Virginia?

You may find affordable health insurance options in Virginia by signing up through Virginia’s Insurance Marketplace.

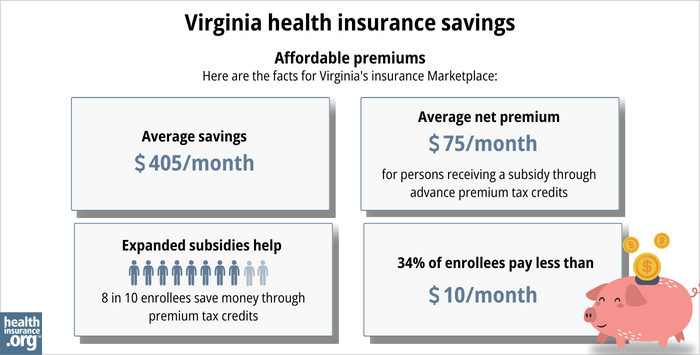

For those who enrolled in private plans through Virginia’s Insurance Marketplace during the open enrollment period for 2024 coverage, more than 87% were eligible for advance premium tax credits (APTC, or premium subsidies). These subsidies averaged $405/month, reducing the average net premium of subsidy-eligible enrollees to $86/month after subsidies.13

The Affordable Care Act provides the income-based APTC to make premiums much more affordable than they would otherwise be. People with household incomes up to 250% of the federal poverty level also qualify for cost-sharing reductions (CSR) that reduce out-of-pocket expenses on Silver plans (CSR benefits aren’t available at other metal levels).

Due to premium subsidies and cost-sharing reductions, you may find that a plan obtained through Virginia’s Insurance Marketplace is the best option.

Source: CMS.gov14

How many insurers offer Marketplace coverage in Virginia?

Eleven insurers offer health plans in Virginia’s exchange for 2024, including two separate Aetna entities.2

For 2025, there will be ten insurers offering on-exchange plans in Virginia. Aetna has two on-exchange entities in 2024: Aetna Health HMO and Aetna Life EPO, but only Aetna Health appears on the state’s summary of rate proposals for 2025,5 and the state’s rate review presentation notes that ten carriers will offer on-exchange plans in 2025.15

One carrier that offered plans in 2023, Piedmont Community Healthcare, opted to withdraw from the individual/family market in Virginia at the end of 2023, so their plans are not available for 2024.

Are Marketplace health insurance premiums increasing in Virginia?

According to SERFF, the following average rate changes have been approved for 2025 for the insurers that offer coverage through Virginia’s health insurance Marketplace, calculated before subsidies are applied (but most enrollees qualify for subsidies). Based on each carrier’s market share, the approved rate changes amount to a weighted average increase of 3.9% for 2025.16

Virginia’s ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Aetna Health (HMO) | 15.4% |

| Aetna Life (EPO) | Exiting market |

| CareFirst | 4% |

| Cigna | 6.3% |

| Group Hospitalization and Medical Services Inc. | 20.1% |

| HealthKeepers (Anthem) | 3.9% |

| Innovation Health Plan | 5.5% |

| Kaiser Foundation Health Plan of the Mid-Atlantic | 8% |

| Optimum Choice | -0.4% |

| Oscar Health | 9.3% |

| Sentara Health Plan (formerly Optima) | -1.9% |

Source: Virginia State Corporation Commission, Bureau of Insurance1718

For perspective, here’s a summary of how overall average pre-subsidy premiums have changed in Virginia’s Marketplace over the years:

- 2015: 10.2% increase

- 2016: 8.5% increase19

- 2017: 16.4% increase20

- 2018: 57.7% increase21

- 2019: 9.6% increase22

- 2020: 3.6% decrease23

- 2021: 3.7% decrease24

- 2022: 3% decrease25

- 2023: 12.9% decrease26 (reinsurance took effect)

- 2024: 1.1% increase27 (much lower than proposed, due to extension of reinsurance)

How many people are insured through Virginia’s Marketplace?

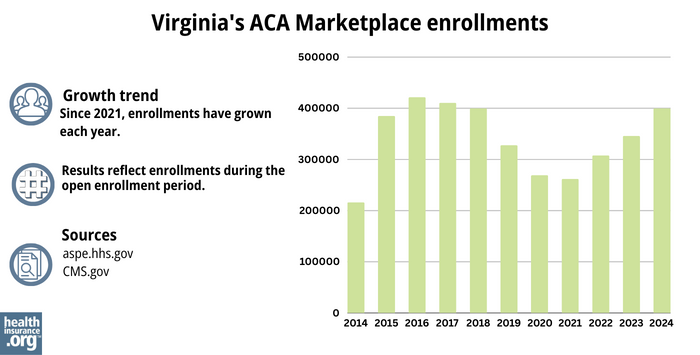

During the open enrollment period for 2024 coverage, 400,058 Virginia residents enrolled in private qualified health plans (QHPs) through the Virginia ACA marketplace.13

This was the highest enrollment the state had seen since 2017 (see chart below). The enrollment growth in recent years stems from the subsidy enhancements under the American Rescue Plan (ARP) and Inflation Reduction Act, as well as the “unwinding” of the pandemic-era Medicaid continuous coverage rule. Virginia began disenrolling people from Medicaid in 2023 (after a three-year pause on disenrollments), and more than 27,000 people had transitioned from Medicaid to a Marketplace plan in Virginia by April 2024.28

Source: 2014,29 2015,30 2016,31 2017,32 2018,33 2019,34 2020,35 2021,36 2022,37 2023, 38 202439

What health insurance resources are available to Virginia residents?

Virginia’s Insurance Marketplace

The state-based exchange began to be used starting in November 2023, and is used for all plans with effective dates of 2024 or later.

Virginia Health Care Foundation

Virginia Consumer Assistance Program

Assists people insured by private health plans, Medicaid, or other plans in resolving problems pertaining to their health coverage; assists uninsured residents with access to care.

(877) 310-6560 / [email protected]

State Exchange Profile: Virginia

The Henry J. Kaiser Family Foundation overview of Virginia’s progress toward creating a state health insurance exchange.

Explore our other comprehensive guides to coverage in Virginia

Dental coverage in Virginia

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Virginia.

Virginia’s Medicaid program

Learn about Virginia's Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Medicare coverage and enrollment in Virginia

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Virginia as well as the state’s Medicare supplement (Medigap) regulations.

Short-term coverage in Virginia

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Virginia.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Health Benefit Exchange” SCC.Virginia.gov ⤶

- 2024 ACA Individual Market Rate Summary. Virginia State Corporation Commission, Bureau of Insurance. October 2023. ⤶ ⤶

- “Virginia Essential Health Benefits Benchmark Plan Receives Federal Approval“ SCC.Virginia.gov. September 21, 2023. ⤶

- ”2024 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed Jan. 7, 2025 ⤶ ⤶

- ”Virginia Rate Review Submissions” RateReview.HealthCare.gov. Accessed Aug. 16, 2024 ⤶ ⤶

- “A quick guide to the Health Insurance Marketplace“HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed MONTH. ⤶

- Updates to frequently asked questions about the Premium Tax Credit. Internal Revenue Service. February 2024. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed January 12, 2024. ⤶

- ”How to Enroll” Virginia’s Insurance Marketplace. Accessed May 22, 2024 ⤶

- ”Virginia’s Insurance Marketplace Urges Virginians to Enroll Before December 15 Deadline” Virginia State Corporation Commission. Dec. 13, 2023 ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 22, 2024 ⤶ ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2024 ⤶

- ”ACA Rate & Form Filing Information; 2025 Presentations” Virginia State Corporation Commission. Aug. 22, 2024 ⤶

- ”2025 ACA Individual Market Rate Summary” Virginia State Corporation Commission. Sep. 18, 2024, and Virginia SERFF filings (for approval clarification) ⤶

- ”2025 ACA Individual Market Rate Summary” Virginia State Corporation Commission. Aug. 15, 2024 ⤶

- ”Virginia SERFF filings” (for approval clarification). Accessed Sep. 19, 2024 ⤶

- “Virginia: *Approved* 2016 Avg. Rate Hikes: 8.5% Individual, 2.9% Small Group” ACA Signups. October 2015 ⤶

- “Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC)” ACA Signups. October 2016 ⤶

- “Virginia: APPROVED Unsubsidized Indy Mkt Rate Hikes: 57.7%, Big Chunk Due To CSR Sabotage” ACA Signups. September 2017 ⤶

- “Virginia: APPROVED (?) 2019 #ACA Rate Hikes Drop *Another* 1.7 Points; Still Would’ve Been Much Lower W/Out #ACASabotage” ACA Signups. August 2018. ⤶

- “2020 Rate Changes” ACA Signups. October 2019 ⤶

- “2021 ACA Rate Filing Data” Virginia State Corporation Commission. August 2020. ⤶

- “Virginia: Approved Avg. 2022 #ACA Rate Changes: -2.9% Indy Market; +3.6% Sm. Group; 3 New Carriers Join Market” ACA Signups. October 2021 ⤶

- “Virginia: Final Avg. Unsubsidized 2023 #ACA Rate Changes: -12.9% Thanks To New Reinsurance Waiver (Updated)” ACA Signups. September 2022 ⤶

- ”Virginia: *Final* avg. unsubsidized 2024 #ACA rate changes plummet from +22.4% to +1.1% via reinsurance renewal” ACA Signups. Sept. 22, 2023 ⤶

- ”HealthCare.gov Marketplace Medicaid Unwinding Report” and ”State-based Marketplace (SBM) Medicaid Unwinding Report” Centers for Medicare & Medicaid Services. Data through April 2024; Accessed Aug. 16, 2024. ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, Accessed August 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶