Medicaid eligibility and enrollment in New Mexico

For some who are disenrolled from Medicaid, state is paying first month of beWellnm premiums

Who is eligible for Medicaid in New Mexico?

Centennial Care Medicaid in New Mexico is available to low-income adults under age 65, as a result of the ACA’s expansion of Medicaid. Coverage is available to children and pregnant women with higher incomes. Medicaid is also available to people who are 65 or older, blind, or disabled, although there are both income and asset limits for those populations.

The following populations are eligible for Medicaid in New Mexico (the limits below include a built-in 5% income disregard that’s used for MAGI-based Medicaid eligibility):

- Adults under age 65 with household incomes up to 138% of poverty.

- Children aged 0 – 5 with household income up to 305% of poverty.

- Children aged 6-18 with household income up to 245% of poverty.

- Pregnant women with household incomes up to 255% of poverty. And postpartum coverage now extends for a year after the baby is born, instead of ending after 60 days. (New Mexico has the nation’s highest percentage of births covered by Medicaid)

Apply for Medicaid in New Mexico

Online at the Centennial Care website or healthcare.gov; or by phone at 1-800-318-2596; with a paper application or in-person at a NM Human Services Department field office.

Eligibility: The aged, blind, and disabled. Also, adults with income up to 138% of poverty. Pregnant women are eligible for pregnancy-related coverage with household income up to 250% of poverty. Children are eligible for CHIP with income up to 240% of poverty (ages 7 - 18) or 300% of poverty (ages 0 - 6).

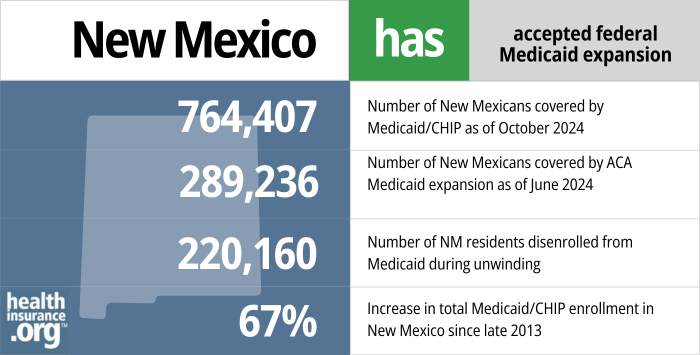

How many New Mexico residents have Medicaid coverage?

From the fall of 2013 through July 2016, total enrollment in New Mexico Medicaid increased by 303,355 people, or 66%, and reached 761,033. As was the case in most states, enrollment grew sharply in 2014 and 2015, but had mostly leveled off by 2016.

But enrollment began to grow sharply in 2020 as a result of the pandemic. By April 2023, total New Mexico Medicaid and CHIP enrollment had grown to 990,982, with enrollment growth due largely to the pandemic-related three-year pause on disenrollments. Enrollment began to drop after that, when eligibility redeterminations and disenrollments resumed post-pandemic. By August 2023, total enrollment had dropped to 895,243 people.

- 764,407 – Number of New Mexicans covered by Medicaid/CHIP as of October 20241

- 289,236– Number of New Mexicans covered by ACA Medicaid expansion as of June 20242

- 220,160 — Number of NM residents disenrolled from Medicaid during unwinding3

- 67% – Increase in total Medicaid/CHIP enrollment in New Mexico since late 20134

Explore our other comprehensive guides to coverage in New Mexico

We’ve created this guide to help you understand the New Mexico health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Learn about health insurance coverage options in New Mexico.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in New Mexico.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in New Mexico as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage.

Frequently asked questions about New Mexico Medicaid

How do I enroll in Medicaid in New Mexico?

- Medicaid enrollment is year-round; there is no open enrollment window. You have several options for submitting an application.

- Apply online through the Centennial Care website.

- Apply online at HealthCare.gov or apply by phone at 1-800-318-2596. Applications through HealthCare.gov are reviewed for eligibility and then transferred to the state Centennial Care program for final determination of eligibility. (Use this option only if you’re under 65 and don’t have Medicare.)

- Call 1-800-283-4465 (customer service) or 1-855-309-3766 (24/7 information line).

- Download a paper application, complete it, and mail it to Central ASPEN Scanning Area, PO Box 830, Bernalillo, NM, 87004.

- Visit a NM Human Services Department field office for in-person assistance with your application.

How does Medicaid provide financial assistance to Medicare beneficiaries in New Mexico?

Many Medicare beneficiaries receive Medicaid assistance that can help them with the cost of Medicare premiums, lower prescription drug costs, and pay for expenses not covered by Medicare – such as long-term care.

Our guide to financial assistance for Medicare enrollees in New Mexico includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

How is New Mexico handling Medicaid renewals after the pandemic?

During the COVID pandemic, from March 2020 through March 2023, people were not disenrolled from Medicaid even if they no longer met the eligibility guidelines. But states could resume disenrollments as early as April 1, 2023. The New Mexico Human Services Department has a page on its website about the return to normal eligibility redeterminations starting in the spring of 2023.

New Mexico began mailing renewal notices in mid-March 2023, and the first round of disenrollments came at the start of May (this process continues for a full year, so some people won’t be due for renewal until early/mid-2024). By October 2023, 120,174 people had been disenrolled from New Mexico’s Centennial Care Medicaid program. At that point, coverage had been renewed for about 181,000 people, and there were another 137,000 pending renewals in process. The vast majority of the disenrollments (all but 4,545 of them) had been for procedural reasons. This means the state was unable to determine whether the person was still eligible. New Mexico had the highest rate of procedural disenrollments in the country as of October 2023.

New Mexico is taking two fairly unique steps to ease the transition to private coverage for people who lose eligibility for Centennial Care Medicaid during the “unwinding” of the pandemic-era rules:

- For people who transition from Medicaid to a plan obtained through the exchange (beWellnm), the state will pay their net (after-subsidy) premium for the first month of their new coverage, as long as they are eligible for premium subsidies and their projected income for 2023 isn’t more than 400% of the poverty level (for a single person, that’s $54,320, and for a family of four, it’s $110,000). This ensures that a person’s coverage is effectuated and that they will thus have the ACA’s 90-day premium grace period going forward. Rhode Island implemented a somewhat similar policy.

- When a person enrolls in a plan through beWellnm after losing Medicaid, they can choose either a prospective effective date (the first of the month after they apply) or a retroactive effective date, with coverage effective back to the first day of the month in which they applied for their new coverage. In most other states, private plans obtained in the exchange cannot have retroactive effective dates (unless the qualifying event is the birth or adoption of a child), but New Mexico’s approach could ultimately be picked up by other state-run exchanges.

New Mexico is also offering an indefinite special enrollment period for people who lose Medicaid during the unwinding period. (HealthCare.gov is offering a similar special enrollment period, although it ends on July 31, 2024 in the states that use HealthCare.gov.)

Legislation impacting New Mexico Medicaid

New Mexico’s Medicaid expansion history

Before 2014, Medicaid was generally only available for the aged, blind, disabled, pregnant women, children, and some low-income parents. But the expanded guidelines provide coverage for adults 19-64 with household incomes up to 133% of poverty (138% counting the five percent income disregard).

On January 9, 2013, then-Governor Susana Martinez announced that New Mexico would participate in Medicaid expansion, describing expansion as “what is best for New Mexicans.” At the time, Martinez was only the second Republican governor to accept Medicaid expansion.

New Mexico’s Medicaid program was renamed Centennial Care starting January 1, 2014. Most of the previously enrolled members of New Mexico Medicaid were eligible to remain covered under Centennial Care, but the newly expanded guidelines meant that many more people were also eligible to join the program in 2014.

Centennial Care was designed to be a modernized overhaul of many aspects of the legacy New Mexico Medicaid system. The new program aims to teach enrollees to become better healthcare consumers and take a more active role in their own health. It’s also focused on integrated care and better case management for the sickest members. In addition, it’s transitioning away from a fee-for-service model towards a payment system that rewards providers based on outcomes.

New Mexico opted for state subsidies instead of Medicaid buy-in, but new legislation calls for a study of the buy-in

In 2017, Nevada lawmakers passed legislation that would have allowed for Medicaid buy-in, but Governor Brian Sandoval vetoed it. If he had approved it, New Mexico would have been the first state with a Medicaid buy-in program.

In early 2018, lawmakers in New Mexico passed two legislative memorials (SM3 and HM9) calling for a cost analysis of a potential Medicaid buy-in program in New Mexico. Lawmakers wanted to get a good idea of the costs of allowing New Mexico residents who aren’t eligible for Medicaid to purchase Medicaid instead of obtaining private coverage or remaining uninsured. They also wanted feedback from stakeholders in terms of the implications and pros and cons of a Medicaid buy-in program in New Mexico.

New Mexico reconsidered the buy-in program in 2019, but it didn’t pass. Instead, the state pivoted to focus on the idea of using state funds to provide additional subsidies for people who buy their own health insurance. In 2021, the state enacted legislation to reinstate the health insurance tax in NM (at the state level rather than the federal level) and use the money to create a Health Care Affordability Fund. That program is being used to make private health insurance more affordable and more robust for people with mid-range incomes who purchased coverage through beWellnm.

But the state is reconsidering the Medicaid buy-in idea, albeit slowly. HB400, which was signed into law in 2023, directs the state to conduct a study on the feasibility of a Medicaid buy-in program in New Mexico. Result of the study are due to the legislative finance committee by October 2024. (The initial version of HB400 would have created a Medicaid buy-in for people under age 65 who aren’t already eligible for Medicaid under existing rules, with coverage available as of 2026. But the version that was enacted just calls for a study of that possibility.)

Senator Ben Ray Lujan, who represents New Mexico in the U.S. Senate, supports the idea of Medicaid buy-in. And Governor Michelle Lujan Grisham, who was a U.S. Representative until winning her 2018 gubernatorial race, introduced legislation at the federal level in 2017 that would have allowed people to buy into Medicaid. The Health Care Choices and Affordability Act did not advance at the federal level, but creating a Medicaid buy-in program may end up being more feasible at the state level.

Centennial Care insurers: Blue Cross Blue Shield of New Mexico, Presbyterian, and Western Sky

Under a Medicaid managed care model like Centennial Care, the state contracts with private insurers rather than directly providing Medicaid coverage to residents. The state pays the insurers, and the insurers provide Medicaid benefits to enrollees. As of 2023, there are three insurers in the Centennial Care Medicaid managed care program: Blue Cross Blue Shield of New Mexico, Presbyterian, and Western Sky Community Care.

Four insurers had Centennial Care contracts through the end of 2018: Blue Cross Blue Shield of New Mexico, Molina, Presbyterian, and UnitedHealthcare. But Molina and UnitedHealthcare were not selected to continue to provide Medicaid managed care services in New Mexico starting in 2019. Presbyterian and Blue Cross Blue Shield had their contracts renewed, and Western Sky Community Care also won a contract with Centennial Care. Those three insurers are continuing to provide Medicaid managed care in 2020.

Molina filed a lawsuit against the state, alleging that Western Sky’s bid win may have been tainted by an official with a conflict of interest, but a judge threw out the lawsuit. Molina initially said that if they couldn’t remain in the Centennial Care program, they may leave the state entirely (including the exchange market), because Medicaid managed care is the “most significant portion” of Molina’s business in New Mexico. But that did not come to pass, and Molina still offers coverage in the New Mexico exchange.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “October 2024 Medicaid & CHIP Enrollment Data Highlights”, Medicaid.gov, Accessed January 2025 ⤶

- “Medicaid Enrollment – New Adult Group”, Medicare.gov, Accessed February 2025 ⤶

- ”Public Health Emergency (PHE) Unwinding Measures“, sites.google.com, Accessed January 2025 ⤶

- “Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment”, KFF.org, Accessed February 2025 ⤶