Medicaid eligibility and enrollment in Rhode Island

Some people who lose Medicaid after the pandemic will be automatically enrolled in HealthSource RI (exchange) plans

Who is eligible for Medicaid in Rhode Island?

In addition to the aged, blind, and disabled, the following residents are eligible for Medicaid coverage in New Hampshire:

- Non-disabled adults under 65 with incomes up to 138% of poverty level.

- Pregnant women with household incomes up to 253% of poverty level (doula services are covered, effective mid-2021. And as part of the state’s fiscal year 2023 budget, Medicaid coverage for the mother continues for 12 months after the baby is born)

- Children with household incomes up to 261% of poverty level.

- Women with household incomes up to 250% of poverty level who lose coverage under RIte Care (Medicaid managed care) 60 days postpartum are eligible for two years of Extended Family Planning coverage that provides gynecological check-ups and contraceptives.

Apply for Medicaid in Rhode Island

Online at HealthSourceRI or HealthyRhode.ri.gov, or you can use a paper application. HealthSourceRI can also help you find local in-person assistance.

Eligibility: The aged, blind, and disabled. Also, adults with income up to 138% of poverty, pregnant women with income up to 253% of poverty, and children with incomes up to 261% of poverty.

ACA’s Medicaid eligibility expansion in Rhode Island

Rhode Island embraced the provision to expand Medicaid in 2014 under the Affordable Care Act (ACA). Federal funding covered the cost of expansion through 2016, after which the state began to pay part of the cost. The federal/state split is now 90/10, so states that have expanded Medicaid receive $9 in federal money for every $1 they spend to provide care for the Medicaid expansion population.

Rhode Island’s Medicaid/CHIP population grew by more than 167,117 people (an 88% increase) from the fall of 2013 through late 2022. Nationwide, the average enrollment growth stood at 59% as of late 2022. The increase in Medicaid enrollment stems mostly from Medicaid expansion under the ACA, and the COVID-related ban on Medicaid disenrollments between March 2020 and March 2023.

According to U.S. Census data, the uninsured rate in Rhode Island dropped from 11.6% in 2013 to 4.3% in 2016, although it inched back up in 2017, to 4.6% (this was typical in many states; the national average uninsured rate was slightly higher in 2017 than it had been in 2016). By 2018 it had dropped back down to 4.1%, and remained at that level in 2019, significantly lower than the national uninsured rate.

Medicaid has served as a crucial safety net during the COVID pandemic, in Rhode Island and across the country. Under the Families First Coronavirus Response Act, the federal government has increased federal Medicaid funding for states’ traditional (non-expansion) Medicaid populations. The additional funding helped to reduce Rhode Island’s costs and generate a budget surplus in 2021, and states will continue to receive additional COVID-related Medicaid funding through the end of 2023 (phasing out gradually over the final three quarters of the year).

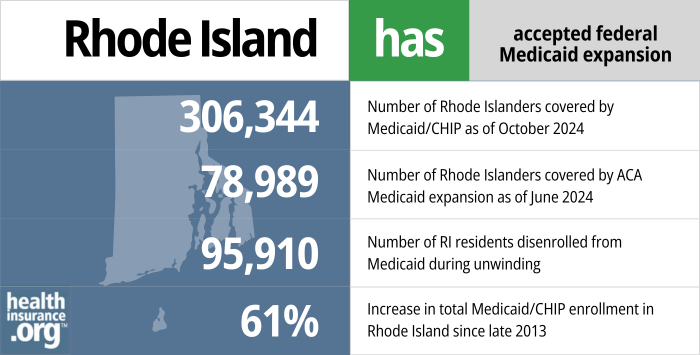

- 306,344 – Number of Rhode Islanders covered by Medicaid/CHIP as of October 20241

- 78,989 – Number of Rhode Islanders covered by ACA Medicaid expansion as of June 20242

- 95,910 – Number of RI residents disenrolled from Medicaid during unwinding3

- 61% – Increase in total Medicaid/CHIP enrollment in Rhode Island since late 20134

Explore our other comprehensive guides to coverage in Rhode Island

We’ve created this guide to help you understand the Rhode Island health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Learn about health insurance coverage options in Rhode Island.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Rhode Island.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Rhode Island as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage.

Learn about short-term insurance regulations in Rhode Island.

Frequently asked questions about Rhode Island Medicaid

How do I enroll in Medicaid in Rhode Island?

The state Medicaid office has worked together with HealthSourceRI (the ACA-created state-run exchange) to streamline the application process for Medicaid. You can apply online via these websites:

- HealthSourceRI (use this option if you’re under 65 and don’t have Medicare)

- HealthyRhode.ri.gov

Alternately, you can print a paper application and mail the completed form to HealthSourceRI, HZD Mailroom, 74 West Road, Suite 900, Cranston, RI, 02920-8413.

You can also call 855-609-3304 for phone assistance, or visit 70 Royal Little Drive in Providence for in-person assistance. HealthSourceRI can help you find local in-person assistance as well.

How does Medicaid provide financial assistance to Medicare beneficiaries in Rhode Island?

Many Medicare beneficiaries receive Medicaid’s help with paying for Medicare premiums, affording prescription drug costs, and covering expenses not reimbursed by Medicare – such as long-term care.

Our guide to financial assistance for Medicare enrollees in Rhode Island includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

How will Rhode Island handle Medicaid renewals after the pandemic?

During the pandemic, federal rules have prevented states from disenrolling anyone from Medicaid, even if they were no longer eligible or didn’t respond to an updated eligibility determination information request. But that rule ends March 31, 2023, and states can once again disenroll people from Medicaid as soon as April 1, 2023. Leading up to that, the Rhode Island Office of Health and Human Services is asking all Medicaid enrollees to ensure that their contact information is up-to-date, so that they can receive renewal packets in a timely manner.

Rhode Island has created a new protocol that will automatically enroll people in a plan through HealthSource RI if they lose Medicaid and their household income is no more than 200% of the poverty level. And for people up to 250% of the poverty level who transition to a plan through HealthSource RI (including those with income above 200% of FPL who manually select a plan), the state will pay their after-subsidy premiums for the first two months.

Rhode Island lawmakers are also considering legislation (H.5254) that would push Medicaid eligibility for current enrollees out through January 1, 2024, even if they no longer meet the eligibility guidelines. So instead of disenrollments resuming in the spring of 2023, this legislation would have them start in early 2024.

Legislation impacting Rhode Island Medicaid

Rhode Island Medicaid covers transgender healthcare

As of November 2015, Rhode Island joined eight other states and the District of Columbia in adding transgender healthcare to the covered services under the state’s Medicaid program. Rhode Island Medicaid now covers gender reassignment surgery and hormone therapy for transgender individuals.

Several others states have since added similar provisions to their Medicaid programs, ensuring access to transgender healthcare.

Hepatitis C drug coverage expanded

Sovaldi and Harvoni have been heralded as miracle drugs for their ability to cure a significant percentage of Hepatitis C cases. But they’re breathtakingly expensive. As a result, many state Medicaid programs — including Rhode Island’s — required patients to meet a pre-determined set of criteria before the Hep C drugs could be prescribed. There were concerns, however, that states were too restrictive in setting their requirements, and the benefits of paying for Hep C treatment sooner and for more patients may outweigh the additional cost of the medication.

In 2015, Rhode Island was denying the majority of claims for Hepatitis C drugs. But in the spring of 2016, Medicaid director Anna Rader Wallack said that the issue was being revisited to determine whether Medicaid should take a larger role in covering the drugs that can cure Hepatitis C. And in early 2018, the state announced a new policy with regards to Hepatitis C treatment: Patients with Hepatitis C no longer need to have severe liver damage or cirrhosis in order to qualify for Hepatitis C drug coverage. That was welcome news for patient advocates, but the increased Medicaid spending for Hepatitis C temporarily pushed Medicaid costs over budget.

This website has details on how each state’s Medicaid program handles coverage for the drugs that treat Hepatitis C.

Rhode Island Medicaid enrollment numbers

As of October 2022, total Rhode Island Medicaid and CHIP enrollment was 357,950, which was 88% higher than enrollment had been in 2013.

Although the federal government is paying nearly all of the cost of covering the newly-eligible population, the existing nearly 50/50 state/federal split in Rhode Island applies to any enrollees who were eligible based on the previous guidelines (note that federal funding for this population was temporarily increased under the Families First Coronavirus Response Act, starting in 2020; that additional funding will be phased out by the end of 2023).

Enrollment for Medicaid and CHIP are year-round, but tend to spike during the general open enrollment due to outreach from the exchanges.

Rhode Island Medicaid history

The first states to implement Medicaid did so in January 1966, and Rhode Island wasn’t far behind them. Medicaid became available in the state in July 1966. Rhode Island uses a Medicaid managed care model to provide coverage. RIte Care and Rhody Health Partners (UnitedHealthcare) are the managed care programs in the state. RIte Care is for pregnant women and children, and utilizes UnitedHealthcare Community Plan of New England, Tufts, or Neighborhood Health Plan of RI to provide coverage.

RIte Share is a premium assistance program that pays all or a portion of an eligible employee’s share of employer-sponsored health insurance premiums.

Rhode Island Medicaid expansion history

Rhode Island was among the states that immediately moved forward with Medicaid expansion as called for in the ACA. Former Governor Lincoln Chafee made it clear immediately after the Supreme Court ruling (which made Medicaid expansion optional for states) that Rhode Island would be implementing Medicaid expansion and fully embracing the ACA (the state also set up its own state-run exchange).

Governor Chafee signed the fiscal year 2014 budget in July 2013, and it included a provision to expand Medicaid starting January 1, 2014. Eligible residents were able to begin enrolling on October 1, 2013, when the state’s health insurance exchange opened for business.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “October 2024 Medicaid & CHIP Enrollment Data Highlights”, Medicaid.gov, Accessed January 2025 ⤶

- “Medicaid Enrollment – New Adult Group”, Medicaid.gov, Accessed February 2025 ⤶

- ”Medicaid Renewals Data Dashboard“, State of Rhode Island, Accessed January 2025 ⤶

- “Total Monthly Medicaid & CHIP Enrollment and Pre-ACA Enrollment”, KFF.org, Accessed February 2025 ⤶