Medicare in Arizona

Arizona does not require Medigap insurers to offer plans to beneficiaries under the age of 65

Key Takeaways

- More than 1.4 million people have Medicare in Arizona.1

- In June 2024, about 49% of Arizona Medicare beneficiaries had Medicare Advantage plans instead of Original Medicare.1

- 48 insurers will offer Medigap plans in Arizona for individuals age 65 or older in 2025,2 but the state does not require insurers to offer coverage to beneficiaries under age 65.

- More than 1.1 million people have Part D coverage in Arizona, including those with stand-alone Part D plans and those with Part D integrated with Medicare Advantage.1

Medicare enrollment in Arizona

As of June 2024, there were 1,4586581 residents with Medicare in Arizona,1 amounting to nearly 20% of the state’s population.3

For most people, Medicare enrollment goes along with turning 65. But a disability that lasts at least two years also triggers Medicare eligibility, as does a diagnosis of kidney failure or ALS. In Arizona, about 8% of Medicare beneficiaries are under 65 — and enrolled due to a qualifying disability, end-stage renal disease, or ALS — while about 92% are eligible due to their age.1

Nationwide, about 11% of all Medicare beneficiaries are eligible due to a disability, but there is some state-by-state fluctuation.4

Learn about Medicare plan options in Arizona by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Arizona

We’ve created this guide to help you understand the Arizona health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Arizona.

Learn about Arizona’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Arizona.

Frequently asked questions about Medicare in Arizona

What is Original Medicare?

Original Medicare, which includes Medicare Part A (hospital coverage) and Medicare Part B (outpatient/medical coverage) is a federal program that does not vary from state to state. So overall Medicare eligibility in Arizona and Medicare enrollment in Arizona both work the same way they do in every state. For people who aren’t yet receiving Social Security benefits and thus aren’t automatically enrolled when they turn 65, the Medicare application in Arizona is available through the Social Security Administration, as is the case nationwide.

But the availability and pricing of private Medicare coverage, including Medicare Advantage plans, Medigap plans, and Medicare Part D plans, does vary from one state to another.

- Read our guide to Medicare’s open enrollment — the window each fall during which beneficiaries can make changes to their Medicare plans.

- Understand the difference between Medigap, Medicare Advantage, and Medicare Part D.

- Learn about how Arizona Medicaid can provide assistance to Medicare beneficiaries in Arizona who have limited income and financial resources.

What is Medicare Advantage?

In most areas of the country, Medicare beneficiaries can choose whether they want to use Original Medicare (coverage provided directly by the federal government) or enroll in a private Medicare Advantage plan. Medicare Advantage plans cover all of the benefits provided by Medicare Parts A and B (although the out-of-pocket costs will differ, as will access to medical providers), and most also include Part D coverage for prescription drugs.

Medicare Advantage plans may include extra benefits, such as dental and vision coverage, and care management programs that can help beneficiaries manage chronic conditions.

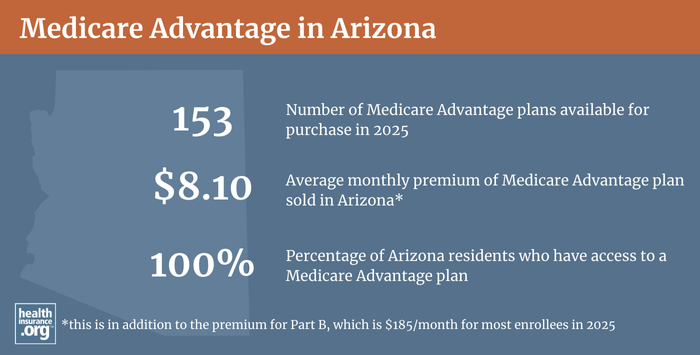

About 49% of Arizona Medicare beneficiaries had Medicare Advantage coverage as of June 2024,1 compared with an average of 50% nationwide.4 Most of the rest of the state’s Medicare beneficiaries had coverage under Original Medicare, but there are also some enrollees in Arizona who have Medicare Cost plans.

Nationwide, enrollment in Medicare Advantage plans has been steadily increasing. Total enrollment in private Medicare plans, including Medicare Advantage and Medicare Cost plans, stood at 753,608 in Arizona as of June 2024, which was about 49% of the state’s total Medicare population1 (nationwide, about 50% of beneficiaries were enrolled in private plans at that point, with the rest in Original Medicare).4

There are Medicare Advantage plans for sale statewide in Arizona for 2024, but plan availability varies considerably from one part of the state to another.5

Medicare Advantage enrollment is available when a person is initially eligible for Medicare, and there’s also an annual enrollment window. Each fall, the Medicare annual election period, from October 15 to December 7, gives Medicare beneficiaries the option to switch between Medicare Advantage and Original Medicare. And people who are already enrolled in Medicare Advantage plans also have access to a Medicare Advantage open enrollment period (January 1 to March 31) during which they can switch to a new Medicare Advantage plan or drop their Medicare Advantage plan and enroll in Original Medicare instead.

What are Medigap plans?

Original Medicare beneficiaries who want help paying some or all of their out-of-pocket costs can purchase Medigap plans (also known as Medicare supplement insurance plans). Medigap plans are issued by private insurers but are standardized under federal rules, with ten different plan designs (differentiated by letters, A through N). The standardization makes it fairly easy to compare plans – plans can differ in price and in things like customer service, but the benefits offered by Plan A, Plan C, Plan G, etc. are the same regardless of which insurer offers the coverage.

Unlike Medicare Advantage and Medicare Part D plans, there is no annual open enrollment period for Medigap plans. Instead, federal regulations allow for a six-month guaranteed-issue window that begins when a person is 65 and enrolled in Medicare Part B. After a person’s enrollment period ends (and unless the person qualifies for one of the limited guaranteed-issue rights), Medigap insurers can use medical underwriting to determine whether an applicant is eligible for coverage, and if so, at what price.

Federal rules do not grant a guaranteed issue open enrollment period for Medigap if the applicant is under 65 and enrolling in Medicare as a result of a disability. The majority of the states have implemented rules ensuring at least some access to Medigap plans for enrollees who are under the age of 65, but Arizona is not among them.

In 2025, there will be 48 insurers licensed to sell Medigap plans in the state.2

People under age 65 who have Medicare in Arizona do have the option to enroll in a Medicare Advantage plan (this includes beneficiaries with end-stage renal disease; prior to 2021, people with ESRD could not join most Medicare Advantage plans, but that is no longer the case). Medicare Advantage plans do not vary their premiums based on medical history, and they do have built-in out-of-pocket caps, so they may appeal to some disabled Medicare beneficiaries who would otherwise have Original Medicare without any caps on out-of-pocket costs. But there are pros and cons to Medicare Advantage, and enrollees should be aware of all of the details before selecting a plan.

Disabled Medicare beneficiaries qualify for a Medigap open enrollment period once they turn 65. At that point, they can enroll in any Medigap plan available in their area, without medical underwriting.

What is Medicare Part D?

Original Medicare does not cover prescription drugs. Some beneficiaries have employer-sponsored coverage to supplement their Medicare, and this often provides prescription coverage. But enrollees without this option need to obtain prescription coverage under Medicare Part D. Part D coverage can be purchased on its own, as a stand-alone plan, or as part of a Medicare Advantage plan that includes Part D prescription drug coverage. (Note that dual-eligibles, who are covered by both Medicare and Medicaid, receive their prescription coverage via Part D.)

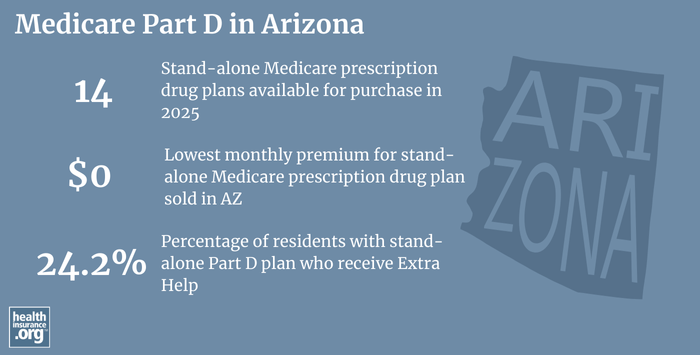

For 2025, insurers in Arizona are offering 14 stand-alone Part D plan options.6 With the lowest monthly premiums starting at $0/month.6

472,305 Arizona Medicare beneficiaries had stand-alone Part D plans as of June 2024, and another 718,897 had Part D coverage as part of their Medicare Advantage plans.1

The annual Medicare open enrollment period (October 15 to December 7) is an opportunity for Medicare beneficiaries to change their Part D coverage if they choose to do so. Any changes made during this window will take effect on January 1 of the coming year. Beneficiaries are encouraged to compare all of the available plans each year, as the plan options may have changed since last year, as might have the enrollee’s prescription needs.

How does Medicaid provide financial assistance to Medicare beneficiaries in Arizona?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums, prescription drug expenses, and services not covered by Medicare – such as long-term care.

Our guide to financial assistance for Medicare enrollees in Arizona includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

What additional resources are available for Medicare beneficiaries and their caregivers in Arizona?

You can contact the Arizona State Health Insurance Assistance Program (SHIP), with questions related to Medicare coverage in Arizona or for help with Medicare enrollment in Arizona.

The Arizona Department of Insurance and Financial Institutions can provide assistance and customer service related to health coverage in the state. This is the agency that licenses and regulates health insurance companies as well as the agents and brokers who sell policies in the state.

The Medicare Rights Center is a nationwide service, with a website and call center, where Medicare beneficiaries and their caregivers can get information and answers to questions about Medicare benefits, eligibility, and enrollment.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Medicare Monthly Enrollment – Arizona.” Centers for Medicare & Medicaid Services Data. Accessed October, 2024. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- “Explore your Medicare coverage options.” Medicare.gov. Accessed October, 2024. ⤶ ⤶

- “U.S. Census Bureau Quick Facts: Arizona.” United States Census Bureau, Accessed October, 2024. ⤶

- “Medicare Monthly Enrollment – National.” Centers for Medicare & Medicaid Services Data. October, 2024. ⤶ ⤶ ⤶

- ”Medicare Advantage 2024 Spotlight: First Look” KFF.org Nov. 15, 2023 ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (8) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶