Medicare in South Carolina

Beneficiaries under 65 can use the SC high-risk pool for supplemental coverage, but it’s very expensive (two private insurers also make plans available)

Key takeaways

- Over 1.2 million people are enrolled in Medicare in South Carolina.1

- About 46% of South Carolina Medicare enrollees have Medicare Advantage plans.1

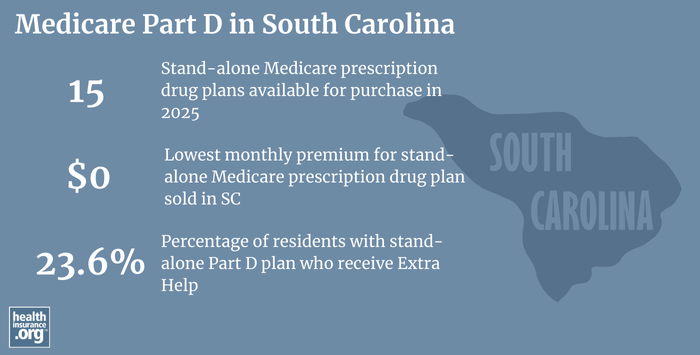

- Insurers offered 15 stand-alone Medicare Part D prescription drug plans in South Carolina for plan year 2025, with premiums as low as $0/month.2

South Carolina Medicare enrollment

As of September 2024, there were 1,228,325 people enrolled in Medicare in South Carolina.1 That’s about 19% of South Carolina’s population enrolled in Medicare.3

People become eligible for Medicare either due to their age (turning 65) or due to a disability. In South Carolina, 12% of Medicare beneficiaries were eligible due to a disability as of late-2024,1 while the rest were eligible due to their age. Nationwide, more than 89% of all Medicare beneficiaries are eligible due to age.4

Learn about Medicare plan options in South Carolina by contacting a licensed agent.

Explore our other comprehensive guides to coverage in South Carolina

We’ve created this guide to help you understand the South Carolina health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Learn about health insurance coverage options in South Carolina.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in South Carolina.

Learn about South Carolina’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in South Carolina.

Learn about short-term insurance regulations in South Carolina.

Frequently asked questions about Medicare in South Carolina

What is Medicare Advantage?

In most areas of the country, Medicare beneficiaries have the option to get their coverage through Original Medicare (directly from the federal government) or from a Medicare Advantage plan. Medicare Advantage plans provide all of the same covered healthcare benefits as Original Medicare (Part A – hospital coverage and Part B – medical/physician coverage), but the out-of-pocket costs can be very different, as Medicare Advantage plans set their own coinsurance, deductibles, and copays.

Many Medicare Advantage plans provide members with integrated Part D coverage for prescription drugs, as well as additional benefits like dental and vision coverage. But Medicare Advantage plans also tend to have localized service areas and much more limited provider networks than the nationwide provider access that Original Medicare offers. In short, there are pros and cons to either option.

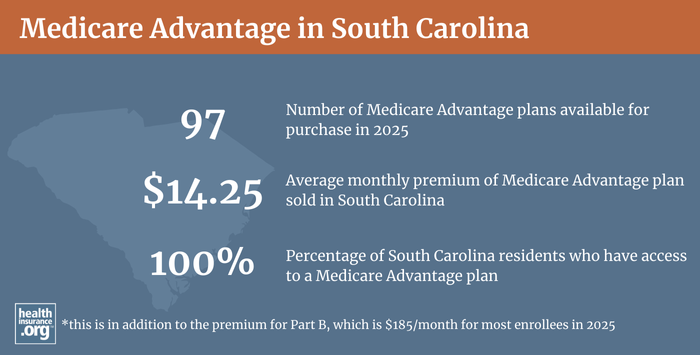

Enrollment in Medicare Advantage plans has been steadily increasing nationwide and also in South Carolina. As of September 2024, about 46% of South Carolina Medicare beneficiaries had Medicare Advantage coverage.1

There are Medicare Advantage plans in all 46 counties in South Carolina in 2025, with plan availability ranging from 29 plans to 50 plans.5

Medicare Advantage enrollment is available when beneficiaries first become eligible for Medicare, and also during the annual Medicare Annual Election Period, which runs from October 15 to December 7. This window gives Medicare beneficiaries the option to switch between Medicare Advantage and Original Medicare. People who are already enrolled in Medicare Advantage plans also have access to a Medicare Advantage Open Enrollment Period (January 1 to March 31) during which they can switch to any other Medicare Advantage plan that offers service in their area, or drop their Medicare Advantage plan and enroll in Original Medicare instead.6

- Learn about Medicare’s annual open enrollment period.

- Learn about how South Carolina Medicaid can provide financial assistance to Medicare beneficiaries with limited income and assets.

- Questions to ask when you’re deciding between Original Medicare and Medicare Advantage.

What is Medigap?

Original Medicare beneficiaries have the option to purchase Medigap plans (also known as Medicare supplement insurance plans), with the Medigap plan covering some or all of the out-of-pocket costs (for coinsurance, copays and deductibles) that they would otherwise have to pay themselves when they need healthcare services. Original Medicare does not cap out-of-pocket costs, making Medigap coverage particularly valuable if a person has extensive medical conditions. Medigap plans are issued by insurers, but are standardized under federal rules, with ten different plan designs (differentiated by letters, A through N), making it fairly easy for consumers to compare one plan to another.7

There were 278,365 people enrolled in Medigap plans in South Carolina according to America’s Health Insurance Plans (AHIP) analysis as of late-2022.8

There are 46 insurers offering Medigap plans in South Carolina in 2025.9

But unlike Medicare Advantage and Medicare Part D prescription drug plans, there is no annual open enrollment period for Medigap plans. Instead, federal regulations allow for a six-month guaranteed-issue window that begins when a person is 65 and enrolled in Medicare Part B. After that window has closed, Medigap insurers can use medical underwriting to determine an applicant’s premium and eligibility for coverage, unless the person qualifies for one of the limited guaranteed-issue rights.

And federal rules do not guarantee access to Medigap plans for people who are under 65 and enrolled in Medicare due to a disability. The majority of the states have rules ensuring at least some access to Medigap plans for enrollees who are under the age of 65, including South Carolina.10

Instead of requiring insurers to offer Medigap plans to people under 65, South Carolina has maintained its high-risk pool and offers three guaranteed-issue Medigap plans through the high-risk pool, for Medicare beneficiaries who are under age 65. The high-risk pool offers Medigap Plan A, Plan C, and Plan D;11 note that under federal rules, Medigap Plan C is only available to people who became eligible for Medicare prior to 2020.12

The South Carolina Health Insurance Pool (SCHIP) allows these enrollees to purchase Medigap coverage when they would otherwise be unable to do so, but at a higher cost: in 2023, Medigap Plan A is $1,024.01 per month,13 Medigap Plan C (only available to beneficiaries who became eligible for Medicare prior to 2020) is $1,317,47 per month,12 and Medigap Plan D is $1,206.49 per month.14

For perspective, premiums for Medigap Plan A for a 65-year-old non-smoking female ranges from $81/month to $601/month in 2023, according to Medicare’s plan finder tool.15 In states that have enacted laws requiring Medigap insurers to offer plans to people under the age of 65, the prices are typically higher, if the state allows it. But the high-risk pool Medigap premiums in South Carolina are several times more expensive than the average Medigap plan sold in the state. Several other states — Alaska, Iowa, Nebraska, New Mexico, North Dakota, Washington, and Wyoming — have maintained their high-risk pools to provide coverage to people with Medicare who are unable to obtain Medigap plans,16 although pricing on high-risk pool supplemental coverage varies considerably across those states.

People enrolled in SCHIP Medigap plans prior to turning 65 are granted the six-month guaranteed-issue Medigap Open Enrollment Period when they turn 65, and can switch to the lower-priced plan at that point, selecting from among all of the available Medigap options in the state.

What is Medicare Part D?

Original Medicare provides fairly comprehensive coverage, but it does not pay for outpatient prescription drugs. Medicare beneficiaries who have supplemental coverage from an employer (via a retiree plan or a plan sponsored by a current employer) often have prescription drug coverage integrated with the employer plan. But without a supplemental employer-sponsored plan or Medicaid, Medicare beneficiaries may need coverage under a Medicare Part D prescription drug plan. These can either be obtained as stand-alone coverage or as part of a Medicare Advantage plan that includes Medicare Part D prescription drug coverage (MA-PDs).

For 2025, there are 15 stand-alone Medicare Part D prescription drug plan options in South Carolina, with premiums that start as low as $0/month.2

Part D coverage in South Carolina is roughly equally split between stand-alone Medicare Part D prescription drug plans and Medicare Advantage Prescription Drug Plans (MA-PD): 456,848 Medicare beneficiaries in South Carolina were covered under stand-alone Medicare Part D prescription drug plans as of late-2024, and an additional 519,401 had Medicare Part D prescription drug plan coverage as part of their Medicare Advantage plans.1

Medicare Part D prescription drug plan enrollment is available on the same schedule that applies to Medicare Advantage plans. Beneficiaries can pick a Medicare Part D prescription drug plan when they’re first eligible for Medicare, and can switch to a different plan during the fall Medicare Annual Election Period, from October 15 to December 7. Beneficiaries who have creditable drug coverage from another source can delay enrollment in Medicare Part D, but a delay without other creditable coverage in place will result in a late enrollment penalty once the beneficiary eventually enrolls in a Part D plan.

Seven rules for shopping for Medicare Part D plans

How does Medicaid provide financial assistance to Medicare beneficiaries in South Carolina?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesn’t cover – such as long-term care.

Our guide to financial assistance for Medicare enrollees in South Carolina includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

What resources are available for beneficiaries and their caregivers in South Carolina?

If you need help with Medicare eligibility in South Carolina or Medicare enrollment in South Carolina, you can contact South Carolina’s Insurance Counseling Assistance and Referral for Elders, the state’s State Health Insurance Assistance Program (SHIP), with questions related to Medicare coverage in South Carolina.

The South Carolina Department of Insurance can provide customer service and assistance with a wide range of insurance-related issues. The Department is responsible for regulating and overseeing Medigap insurers, and also licenses the insurers that sell Medicare Advantage and Medicare Part D prescription drug plans in the state (but most regulatory oversight of Medicare Advantage and Medicare Part D prescription drug plans is conducted at the federal level, by Centers for Medicare and Medicaid Services). The South Carolina Department of Insurance has a resource called “Making sense of health insurance after retirement,” which provides some useful information to people with Medicare and people who aren’t yet eligible for Medicare.

The Medicare Rights Center is a nationwide service that can provide a wide range of information and assistance related to Medicare enrollment, eligibility, and benefits.

This page will provide detailed information about how South Carolina Medicaid can help Medicare beneficiaries who have limited financial means.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Medicare Monthly Enrollment – South Carolina.” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (122) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶

- U.S. Census Bureau Quick Facts: United States & South Carolina.” U.S. Census Bureau, July 2024. ⤶

- “Medicare Monthly Enrollment – US” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶

- ”Medicare Advantage 2025 Spotlight: First Look” KFF.org Nov. 15, 2024 ⤶

- “Joining a Plan.” Medicare.gov. Accessed October 3, 2023. ⤶

- “Get Medigap Basics.” Medicare.gov. Accessed January, 2025. ⤶

- ”The State of Medicare Supplement Coverage” AHIP. May 2024 ⤶

- “Explore your Medicare coverage options.” Medicare.gov. Accessed October, 2024. ⤶

- “South Carolina Health Insurance Pool (SCHIP) Medicare Supplement.” doi.sc.gov. Accessed October 26, 2023. ⤶

- “South Carolina Health Insurance Pool.” Department of Insurance, SC . Accessed October 5, 2023. ⤶

- “South Carolina Health Insurance Pool (SCHIP), Plan C.” doi.sc.gov, January 2023. ⤶ ⤶

- “South Carolina Health Insurance Pool (SCHIP), Plan A.” doi.sc.gov, January 2023. ⤶

- “South Carolina Health Insurance Pool (SCHIP), Plan D.” doi.sc.gov, January 2023. ⤶

- “Supplement Insurance (Medigap) Plans in South Carolina.” Medicare.gov, 2023. ⤶

- “When Can I Buy a Medigap Policy?” Medicare.gov. Accessed October 27, 2023. ⤶