Medicare in Washington

Washington has extensive Medigap consumer protections, but does not require insurers to cover people under age 65. High-risk pool coverage is an option.

Key takeaways

- More than 1.48 million people are enrolled in a Medicare plan in Washington.1

- Over 49% of Washington’s Medicare beneficiaries have Medicare Advantage plans.1

- There are 14 stand-alone Medicare Part D prescription drug plans available in Washington in 2025, with premiums starting at $0 per month.2

- More than 1.1 million Washington Medicare plan beneficiaries have Part D prescription drug coverage, either as stand-alone plans or integrated with Medicare Advantage plans.1

Washington Medicare enrollment

As of September 2024, there were 1,523,702 people with Original Medicare or Medicare Advantage plans in Washington, amounting to 17% of the state’s population.13

Most individuals become eligible for Medicare when they turn 65. But Medicare eligibility is also triggered for younger people if they’re disabled and have been receiving disability benefits for at least 24 months, or have end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS). Nationwide, about 11% of Medicare beneficiaries are under the age of 65.4 In Washington, about 9% of Medicare beneficiaries are eligible due to disability rather than age, and are under the age of 65.1

Medicare’s Annual Election Period (October 15 to December 7 each year) allows Medicare beneficiaries the chance to switch between Medicare Advantage and Original Medicare (and add, drop, or change to a different Medicare Part D prescription drug plan). In addition, the Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31, gives people who already have Medicare Advantage plans an opportunity to switch to a different Medicare Advantage plan or to Original Medicare.

Learn about Medicare plan options in Washington by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Washington

We’ve created this guide to help you understand the Washington health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Learn about health insurance coverage options in Washington.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Washington.

Learn about Washington’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Washington.

Frequently asked questions about Medicare in Washington

What is Medicare Advantage?

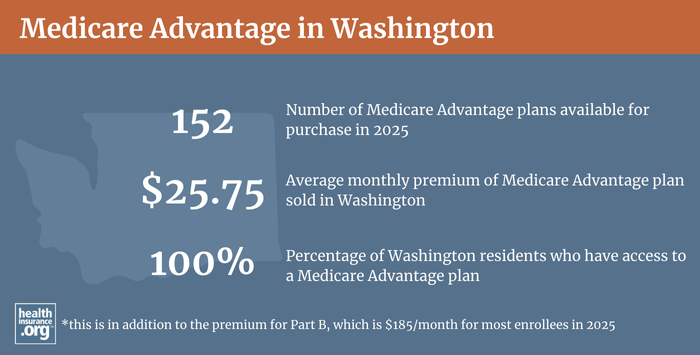

Medicare Advantage plans are an alternative to Original Medicare, and are available in most areas of the United States, including all counties in Washington in 20255

In 2025, Medicare Advantage plan availability ranges from 5 plan in Klickitat County, to 53 plan options in Clark County.5

As of September 2024, 748,158 enrollees were in Washington Medicare Advantage plans.1 Nationwide, Medicare Advantage enrollment has been steadily increasing for nearly two decades, and that’s true in Washington as well.

Original Medicare coverage is provided directly by the federal government, and enrollees have access to a nationwide network of providers. But people with Original Medicare may need supplemental coverage (from an employer-sponsored plan, Medicaid, or privately purchased plans) for prescription drug coverage and to reduce and cap their exposure to out-of-pocket costs (deductibles, copays and coinsurance), which are not capped under Original Medicare).

Medicare Advantage includes all of the benefits of Original Medicare, and the plans usually also have additional benefits and programs, such as integrated Part D prescription drug coverage, dental and vision coverage, and extras like nurse hotlines and gym memberships. But Medicare Advantage insurers establish their own provider networks and service areas, which are generally localized and may be more limited than the nationwide network for Original Medicare.

Out-of-pocket costs for Medicare Advantage are often higher than they would be if a beneficiary had Original Medicare plus a Medigap plan. There are pros and cons to either alternative, and no single solution that works for everyone.

What is Medigap?

Original Medicare does not limit out-of-pocket costs (ie, the deductibles and coinsurance that Medicare beneficiaries have to pay for hospital and outpatient care), so most enrollees maintain some form of supplemental coverage.

More than half of Original Medicare beneficiaries get their supplemental coverage through an employer-sponsored plan or Medicaid.6 But for those who don’t, Medigap plans (also known as Medicare supplement insurance plans) will pay some or all of the out-of-pocket costs they would otherwise have to pay if they had only Original Medicare (Medigap plans cannot be used with Medicare Advantage plans).

According to America’s Health Insurance Plans (AHIP) analysis, there were 312,038 Washington residents with Medigap coverage as of 2022.7

There are 16 insurers that offer Medigap plans in Washington for 2025, although some of them have a service area that does not include the whole state.8 Medigap plans are sold by private insurance companies, but the plans are standardized under federal rules. There are ten different plan designs (differentiated by letters, A through N), and the benefits offered by a particular plan (Plan A, Plan F, etc.) are the same regardless of which insurer sells the plan. Pricing, however, varies from one insurer to another.

But Washington is one of eight states where Medigap insurers are required to use community rating for enrollees age 65 and older (see Washington statute RCW 48.66.045).

In addition to community-rating requirements, Washington state law also gives Medigap enrollees the option to switch to a different Medigap plan at any time, guaranteed-issue. Federal rules only grant a one-time six-month open enrollment period for Medigap, beginning when the enrollee first files for Medicare benefits; after that, unless a person experiences one of the limited circumstances that trigger a guaranteed-issue right, Medigap plans can be medically underwritten, unless states impose other rules.

But Washington is one of just a handful of states where state law prevents Medigap insurers from using medical underwriting if a person with Medigap wants to switch to a different policy after their initial enrollment window has ended. State law in Washington allows a person with Medigap Plan A to switch to any other Medigap Plan A. And a person with Medigap Plan B through N can switch to any other Plan B through N. This opportunity to switch plans on a guaranteed-issue basis applies year-round, as long as the person has been covered under a Medigap plan for at least 90 days.

Washington has also enacted legislation to limit pre-existing condition waiting periods for Medigap enrollees. Although the Affordable Care Act eliminated pre-existing condition exclusions in most of the private health insurance market, those rules don’t apply to Medigap plans. Medigap insurers can impose a pre-existing condition waiting period if you didn’t have continuous coverage prior to your enrollment. Federal rules allow Medigap insurers to impose pre-existing condition waiting periods of up to six months, but Washington law limits it to three months instead.

People who aren’t yet 65 can enroll in a Medicare plan if they’re disabled and have been receiving disability benefits for at least two years (people with end-stage renal disease (ESRA) or amyotrophic lateral sclerosis (ALS) do not have to wait 24 months for Medicare eligibility), and about 9% of Washington Medicare beneficiaries are under age 65.1 But federal rules do not guarantee access to Medigap plans for people who are under 65.9

The majority of the states have implemented rules to ensure that disabled Medicare beneficiaries have at least some access to Medigap plans. But although Washington has gone beyond federal regulations in terms of rating requirements and allowing Medigap enrollees to switch plans on a guaranteed-issue basis, the state does not require Medigap insurers to offer coverage to people under the age of 65 who are enrolled in Medicare due to a disability.

Only two of Washington’s Medigap insurers offer plans to people under the age of 65.10 For example, a Medigap Plan B premium in 2023 is $482/month for individuals under 65, versus $256/month that the same insurance carrier would charge for Medigap Plan B if the enrollee is 65 or older.11

Disabled Medicare beneficiaries can choose instead to enroll in a Medicare Advantage plan. Medicare Advantage plans are otherwise available to anyone who is eligible for Medicare, and the premiums are not higher for those under 65. But as noted above, Medicare Advantage plans may have more limited provider networks than Original Medicare, and total out-of-pocket costs can be as high as $8,300 per year for in-network care, plus the out-of-pocket cost of prescription drugs.12

But Washington has also maintained their pre-Affordable Care Act (ACA) high-risk pool (WSHIP, the Washington State Health Insurance Pool), and it serves as an option for disabled Medicare beneficiaries (WSHIP’s non-Medicare plans have been closed to new enrollees since 2014, as the ACA eliminated the need for a high-risk pool in the non-Medicare market).13 WSHIP’s Medical Supplement Plan is available to people who are unable to obtain Medigap plans due to medical underwriting, and who live in an area where they don’t have “a reasonable choice of Medicare Advantage plans,” or who have end-stage renal disease (since Medicare Advantage plans can decline applicants with ESRD; this will no longer be the case as of 2021, however).

As noted above, there were seven counties in Washington where there were no Medicare Advantage plans available in 2022 (all counties have plans available in 2023). Washington’s approach is that people who are unable to qualify for a Medigap plan can rely on Medicare Advantage if it’s available, but if it’s not, WSHIP is an option that allows Medicare beneficiaries to have supplemental coverage on a guaranteed-issue basis. As of 2023, WSHIP Medicare supplemental coverage is not available to residents of Clark, Cowlitz, Island, King, Kitsap, Lewis, Pierce, Skagit, Snohomish, Spokane, Thurston, Walla Walla, Whatcom, and Yakima counties, because those counties are considered to have a reasonable choice of Medicare Advantage plans.

WSHIP’s Medicare supplement plan is $483/month in 2025 for beneficiaries under 65, and $385 for those age 65+14 (a person who missed their initial enrollment period for Medigap and tried to enroll at a later time, without a guaranteed-issue right, could be declined by the insurer; WSHIP then becomes an option).15

Several other states — Alaska, Iowa, Nebraska, New Mexico, North Dakota, South Carolina, and Wyoming — have also maintained their high-risk pools and use them to provide supplemental coverage to Medicare beneficiaries who are unable to obtain private Medigap coverage.

Disabled Medicare beneficiaries have access to the Medigap Open Enrollment Period when they turn 65. At that point, they can select from among any of the available Medigap plans, at the standard community-rated premiums that apply to people who are 65 or older.

What is Medicare Part D?

Original Medicare does not provide coverage for outpatient prescription drugs. More than half of Original Medicare beneficiaries have supplemental insurance coverage via an employer-sponsored plan (from a current or former employer or spouse’s employer) or Medicaid, and these plans often include prescription drug coverage.6

But Medicare beneficiaries who do not have prescription drug coverage through Medicaid or an employer-sponsored plan may need to obtain Medicare Part D prescription drug coverage. Medicare Part D prescription drug coverage can be purchased as a stand-alone plan, or as part of a Medicare Advantage plan with integrated Part D coverage.

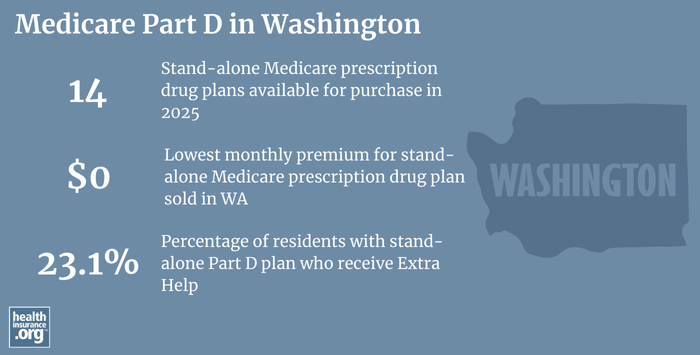

There were 14 stand-alone Medicare Part D prescription drug plans available in Washington in 2025, with monthly premiums starting at $0 per month.2

As of September 2024, there were 431,120 Medicare beneficiaries in Washington who had stand-alone Medicare Part D prescription drug plans. Another 687,922 had Medicare Part D prescription drug coverage integrated with their Medicare Advantage plans.1 The number of people with stand-alone Medicare Part D prescription drug plans has declined recently in Washington — despite the fact that total Medicare Part D prescription drug plan enrollment has continued to increase in the state — because Medicare Advantage plan enrollment has increased. Most Medicare Advantage plans include integrated Part D prescription drug coverage, and their growing popularity has resulted in fewer people buying stand-alone Medicare Part D prescription drug plans.

Medicare Part D prescription drug plan enrollment is available during the Medicare Annual Election Period each fall, from October 15 to December 7. Plans selected during this window take effect January 1 of the coming year. If you change your mind more than once during the open enrollment period, the last Medicare Part D prescription drug plan you select will be the one that takes effect.

How does Medicaid provide financial assistance to Medicare beneficiaries in Washington?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesn’t cover – such as long-term care.

Our guide to financial assistance for Medicare enrollees in Washington includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

What additional resources are available for Medicare beneficiaries and their caregivers in Washington?

Need help with your Medicare enrollment in Washington, or have questions about Medicare eligibility in Washington? You can also contact SHIBA, the Washington Statewide Health Insurance Benefits Advisors, with questions related to Medicare coverage in Washington.

The Medicare Rights Center offers a comprehensive national website and a helpful call center that can provide a variety of assistance with Medicare-related questions.

The Washington Office of the Insurance Commissioner regulates Medigap plans and also licenses and regulates the brokers and agents who help residents in the state secure various forms of private Medicare coverage (Part D, Medicare Advantage, and Medigap plans). The Washington Office of the Insurance Commissioner maintains an extensive collection of resources for Medicare beneficiaries in the state, as well as a page about how consumers can identify and report Medicare fraud and abuse.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Medicare Monthly Enrollment – Washington.” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (143) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶

- U.S. Census Bureau Quick Facts: United States & Washington.” U.S. Census Bureau, July 2024. ⤶

- “Medicare Monthly Enrollment – US” Centers for Medicare & Medicaid Services Data, November 2024. ⤶

- ”Medicare Advantage 2025 Spotlight: First Look” KFF.org Nov. 15, 2024 ⤶ ⤶

- Ochieng, Nancy, Gabrielle Clerveau, and Tricia Neuman. “A Snapshot of Sources of Coverage among Medicare Beneficiaries.” Kaiser Family Foundation, August 14, 2023. ⤶ ⤶

- ”The State of Medicare Supplement Coverage” AHIP. May 2024 ⤶

- “Explore your Medicare coverage options.” Medicare.gov. Accessed October, 2024. ⤶

- “Get Ready to Buy.” Medicare.gov. Accessed October 11, 2023. ⤶

- “Supplement Insurance (Medigap) Plans in Washington.” Medicare.gov. Accessed November 7, 2023. ⤶

- “October – December 2023 Approved Medicare Supplement (Medigap) Plans.” insurance.wa.gov, October 2023. ⤶

- Fuglesten Biniek, Jeannie, Nancy Ochieng, Meredith Freed, Anthony Damico , and Tricia Neuman. “Medicare Advantage in 2023: Premiums, out-of-Pocket Limits, Cost Sharing, Supplemental Benefits, Prior Authorization, and Star Ratings.” KFF, August 9, 2023. ⤶

- “Non-Medicare Plans – Eligibility Requirements.” Washington State High Risk Pool. Accessed October 11, 2023. ⤶

- Washington State Health Insurance Pool (WSHIP) 2025 Monthly Premium Rates. MEDICAL SUPPLEMENT PLAN. wship.gov. Accessed November, 2024 ⤶

- “Medicare Plans – Eligibility Requirements.” Washington State Health Insurance Pool. Accessed October 11, 2023. ⤶