Medicare in West Virginia

WV is among the minority of states where there is no rule guaranteeing access to Medigap for people under 65, but a few companies voluntarily offer coverage

Key takeaways

- More than 450,000 residents are enrolled in Medicare in West Virginia.1

- About 54% of West Virginia Medicare beneficiaries are enrolled in Medicare Advantage plans.1

- More than 85,000 beneficiaries of Medicare in West Virginia had Medigap plans as of 2022.2

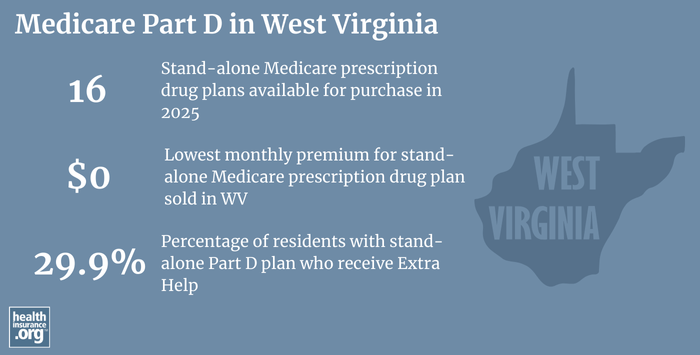

- There are 16 stand-alone Medicare Part D prescription drug plans available in West Virginia in 2025, with premiums starting at $0 a month.3

West Virginia Medicare enrollment

As of September 2024, there were 452,408 residents in West Virginia with Medicare coverage.1 That’s almost a quarter of the state’s population, compared with about 18% of the United States population enrolled in Medicare.4

As of late 2024, about 15% of Medicare beneficiaries in West Virginia were under 65 and eligible due to a disability (as opposed to being age 65+), versus 11% nationwide.15 According to data compiled by the University of New Hampshire, West Virginia had the highest percentage of disabled residents in the country in 2016.

West Virginia also has among the nation’s highest percentages of elderly residents (age 65+). Combined with the high rate of disability, it makes sense that a larger-than-average number of residents are enrolled in Medicare in West Virginia.

Learn about Medicare plan options in West Virginia by contacting a licensed agent.

Explore our other comprehensive guides to coverage in West Virginia

We’ve created this guide to help you understand the West Virginia health insurance options available to you and your family, and to help you select the coverage that will best fit your needs and budget.

Learn about health insurance coverage options in West Virginia.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in West Virginia.

Learn about West Virginia’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in West Virginia.

Learn about short-term insurance regulations in West Virginia.

Frequently asked questions about Medicare in West Virginia

What is Medicare Advantage?

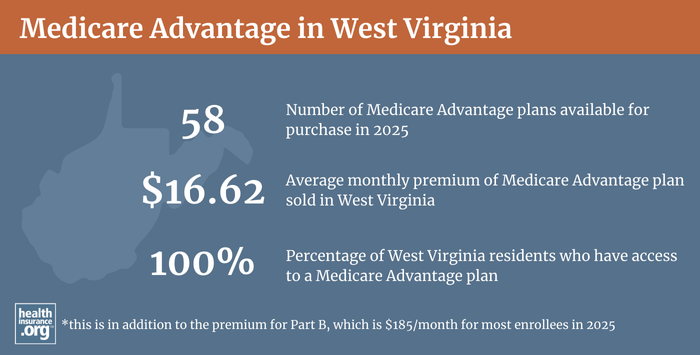

As of late-2024, about 54% of West Virginia’s Medicare beneficiaries were enrolled in private Medicare Advantage plans1 — The nationwide average is just slightly lower at 50%.5

Medicare Advantage plans provide all of the benefits of Medicare Part A and Part B, and most Advantage plans also incorporate Medicare Part D (coverage for prescription drugs) as well as extras like dental and vision. But the deductible and coinsurance amounts vary with Medicare Advantage, and the provider networks tend to have much more localized service areas than the nationwide provider access that Original Medicare enrollees can use.

Medicare Advantage plans are often less costly in terms of monthly premiums (compared with Original Medicare plus a Medigap plan and Part D plan), but the out-of-pocket costs might end up being higher with the Medicare Advantage plan (assuming the person would otherwise have a Medigap plan) and the network restrictions can be challenging depending on the circumstances. There are pros and cons either way, and no single solution that works for everyone.

There is a robust Medicare Advantage market in West Virginia. The number of available plans for 2025 ranges depending on the county, with a fairly uniform number of options available throughout the state.6

Medicare beneficiaries can switch from Medicare Advantage to Original Medicare or vice versa during the annual election period in the fall (October 15 through December 7), with coverage effective January 1. There is also a Medicare Advantage open enrollment period in the first quarter of the year (January 1 to March 31) during which people who are already enrolled in Medicare Advantage plans can switch to a different Medicare Advantage plan or drop their Medicare Advantage plan and enroll in Original Medicare instead.

What is Medigap?

Because Original Medicare includes out-of-pocket costs that can be substantial and that aren’t limited under the terms of Medicare’s coverage, many enrollees rely on Medigap plans to supplement Original Medicare, covering some or all of the out-of-pocket costs (for coinsurance and deductibles) that they would otherwise have to pay themselves if and when they need medical care.

There are 38 insurers that offer Medigap coverage in West Virginia.7 And according to data compiled by AHIP, there were 85,218 West Virginia Medicare beneficiaries with Medigap coverage as of 2022.2 Although overall Medicare enrollment has been growing, the number of people with Medigap coverage in West Virginia was lower in 2019 than it was in 2018, and lower still in 2020. That’s because Medicare Advantage enrollment has been growing even faster than overall Medicare enrollment, and Medigap plans aren’t used with Medicare Advantage (only Original Medicare beneficiaries need or can use Medigap plans).

West Virginia implemented new regulations in 2019, requiring Medigap insurers that use attained-age rating (ie, prices that increase as enrollees get older) to adjust rates annually, as opposed to keeping them flat for several years and then adjusting them all at once when the insured crossed into a new age band. But the state amended the rules to allow insurers that were already using multi-year age bands to transition to the new method over a period of no more than five years. The state also clarified that insurers can continue to have a maximum rate that applies once an insured reaches a certain age (ie, rates do not have to continue to increase annually for an insured’s entire lifetime).

Medigap plans offer benefits that are standardized under federal rules, with ten different plan designs (denoted by letters, A through N). And federal rules allow for a six-month guaranteed-issue window for Medigap plans, which begins when the person is at least 65 and enrolled in Medicare Part B (note that applications can be submitted within a reasonable timeframe in advance of this window).

But federal rules do not guarantee access to a Medigap plan if you’re under 65 and eligible for Medicare as a result of a disability. The majority of the states have adopted rules to ensure at least some access to Medigap plans for under-65 enrollees, but West Virginia is not among them.

Information about West Virginia’s Medigap regulations is available here.

According to the West Virginia Office of the Insurance Commissioner, there is no state rule requiring Medigap insurer to offer coverage to people under 65, and most of the insurers choose not to (people under 65 who are eligible for Medicare are, by definition, disabled, so their medical expenses can be expected to be higher than the average enrollee who qualifies for Medicare based on age alone). But according to Medicare’s plan finder tool, there are three insurers in West Virginia that provide Medigap plans to people under the age of 65:

- United American (Plan B and high-deductible Plan F)

- State Farm Mutual Automobile Insurance Company (multiple plans available)

- Highmark Blue Cross Blue Shield (multiple plans available)

The premiums for Medigap plans for people under 65 are higher than the standard premiums for people who are eligible for Medicare due to their age. Disabled enrollees who have a higher-priced Medigap plan when they’re under 65 are allowed another enrollment window when they turn 65, so they can then switch to lower-cost Medigap coverage at that point. Disabled Medicare beneficiaries also have the option to enroll in any available Medicare Advantage plan, and rates for those plans are not based on age or medical history.

As noted above, there are pros and cons to Medicare Advantage, and it’s important to understand the details before enrolling in a plan, especially since the ability to transition to Medigap more than a year after signing up for an Advantage plan will be limited or non-existent, depending on the person’s medical history, although an under-65 beneficiary will have access to all available Medigap plans in the six-month window that starts when they turn 65.

What is Medicare Part D?

Original Medicare does not cover outpatient prescription drugs. People enrolled in Medicare plans can obtain prescription coverage through a Medicare Advantage plan (most Advantage plans have built-in prescription coverage), an employer-sponsored plan (offered by a current or former employer), or a stand-alone Medicare Part D prescription drug plan.

Insurers in West Virginia offer 16 stand-alone Medicare Part D plans for 2025, with premiums starting at $0 per month.3

As of September 2024, there were 350,079 West Virginia Medicare beneficiaries with Part D coverage.1 About 138,000 had stand-alone Part D plans, while nearly 211,000 had Part D coverage that was integrated with Medicare Advantage plans.1 As Medicare Advantage enrollment has increased in West Virginia, the number of residents with coverage for prescription drugs under stand-alone Part D coverage has been shrinking while the number with Part D coverage as part of an Advantage plan has been growing.

How does Medicaid provide financial assistance to Medicare beneficiaries in West Virginia?

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesn’t cover – such as long-term care.

Our guide to financial assistance for Medicare enrollees in West Virginia includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

What additional resources are available for Medicare beneficiaries and their caregivers in West Virginia?

You can contact the West Virginia State Health Insurance Assistance Program (SHIP), with questions related to Medicare eligibility in West Virginia, or for assistance with the enrollment process.

For Medicare beneficiaries with limited means (income and assets), this overview of how West Virginia Medicaid can assist Medicare beneficiaries is a helpful resource.

The West Virginia Office of the Insurance Commissioner oversees, licenses, and regulates health insurance companies and the brokers and agents who sell policies to West Virginia residents. The WVOIC can answer questions, provide information, and address complaints related to any of the entities they regulate.

The Medicare Rights Center is a nationwide resource, with a website and call center that can provide assistance, education, and information about Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- “Medicare Monthly Enrollment – West Virginia.” Centers for Medicare & Medicaid Services Data. Accessed January, 2025. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- ”The State of Medicare Supplement Coverage” AHIP. May 2024 ⤶ ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (146) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶ ⤶

- U.S. Census Bureau Quick Facts: United States & West Virginia.” U.S. Census Bureau, July 2024. ⤶

- “Medicare Monthly Enrollment – US” Centers for Medicare & Medicaid Services Data, November 2024. ⤶ ⤶

- ”Medicare Advantage 2025 Spotlight: First Look” KFF.org Nov. 15, 2024 ⤶

- “Explore your Medicare coverage options.” Medicare.gov. Accessed October, 2024. ⤶