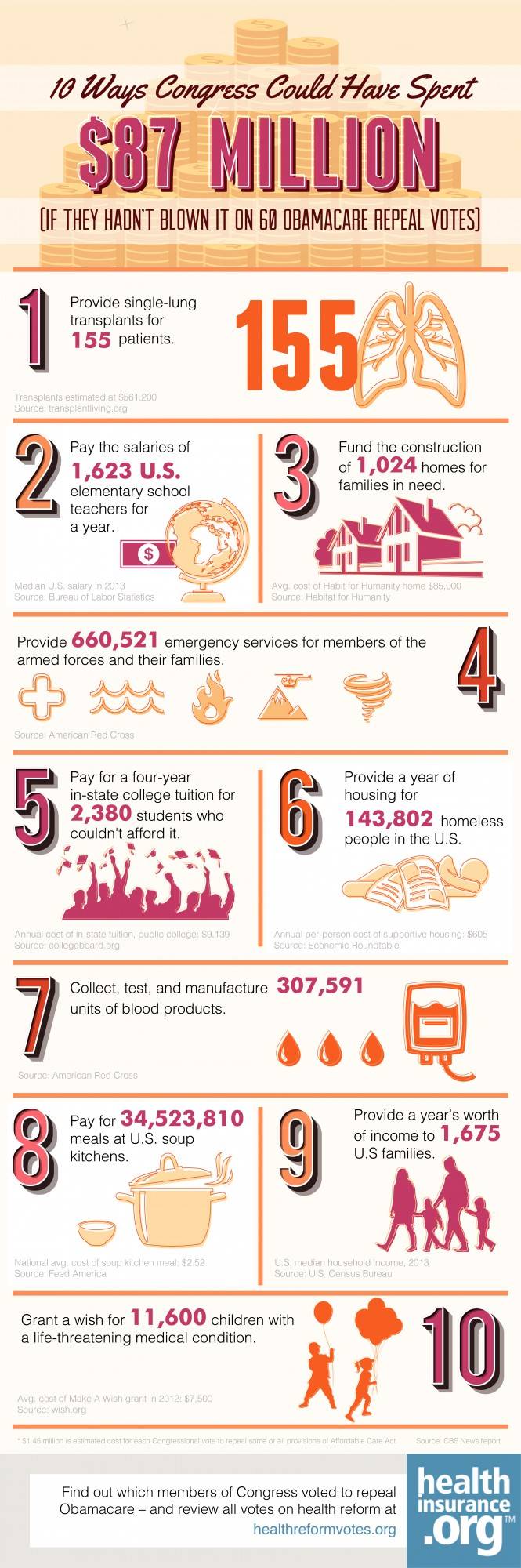

Republican-led Congressional votes this year to repeal the Affordable Care Act in full or in part brought the number of Obamacare repeal votes to at least 60 (depending on whom you ask). If you use a 2012 estimate by CBS News, that would put the cost of 60 repeal votes at more than $87 million.

Regardless of how much expense one assigns to the time spent by Congressional legislators on votes based on blind ideology and pandering, we see millions in taxpayer funds headed down the drain with each vote. And there's no end to repeal attempts in sight.

So we asked ourselves, couldn't all that time (and money) be put to better use? Here's what we came up with.