Home > ACA Marketplace > Kansas

Kansas Marketplace health insurance in 2025

Compare ACA plans and check subsidy savings from a third-party insurance agency.

Kansas health insurance Marketplace guide

Use this guide, including the FAQs below, to help you find the right health plan in Kansas. Many people find an ACA Marketplace plan, also known as Obamacare or exchange, to be a cost-effective choice.

Kansas uses the federally-run Marketplace, which is HealthCare.gov. The HealthCare.gov platform allows Kansas residents to select from among a variety of health plans, and receive income-based financial assistance if eligible.

For 2025, seven private insurers are offering individual/family health plans through the Kansas exchange, down from eight in 20241 (details below).

Frequently asked questions about health insurance in Kansas

Who can buy Marketplace health insurance?

You must meet certain criteria to qualify for health coverage through the Marketplace in Kansas. Generally, you’re eligible to apply if you:4

- Live in Kansas and are lawfully present in the U.S.

- Are not incarcerated

- Are not enrolled in Medicare

By those standards, most Kansas residents can use the Marketplace. But eligibility for financial assistance is also an important factor. To be eligible for income-based subsidies, you must:

When can I enroll in an ACA-compliant plan in Kansas?

To buy an ACA-compliant individual or family health insurance in Kansas, sign up between November 1 and January 15 during open enrollment.

Enroll by December 15 for your coverage to become effective on January 1. But if you enroll from December 16 to January 15, your coverage will start on February 1.7

Outside of open enrollment, you can get coverage through the Marketplace if you have a qualifying life event that triggers a special enrollment period (SEP).8 Examples of qualifying life events include loss of health coverage, getting married, or permanent relocation.

Subsidy-eligible applicants can enroll in a Marketplace health plan at any time during the year if their household income doesn’t exceed 150% of the federal poverty level.9

American Indians and Alaska Natives enroll in an ACA exchange plan year-round.

Where do I enroll in a Marketplace plan in Kansas?

If you’re eligible for an ACA Marketplace plan, there are a few ways to enroll, with or without free assistance:

- Online through HealthCare.gov

- By phone at (800) 318-2596

- With the help of an agent/broker, navigator, or certified application counselor (help is available online, over the phone, or in person)

- Via an approved enhanced direct enrollment entity.10

How can I find affordable health insurance in Kansas?

In Kansas, you can find affordable individual and family health insurance through HealthCare.gov – the ACA Marketplace.

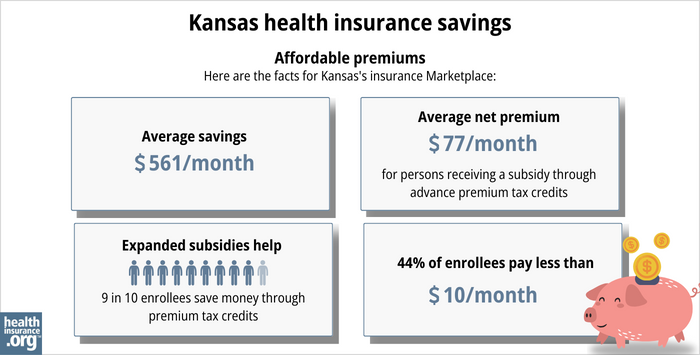

Of the roughly 165,000 people who had effectuated coverage through the Kansas Marketplace in early 2024, nearly 156,000 — 94% — were receiving premium subsidies (advance premium tax credits, or APTC) that averaged $561/month. After the subsidies were applied, the average Kansas Marketplace enrollee was paying about $103/month for their coverage.11

(The numbers above are based on effectuated enrollment; the chart below has some different metrics, and uses data from all enrollments submitted during the open enrollment period for 2024 coverage.)

In addition to APTC, if your household income isn’t more than 250% of the federal poverty level, you may also be eligible for cost-sharing reductions (CSR), as long as you select a Silver-level plan in the Marketplace.12 CSRs help reduce deductibles and out-of-pocket expenses.

Source: CMS.gov13

You may also find affordable coverage through Medicaid (KanCare) if you’re eligible.

Kansas has not yet implemented the ACA’s expansion of Medicaid for low-income adults. However, children may be eligible for Medicaid or CHIP even if their parents aren’t. For certain families, enrolling children in Medicaid or CHIP while parents get coverage through the Marketplace can be an affordable way to obtain family coverage.

Kansas had been considering changes to its essential health benefits (EHB) benchmark plan starting with the 2025 plan year (recommendations included coverage of hearing aids, bariatric surgery, and applied behavior analysis for autism).14 But appropriations legislation enacted in 202315 prohibited the state from using any funds to make changes to the EHB benchmark plan. As a result, the state halted the process of changing its EHB benchmark plan.16

How many insurers offer Marketplace coverage in Kansas?

For 2025, seven insurers are offering plans through the Kansas health insurance Marketplace.17

This is down from eight in 2024,18 as Ascension Personalized Care (US Health & Life) is exiting the market at the end of 2024.19 People enrolled in an Ascension Personalized Care plan in 2024 can select a new plan for 2025 during the open enrollment period that began in November 2024.

There were also eight participating insurers in 2023, but there were some changes for 2024: Aetna was new to the Marketplace in Kansas for 2024, and Cigna stopped offering coverage in the Kansas Marketplace at the end of 2023.

Are Marketplace health insurance premiums increasing in Kansas?

For 2025, the following average rate changes were approved for the insurers that offer individual coverage through the Kansas Marketplace,20 calculated before subsidies are applied:

Kansas’ ACA Marketplace Plan 2025 APPROVED Rate Increases by Insurance Company |

|

|---|---|

| Issuer | Percent Increase |

| Ambetter from Sunflower Health Plan/Celtic | 2.07% |

| Blue Cross and Blue Shield of Kansas City | 24.4% |

| Blue Cross and Blue Shield of Kansas, Inc. | 12.45% |

| Medica Insurance Company | 5.96% |

| Oscar Insurance Company | 4.55% |

| UnitedHealthcare | 14.51% |

| US Health and Life Insurance Company | exiting the market |

| Aetna | 16.73% |

Source: Federal Rate Review Summary20 and the Kansas Insurance Department17

Rate changes apply to full-price premiums. Since most people using the Kansas exchange receive premium tax credits, they don’t pay the full premium amount.11 If you qualify for subsidies, your actual rate change will depend on your plan and the subsidy amounts. Factors such as your age can affect your premium too.

If the cost of your current plan increases, you can explore other health plans in the exchange that may be more affordable and offer comparable benefits.

For perspective, here’s a summary of how overall average premiums have changed over the years for the individual/family market in Kansas, before any subsidies were applied:

- 2015: Average increase of 4%21

- 2016: Average increase of 23%22 (carrier with largest rate increase ultimately left the market)

- 2017: Average increase of 36.6%23

- 2018: Average increase of 29%24 (BCBSKS rate change wasn’t counted because their plans (HMOs) were terminated and replaced with EPOs)

- 2019: Average increase of 5.3%25

- 2020: Average increase of 0.3%26

- 2021: Average increase of 7.8%27 (unweighted average)

- 2022: Average increase of 6%28 (unweighted average)

- 2023: Average increase of 7.2%29

- 2024: Average increase of 7.3%30

How many people are insured through Kansas’ Marketplace?

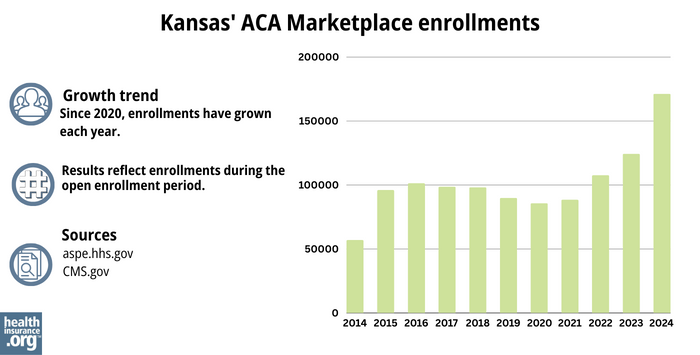

During the open enrollment period for 2024 coverage, a significant new record high enrollment was reached in Kansas, with 171,376 people signing up for private plans through the Kansas Marketplace. 31

The previous record high had come the year before, when 124,473 people signed up during the open enrollment period.32

As with many states, Kansas experienced a pattern where many people signed up in 2016, fewer in the following years, then rebounding enrollment in 2021. This growth trend continued with record highs in 2022, 2023, and 2024. (See chart below that shows year-by-year enrollment.)

The recent increase in enrollment is due in large part to the American Rescue Plan (ARP). Under the ARP, ACA’s premium subsidies are larger and more widely available. ARP has been extended through 2025 by the Inflation Reduction Act.32

And the enrollment growth for 2024 is also partially due to the Medicaid disenrollments that resumed in 2023, after being paused for three years during the pandemic. CMS reported that by April 2024, more than 31,000 Kansas residents had transitioned from Medicaid to Marketplace coverage since the disenrollments began in the spring of 2023.33

Source: 2014,34 2015,35 2016,36 2017,37 2018,38 2019,39 2020,40 2021,41 2022,42 2023,43 202444

What health insurance resources are available to Kansas residents?

Healthcare.gov: This is the ACA Marketplace where you can enroll in a health insurance plan online. You may also get help by calling (800) 318-2596.

Kansas Insurance Department: Call the Consumer Assistance Hotline at (800) 432-2484 in Kansas or (785) 296-7829 if out of state.

Senior Health Insurance Counseling for Kansas (SHICK): SHICK offers help with questions about Medicare.

Medicaid (KanCare): Though Kansas has not expanded Medicaid, certain people who meet the income limits may qualify.

Explore our other comprehensive guides to coverage in Kansas

Dental coverage in Kansas

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Kansas.

Medicaid in Kansas

Learn about Kansas' Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Medicare in Kansas

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Kansas as well as the state’s Medicare supplement (Medigap) regulations.

Short-term coverage in Kansas

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Kansas.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Footnotes

- 2025: Overview of the Health Insurance Market in Kansas. Kansas Insurance Department. Accessed Nov. 29, 2024 ⤶

- ”2024 OEP State-Level Public Use File (ZIP)” Centers for Medicare & Medicaid Services, Accessed Jan. 7, 2025 ⤶ ⤶

- ”Rate Review Submissions” RateReview.HealthCare.gov. Accessed Jan. 7, 2025 ⤶

- “A quick guide to the Health Insurance Marketplace” HealthCare.gov ⤶

- Medicare and the Marketplace, Master FAQ. Centers for Medicare and Medicaid Services. Accessed November 2023. ⤶

- Premium Tax Credit — The Basics. Internal Revenue Service. Accessed May 10, 2024 ⤶ ⤶

- When can you get health insurance? HealthCare.gov, 2023 ⤶

- Health Insurance. Kansas Insurance Department, accessed August 2023 ⤶

- An SEP if your income doesn’t exceed 150% of the federal poverty level. healthinsurance.org. Accessed August 2023 ⤶

- “Entities Approved to Use Enhanced Direct Enrollment” CMS.gov, Aug. 9, 2024 ⤶

- ”Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶ ⤶

- “Federal Poverty Level (FPL)” Healthcare.gov, 2023 ⤶

- “2024 Marketplace Open Enrollment Period Public Use Files” CMS.gov, March 2024 ⤶

- ”Kansas Essential Health Benefits Update, Plan Year 2025” Lewis & Ellis Actuaries and Consultants. Oct 13, 2022 ⤶

- ”Kansas Senate Bill 25” BillTrack50. Enacted April 28, 2023 ⤶

- ”ACA – Benchmark Health Insurance Plan Selection” Kansas Insurance Department. Accessed Jan. 15, 2024 ⤶

- 2025: Overview of the Health Insurance Market in Kansas. Kansas Insurance Department. Accessed Nov. 29, 2024 ⤶ ⤶

- 2024: Overview of the Health Insurance Market in Kansas. Kansas Insurance Department. Accessed October 2023 ⤶

- ”APC withdrawal in 2025” Ascension Personalized Care. Accessed Aug. 20, 2024 ⤶

- Kansas Rate Review Submissions. RateReview.HealthCare.gov. Accessed Nov. 29, 2024 ⤶ ⤶

- Analysis Finds No Nationwide Increase in Health Insurance Marketplace Premiums. The Commonwealth Fund. December 2014. ⤶

- FINAL PROJECTION: 2016 Weighted Avg. Rate Increases: 12-13% Nationally* ACA Signups. October 2015. ⤶

- Avg. UNSUBSIDIZED Indy Mkt Rate Hikes: 25% (49 States + DC). ACA Signups. October 2016. ⤶

- 2018 Rate Hikes. ACA Signups. October 2017. ⤶

- 2019 Rate Hikes. ACA Signups. October 2018. ⤶

- 2020 Rate Changes. ACA Signups. October 2019. ⤶

- 2021 Rate Changes. ACA Signups. October 2020. ⤶

- 2022 Rate Changes. ACA Signups. October 2021. ⤶

- UPDATED: FINAL Unsubsidized 2023 Premiums: +6.2% Across All 50 States +DC. ACA Signups. Accessed November 2023. ⤶

- So How’d I Do On My 2024 Avg. Rate Change Project? Not Bad At All! ACA Signups. December 2023. ⤶

- Marketplace 2024 Open Enrollment Period Report: Final National Snapshot. Centers for Medicare and Medicaid Services. January 2024. ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report”CMS.gov, 2023 ⤶ ⤶

- HealthCare.gov Marketplace Medicaid Unwinding Report. Centers for Medicare and Medicaid Services. Data April 2024; Accessed Aug. 20, 2024 ⤶

- “ASPE Issue Brief (2014)” ASPE, 2015 ⤶

- “Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report”, HHS.gov, 2015 ⤶

- “HEALTH INSURANCE MARKETPLACES 2016 OPEN ENROLLMENT PERIOD: FINAL ENROLLMENT REPORT” HHS.gov, 2016 ⤶

- “2017 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2017 ⤶

- “2018 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2018 ⤶

- “2019 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2019 ⤶

- “2020 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2020 ⤶

- “2021 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2021 ⤶

- “2022 Marketplace Open Enrollment Period Public Use Files” CMS.gov, 2022 ⤶

- “Health Insurance Marketplaces 2023 Open Enrollment Report” CMS.gov, 2023 ⤶

- ”HEALTH INSURANCE MARKETPLACES 2024 OPEN ENROLLMENT REPORT” CMS.gov, 2024 ⤶